USDC Floods Exchanges: Are Traders Buying The Bitcoin Crash?

On-chain data shows a large amount of USDC inflows have just hit exchanges, a potential sign that investors are looking to buy the Bitcoin dip.

USDC Exchange Inflow Has Registered Multiple Spikes Recently

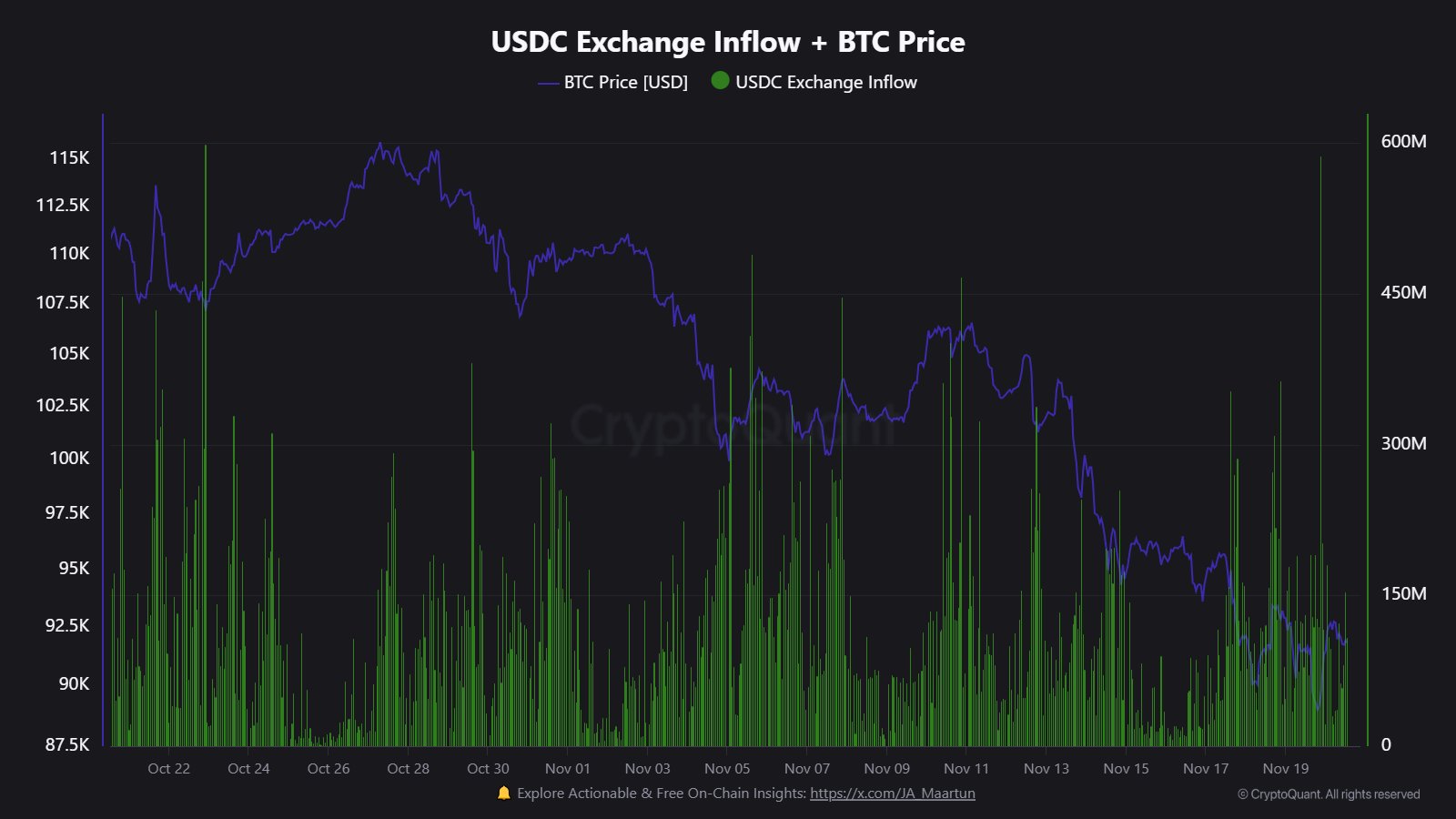

As explained by CryptoQuant community analyst Maartunn in a new post on X, the USDC Exchange Inflow has shot up recently. The “Exchange Inflow” here refers to an indicator that keeps track of the total amount of a given asset that’s being transferred to wallets connected with centralized exchanges.

Generally, investors deposit their coins to these platforms when they want to trade them away. As such, whenever the Exchange Inflow spikes, it can be a sign that there is demand for selling the asset.

Such a trend can naturally be bearish for Bitcoin and other volatile cryptocurrencies. When it comes to stablecoins, however, trading has no effect on their price, as they are, by definition, stable around the fiat currency that they are pegged to.

This doesn’t mean that stablecoin exchange deposits are without consequences, though. Investors usually store their capital in the form of USDC or another stablecoin when they want to avoid the volatility associated with Bitcoin and company. Once these traders feel the time is right to buy back in, they send their stables to exchanges and swap to the asset of their choice.

