Alarming: Coinbase BTC Premium Stays Negative for 3 Weeks Straight – What This Reveals About US Investor Sentiment

BitcoinWorld

Alarming: Coinbase BTC Premium Stays Negative for 3 Weeks Straight – What This Reveals About US Investor Sentiment

Have you noticed the concerning trend in Bitcoin markets? The Coinbase BTC premium has remained negative for three consecutive weeks, creating waves of uncertainty among cryptocurrency investors. This persistent negative premium signals something crucial about American investor behavior that could impact your trading decisions.

What Exactly is the Coinbase BTC Premium?

The Coinbase BTC premium measures the price difference between Bitcoin trading on Coinbase versus Binance. When this premium turns negative, it indicates weaker buying pressure from US investors compared to global markets. Currently, the BTC/USD pair on Coinbase is trading at a discount to the BTC/USDT pair on Binance, which started on October 31st and has continued for three straight weeks.

Why Should You Care About This Negative Trend?

This extended negative Coinbase BTC premium reveals several critical market insights:

- Weak US institutional demand for Bitcoin

- Reduced buying pressure from American investors

- Potential price volatility ahead

- Shifting global market dynamics

The consistent negative premium suggests that US investors are either cautious or redirecting their capital elsewhere. This trend becomes particularly significant when you consider that American investors typically drive substantial market movements.

What’s Driving This Extended Negative Coinbase BTC Premium?

Several factors contribute to this sustained negative Coinbase BTC premium. Regulatory uncertainty in the US continues to create hesitation among institutional investors. Moreover, global economic conditions and alternative investment opportunities are pulling capital away from cryptocurrency markets. The data from CryptoQuant clearly shows this pattern isn’t temporary but reflects a broader sentiment shift.

How Does This Impact Your Bitcoin Strategy?

Understanding the Coinbase BTC premium movement can help you make smarter investment decisions. When the premium remains negative, it often indicates:

- Potential buying opportunities for long-term holders

- Increased short-term volatility

- Possible market bottom formations

- Divergence between US and global market sentiment

However, remember that market indicators should never be used in isolation. The Coinbase BTC premium is just one piece of the larger cryptocurrency puzzle.

What Can We Expect Moving Forward?

The three-week negative Coinbase BTC premium pattern suggests we might see continued pressure on Bitcoin prices from the US side. However, markets often reverse when sentiment reaches extreme levels. Watch for these key signals that could indicate a turnaround:

- Positive regulatory developments

- Institutional buying returning

- Premium returning to positive territory

- Increased trading volume on Coinbase

Final Thoughts: Navigating the Current Market

The extended negative Coinbase BTC premium serves as a clear warning signal about US investor sentiment. While concerning, it also presents opportunities for informed investors who understand market cycles. The key is to monitor this indicator alongside other market metrics and maintain a balanced perspective.

Frequently Asked Questions

What does a negative Coinbase BTC premium mean?

A negative Coinbase BTC premium indicates that Bitcoin is trading at a lower price on Coinbase compared to Binance, suggesting weaker demand from US investors.

How long has the Coinbase BTC premium been negative?

The Coinbase BTC premium has been negative for three consecutive weeks, starting from October 31st according to CryptoQuant data.

Is a negative Coinbase BTC premium bad for Bitcoin?

While it indicates weak US demand, it doesn’t necessarily mean Bitcoin will decline. Global markets can still support prices, and negative premiums can sometimes signal buying opportunities.

Should I change my investment strategy because of this?

Use this information as one of many factors in your decision-making. Don’t make drastic changes based on a single indicator, but do consider adjusting your risk management accordingly.

How often does the Coinbase BTC premium change?

The premium fluctuates constantly based on real-time trading activity, but sustained trends like the current three-week negative period are more significant than daily movements.

Where can I track the Coinbase BTC premium?

You can monitor the Coinbase BTC premium through platforms like CryptoQuant, which provide real-time data and historical analysis of this important metric.

Found this analysis helpful? Share this article with fellow cryptocurrency enthusiasts on social media to help them understand what the extended negative Coinbase BTC premium means for their investment strategy. Knowledge sharing strengthens our entire community!

To learn more about the latest Bitcoin trends, explore our article on key developments shaping Bitcoin price action and institutional adoption.

