Most Popular Mental Health Apps Based on Downloads

\ Mental well-being has become a global priority. In an era of perpetual stress and exhaustion, people need consistent support for well-being. Mental well-being apps provide this help right at your fingertips. People are turning to their phones not for diversion but to develop healthy self-care practices, mindfulness and calm.

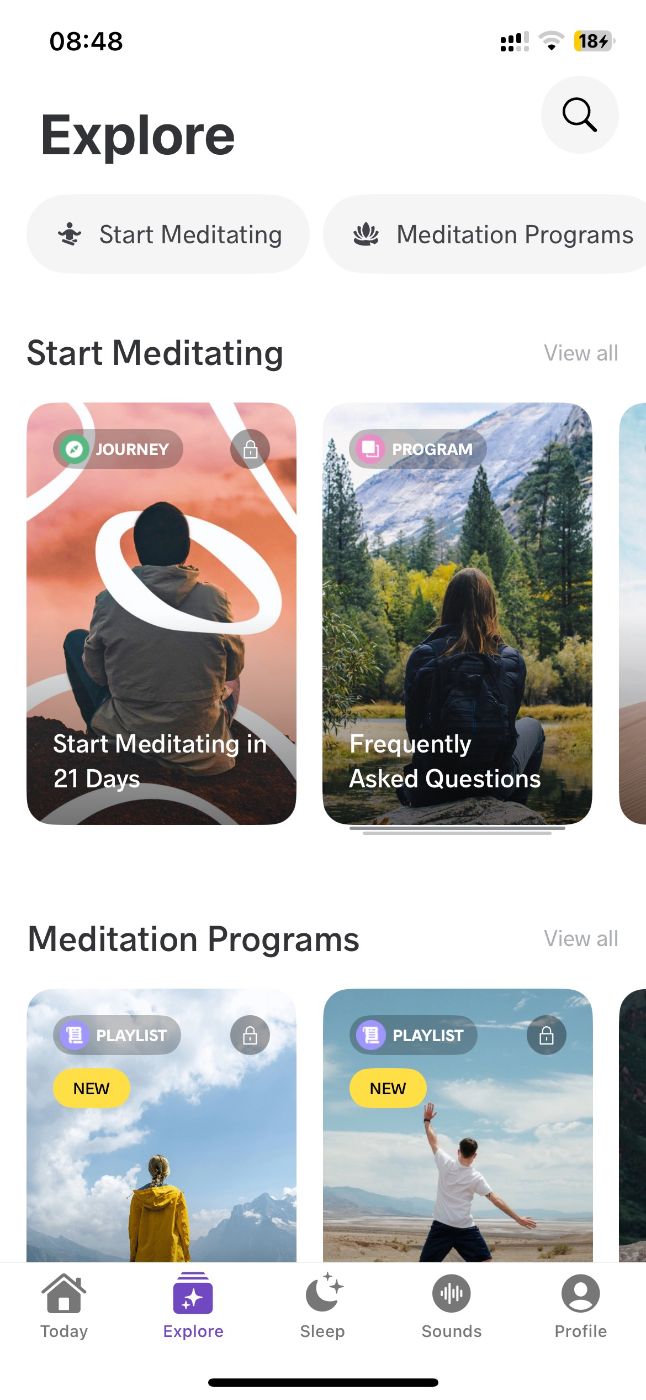

Whether it’s guided meditation, stress relief, or sleep improvement, these apps provide value for their users—designed as personal care tools for everyday well-being. These apps have gained tens of millions of users on both Android and iOS. But only a few have topped the charts.

Calm: Global Leader with Over 133 Million Downloads

Calm holds the top position worldwide with the highest global downloads. It had roughly 133 million downloads in 2023. It offers guided meditation and sleep stories, often narrated by well-known celebrities such as Matthew McConaughey and Harry Styles. It also includes ambient soundscapes and breathing exercises. Using Calm can help reduce anxiety and improve sleep quality, as evidenced by clinical endorsements. Its broad device integration comprises Apple Watch, Wear OS, Sonos, and smart TVs.

Headspace: Structured Mindfulness with Around 80 Million Downloads

Headspace ranks second in global adoption, with an estimated 80 million downloads across over 190 countries. The app supports multiple languages, including English, French, German, Spanish, Portuguese, and Mandarin. It delivers bite-sized guided meditations, sleep tracks, mindfulness exercises and stress-relief tools. There’s also an AI-based emotional assistant called Ebb. Headspace demonstrates clinical efficacy in improving mood and reducing anxiety in users. Headspace is often recommended to beginners. It offers clear and structured guidance for new users.

