Crypto Crash Is A Forced Crypto Seller Unwind, Glassnode Co-Founders Claim

Glassnode co-founders Jan Happel and Yann Allemann, who publish under the @Negentropic handle on X, argue that the current crypto crash is being driven not by a broad narrative turn, but by a single, systematic source of sell pressure whose footprint is most visible in Bitcoin and is spilling into the wider complex. Their core assertion is categorical: “What’s happening in Bitcoin right now isn’t a narrative shift: it’s a mechanical unwind.” In that framing, the tape is reflecting the forced exit of one participant rather than an organic repricing of crypto risk.

Why Is The Crypto Market Crashing?

Negentropic’s thesis starts with momentum indicators behaving in ways they say are inconsistent with “natural markets.” They note that “the 1D MACD just printed a new all-time low… yet price is only down ~33% from the highs,” and add, “This doesn’t happen in natural markets. You only get this when someone is dumping in a straight line.”

They pair that observation with capitulation-like oscillators that are not accompanied by the usual macro or leverage shock. As they put it, RSI is near capitulation, “but there’s no macro stress, no credit shock, no leverage detonation, no ETF outflows.” The mismatch matters to their conclusion: “It’s extreme momentum without a catalyst: classic signature of mechanical selling.”

They then contrast today’s setup with prior episodes where MACD and RSI reached similar extremes. In those historical cases, Negentropic says, “Price was down 60%, derivatives were blowing out, funding was deeply negative.” By contrast, their read of the present is that confirming stress isn’t there. “ETFs remain net positive, their cost basis is still intact,” they write, and they emphasize that “long-term holders are removing supply aggressively.”

They also point to cross-crypto resilience: “Solana ETF inflows are steady, altcoins are holding up relatively well vs btc & eth,” and “eth is holding stronger than btc.” For Negentropic, those relative-strength signals are the tell that this is not a systemwide risk-off event. “If this were real sentiment, all of that would be breaking. It isn’t,” they conclude.

Flow regularity is the other pillar of the Glassnode co-founders’ case. They describe a pattern that they say has repeated since October 10: “Same timestamps, same venue-specific thinness, same lack of reflexive bids.” The implication is mechanical intent rather than discretionary trading. “It’s a schedule, not a market,” they write, claiming “21 days of consistent toxic flow.” That sequence, in their view, aligns with “one explanation”: “a liquidity provider or fund was structurally damaged on October 10th,” and “the entity tied to that failure has been reducing risk in a forced, rules-based manner.”

Independent tape watchers are describing a remarkably similar cadence. Front Runners (@frontrunnersx) reports that a large seller on Binance has been hitting the market with clock-like consistency. Over “two weeks straight,” they say, the entity “hit the sell button exactly at 9:30 EST, every US market open, without fail.”

They add that “kind of consistency usually points to a sophisticated actor operating under specific mandates or time windows,” and that it looks “less like random flow and more like a single entity (or a tightly-coordinated group).”

Macro analyst Alex Krüger expands on how that could manifest across venues. He suggests the seller could be “dumping during US hours via a broker or OTC desk that employs smart order routing or hedging strategies across multiple venues.” In his view, the dominance of Binance prints doesn’t require Binance to be the origin. “Most volume naturally” would flow there, he argues, “since it’s where the bulk of the liquidity resides.”

Krüger also highlights venue asymmetries that fit a routed-flow story: he has seen “relatively little spot selling routed via Coinbase this week,” while noting “extraordinary levels of spot selling via Bitfinex.”

Will The Crypto Crash Be Short-Lived?

Delphi Ventures founding partner Tommy Shaughnessy focuses on the urgency implied by the pace. If the flow has been present since 10/10, he writes, “the speed at which they’re selling BTC is pretty crazy.” He interprets that as compulsion rather than strategy: “Means they are price insensitive and need to exit, fast.” Shaughnessy characterizes the move as “violent,” but adds a key qualifier consistent with Negentropic’s finite-seller framing: it’s likely “short lived because it’s not orderly.”

Multicoin Capital founder Tushar Jain likewise describes what he sees as forced liquidation behavior. “It feels like a big forced seller is in the market,” he writes, adding, “We are seeing systematic selling during specific hours.” Jain explicitly ties this to the same October window Negentropic flags, calling it “probably a consequence of 10/10 liquidations,” and says it’s “hard to imagine this scale of forced selling continues for much longer.”

He also situates the moment within a longer unwind process, recalling a lesson from prior cycles: “it takes some time for all the bankruptcies to reveal themselves after a big liquidation flush like this,” because “shops are running around trying to figure out what their exposure to insolvent counterparties is.”

Taken together, the sources are presenting a coherent, internally consistent read: crypto’s downside is being dominated by a single, time-boxed, price-insensitive seller whose execution pattern is systematic enough to warp momentum indicators and intraday structure.

Negentropic’s bottom line is not merely descriptive but interpretive: “This is not capitulation. This is not a trend break.” It is, instead, “a constrained unwinding through a fractured market.” And because mechanical sellers end when inventory or mandate ends, the Glassnode co-founders argue that when it does, “the rebound will likely be far sharper than the decline that preceded it.”

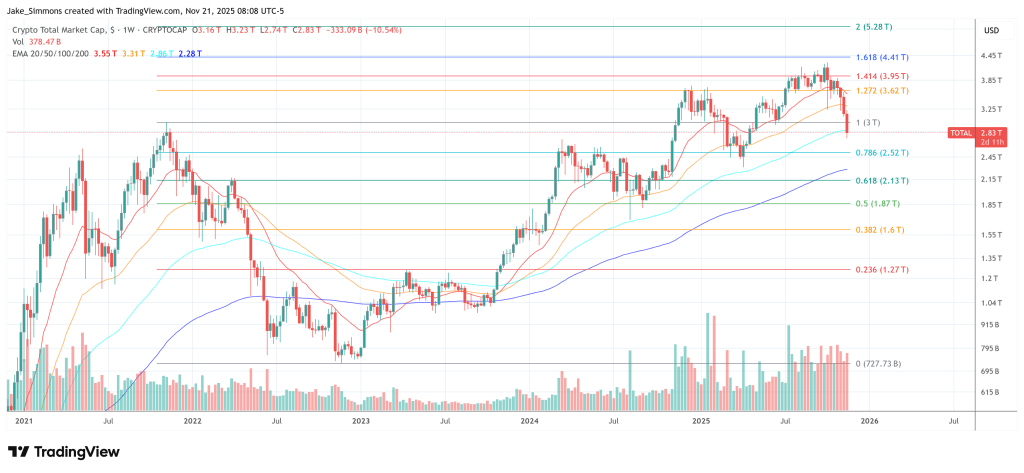

At press time, the total crypto market cap was at $2.83 trillion.

You May Also Like

Buterin pushes Layer 2 interoperability as cornerstone of Ethereum’s future

BlackRock Increases U.S. Stock Exposure Amid AI Surge