This post Alarming: Coinbase BTC Premium Stays Negative for 3 Weeks Straight – What This Reveals About US Investor Sentiment first appeared on BitcoinWorld.

You May Also Like

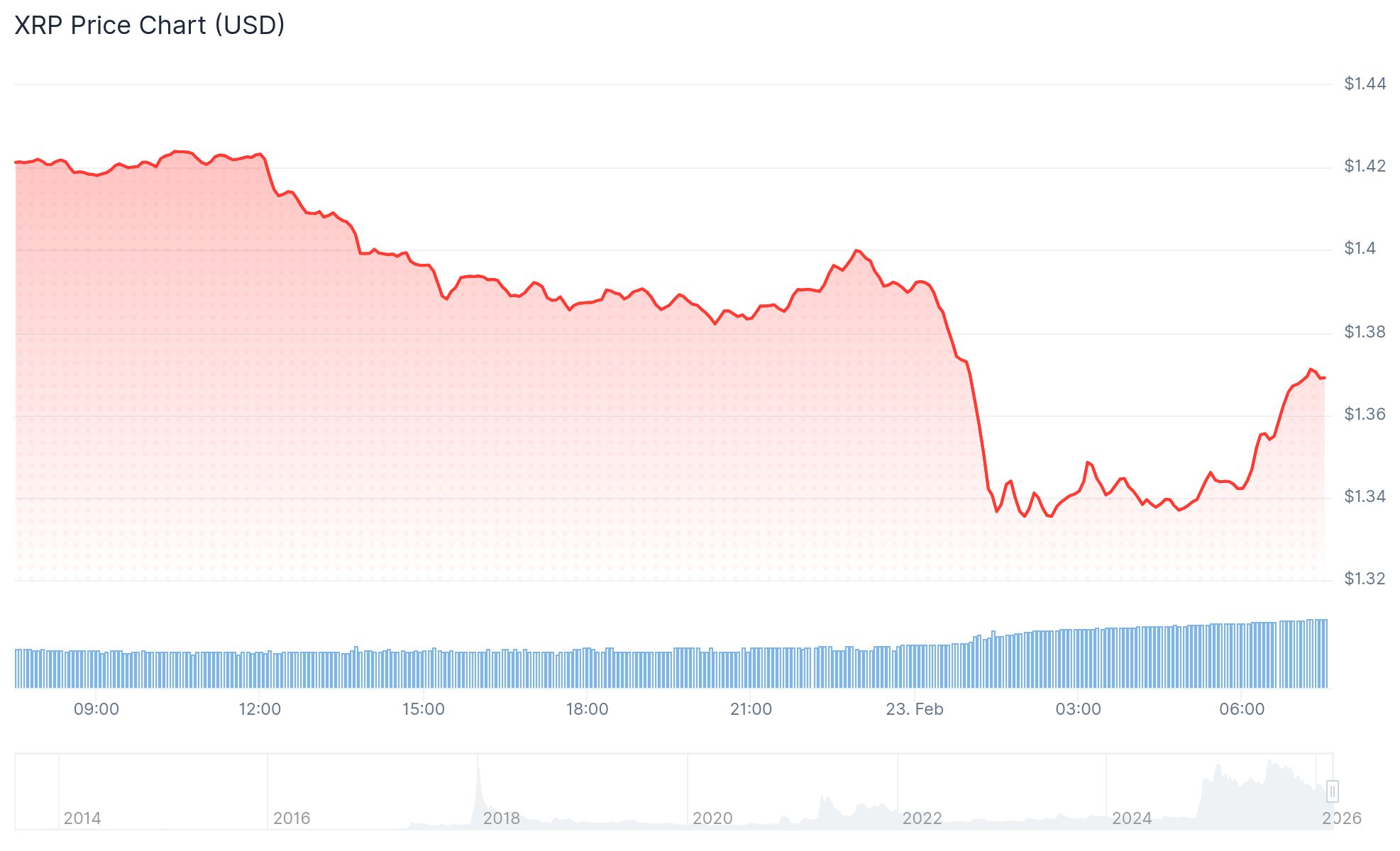

XRP Price Crashed 69% From its Peak

XRP Price: Falls to $1.33 as Realized Losses Hit 39-Month High – Watch These Levels