Insight Timer: Free Meditation Giant with Massive Library

Insight Timer is the most popular free meditation app globally. It offers more than 230,000 guided meditations and has contributions from 17,000 teachers. It is one of the best budget‑friendly apps and delivers over 150,000 free tracks. Downloads have exceeded tens of millions, likely placing total installs between 50–100 million, given its global availability and app store data.

Meditopia: Growing Reach with Over 4.5 Million Users \n

Meditopia serves users in over 75 countries and offers content in eleven languages. It attracts users, especially in Spanish-, Portuguese-, and Turkish-speaking markets. The app is estimated to have 4.5 million users. Though smaller than others, it still stands out. Its multilingual content library drives steady growth. It offers culturally tailored meditations for diverse users, helping it grow outside English-speaking markets. The app includes over 1,000 guided sessions. It also features sleep stories and reflective prompts, offering offline listening in premium mode. Its user base continues to expand in non-English regions.

Meditopia serves users in over 75 countries and offers content in eleven languages. It attracts users, especially in Spanish-, Portuguese-, and Turkish-speaking markets. The app is estimated to have 4.5 million users. Though smaller than others, it still stands out. Its multilingual content library drives steady growth. It offers culturally tailored meditations for diverse users, helping it grow outside English-speaking markets. The app includes over 1,000 guided sessions. It also features sleep stories and reflective prompts, offering offline listening in premium mode. Its user base continues to expand in non-English regions.

Why These Apps Rank by Downloads

Reliable Data from Industry Reports

Calm and Headspace download figures are derived from Statista and market intelligence summaries. Insight Timer’s massive free offerings suggest broad adoption, though their exact download count is not published. Meditopia’s user base estimate is based on review samples and developer claims.

Balance of Features and Accessibility

Calm and Headspace provide polished, premium experiences and clinical validation. Insight Timer offers unmatched free depth and community features. Meditopia focuses on localization, language diversity, and culturally relevant mental wellness tools.

Clinical Validation and Expert Endorsements

Headspace has demonstrated clinical efficacy for anxiety and mood improvements. Healthcare systems and clinicians for sleep and stress recommend calm. Insight Timer includes content from verified teachers, and Meditopia shows reductions in stress and anxiety in coaching studies.

App Overviews and Best Use Cases

Calm: Best for Sleep, Anxiety and Relaxation

Calm includes Sleep Stories narrated by celebrities, as well as ambient music and breathwork sessions. Users get daily meditations and mindful movement routines. The app integrates with smartphones and wrist devices. It also works on smart speakers and TVs. It targets users seeking improved sleep, reduced stress, or structured daily mindfulness.

Headspace: Best for Beginners and Structured Courses

Headspace offers structured starter courses, stress‑management tracks, mindfulness workouts, and AI emotional support via Ebb. Users receive guided content in multiple languages and work through skill‑based levels. It suits users who prefer a guided, step‑by‑step structure.

Insight Timer: Best for Budget and Community Focus

Insight Timer offers free access to a vast library of meditations, with timer customization and offline play. It supports community groups and live events. Insight Timer also includes Social features that help connect users from all over the world. It fits users who prefer free content and peer support over premium subscriptions.

Meditopia: Best for Language‑Specific Experience

Meditopia provides deep libraries in local languages with culturally relevant themes and narration. It includes sleep sessions, breathing exercises, and introspective prompts, making it convenient for non-English speakers or users of region-specific mindfulness practices.

Rankings Based on Estimated Downloads

- Calm – 133 million downloads globally in 2023.

- Headspace – roughly 80 million downloads in 2023.

- Insight Timer – likely tens of millions of installs based on library size.

- Meditopia – around 4.5 million users in global markets.

These four apps rank highest by adoption and user base as of mid‑2025. Calm and Headspace remain global leaders with a large paid and free user base. Insight Timer stands out for its unmatched breadth of free meditation courses and large community. Meditopia grows steadily among multilingual and culturally specific user groups. Each app offers unique value, whether you seek premium sleep aids, structured programs, free content, or localized wellness solutions.

ISNation was built to help athletes train their minds with the same effort they train their bodies to prepare them for competition and give them an edge in sport and in life. Learn more about our mission and sign up to be an ambassador here.

\ \

You May Also Like

‘Mysteriously disappeared’: DOJ Epstein prosecution memo vanishes after press inquiry

Mike Belshe: Stablecoins are a safer alternative to banks, BitGo’s operational controls are key for crypto market structure, and the future of finance is in asset tokenization