Bitcoin Loses $85K as Coinbase Premium Stays Negative for 21 Straight Days – Details

Bitcoin has officially lost the critical $85,000 level, triggering a wave of panic across the market as price briefly tagged the $81,000 zone. This breakdown has pushed the entire crypto ecosystem into a deep corrective phase, with fear escalating and liquidity rapidly evaporating. Analysts warn that the market is now entering full capitulation territory — a stage where short-term holders (STHs) are forced to realize heavy losses, often accelerating downward momentum.

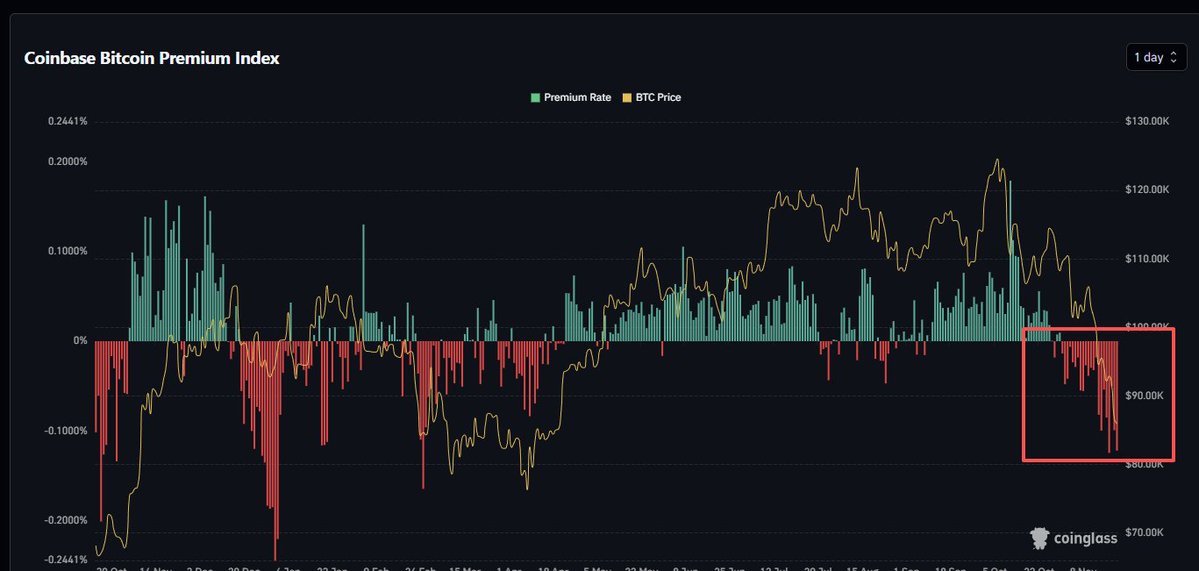

On-chain data confirms the severity of the move. According to CoinGlass, the Coinbase Bitcoin Premium Index has remained negative for 21 consecutive days, marking the longest sustained sell streak of this cycle. A negative premium means US spot-based traders — historically among the strongest demand segments — are selling more aggressively than global markets. This persistent pressure confirms that sentiment among US investors has flipped decisively bearish.

With STHs capitulating and major spot venues showing sustained sell dominance, the market structure reflects a classic late-stage correction. Historically, similar conditions have appeared during significant macro washouts — moments that either precede deeper breakdowns or set the foundation for powerful recoveries. For now, Bitcoin must reclaim higher levels quickly to avoid sliding into a prolonged bear phase.

Understanding the 21-Day Negative Coinbase Premium

A 21-day streak of negative Coinbase Premium is not just another datapoint — it is a clear signal that US-based spot demand has flipped aggressively bearish. The premium compares Bitcoin’s price on Coinbase to global exchanges; when it turns negative for this long, it means American investors are consistently selling at a discount, exerting persistent downward pressure.

Historically, prolonged negative readings have coincided with market stress, liquidity withdrawals, and risk-off behavior — all of which fit the current environment.

This trend also reflects how deeply short-term holders have capitulated. With many sitting on losses, even small price drops trigger panic selling, reinforcing a feedback loop that pushes prices lower. Under these conditions, Bitcoin must hold current levels to avoid a deeper structural breakdown. If the price fails to stabilize, the market could enter a prolonged bear phase as confidence erodes and liquidity thins further.

Still, not everyone agrees on the bearish outcome. Some analysts argue that capitulation events like this — especially when aligned with extreme negative premiums — often mark late-cycle cleanses rather than beginnings of a bear market. They believe that if Bitcoin manages a fast recovery, the broader bull cycle could remain intact. But for now, the burden is on BTC to reclaim higher levels before sentiment deteriorates beyond repair.

Weekly Chart Signals a Critical Breakdown

Bitcoin’s weekly chart shows a sharp and decisive breakdown, with BTC falling to $82,571 after losing the $85K level. This move marks one of the strongest weekly sell-offs of the cycle, with the latest candle dropping more than 12% and closing well below the 50-week moving average. The rejection from the $110K–$120K zone has now escalated into a full breakdown, and momentum has flipped aggressively bearish.

Volume confirms the shift. The past two weeks show clear selling dominance, with red candles expanding as the price accelerates downward. This suggests distribution rather than a temporary shakeout. The 100-week moving average — currently near $80K — now becomes the next major line of defense. A weekly close below this area could open the door to a deeper flush toward the 200-week moving average, a historically powerful support level.

Structurally, BTC has broken below a year-long uptrend structure, invalidating higher-timeframe bullish setups and signaling that buyers have lost control. However, this area also aligns with the prior consolidation zone from late 2024, meaning it could become a key battleground for a potential bottom.

To regain strength, Bitcoin needs to reclaim $90K quickly. Otherwise, sentiment may deteriorate further as more holders move into loss and capitulation deepens.

Featured image from ChatGPT, chart from TradingView.com

You May Also Like

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!

Edges higher ahead of BoC-Fed policy outcome