As such, stablecoin inflows can actually be a bullish sign for the market. From the chart shared by Maartunn, it’s visible that the USDC Exchange Inflow has surged recently, a potential sign that fresh capital is looking to accumulate the volatile coins.

The latest wave of USDC exchange deposits have arrived as Bitcoin and other digital assets have gone through a crash. Given this timing, it’s possible that traders are buying the dip.

In some other news, the recent bearish price action has been especially hard on the short-term holders (STHs), as Glassnode analyst Chris Beamish has pointed out in an X post.

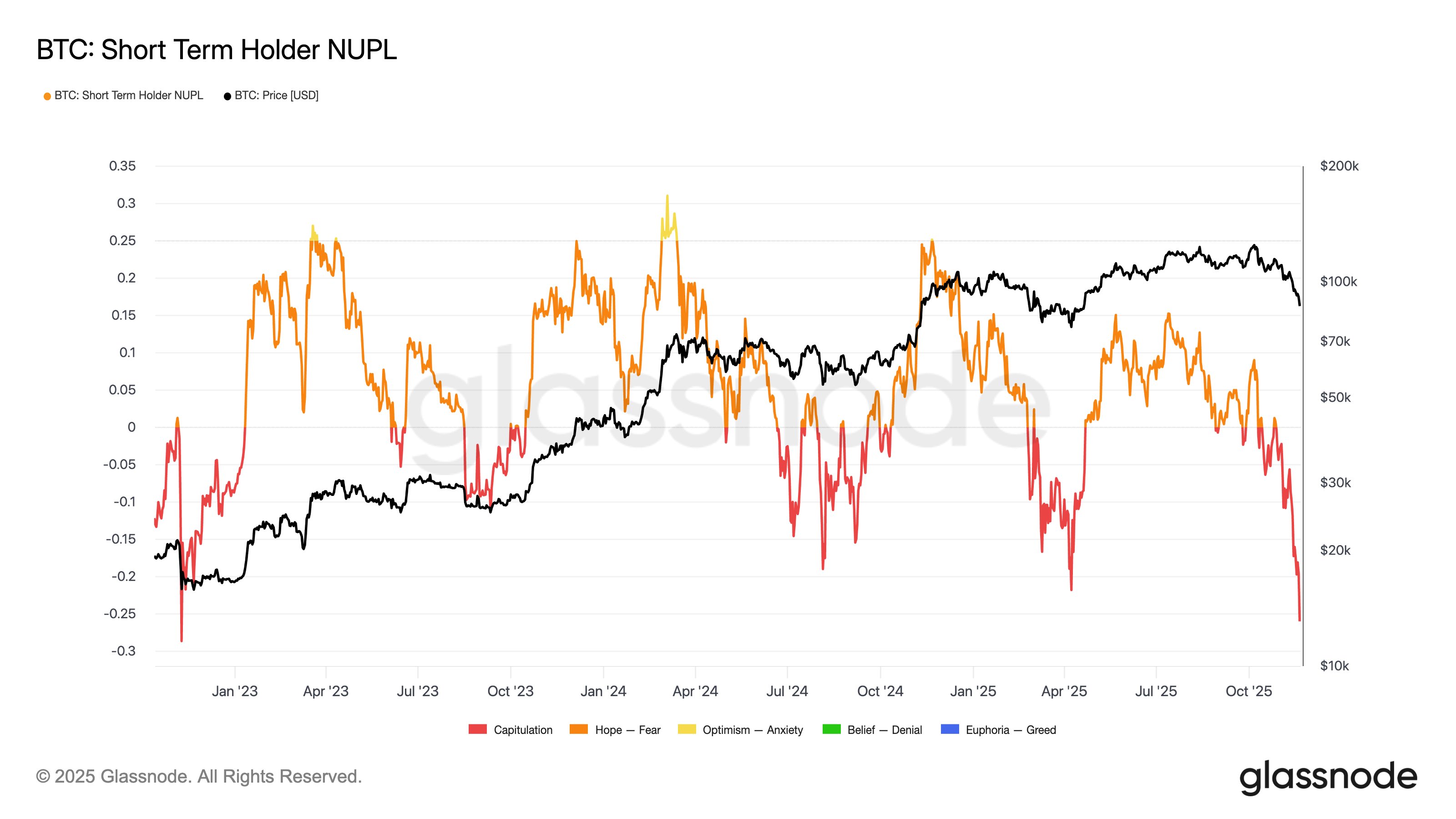

As displayed in the above graph, the Bitcoin STHs have witnessed a plunge in their Net Unrealized Profit/Loss (NUPL) alongside the market downturn. STHs are the investors who purchased their coins within the past 155 days, and the asset is currently trading at levels notably below any seen during this window, so the entire cohort has dropped into a state of loss.

Since the recent downtrend has been quite steep, the degree of unrealized loss faced by the cohort has also been unlike anything witnessed since November 2022, when the last bear market reached its bottom. “STH are seriously feeling the pain,” noted Beamish.

BTC Price

Bitcoin briefly slipped below $81,000 earlier in the day, but it has since seen a small jump back to $83,900.

You May Also Like

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!

Edges higher ahead of BoC-Fed policy outcome