BNB News: BNB Key Supports Spark Speculation as Derivatives Heat Up

The market of BNB demonstrates that there is strong support at $853, $660, and $564 as the derivatives’ volatility and hedging increase.

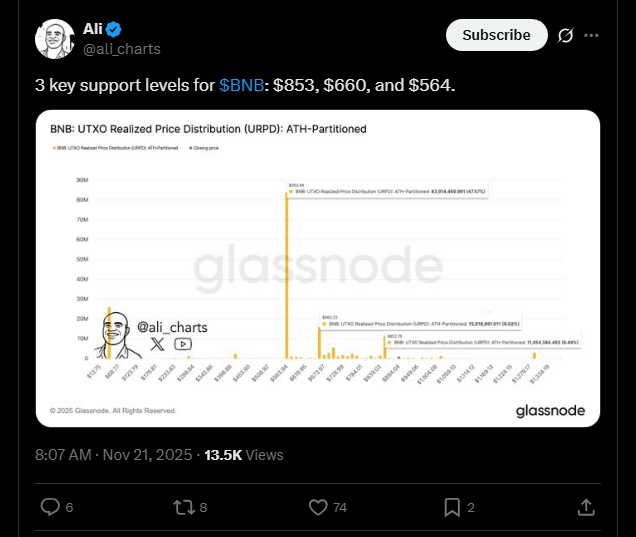

BNB faces a fluctuating market environment, and the most significant support levels have been identified based on on-chain metrics and derivatives trading.

Three key areas at $853, $660, and $564 are being closely observed by market participants and are layered to potentially determine the short-term direction of BNB.

These levels of support are the biggest aggregates of realized volume and past on-chain actions, according to analyst Ali (@ali_charts) on

Source – Ali (@ali_charts) on X

This is the most concentrated area with the highest concentration of previous trading activity, and this is at around $853.

Under this, the level of 660 is a key mid-range point where there is frequent intervention of long-term holders. Its bottom-most and deepest support cluster is at 564, indicating a previous accumulation stage which could reduce further fall in prices.

You might also like: BNB News: BNB Surges After Consolidation, Eyes $1,230 to $1,300 Zone

Rising Volatility Fuels Derivatives Action

The derivative market of BNB witnessed a significant increase in the number of options that saw a soaring 139 percent and a moderate decline in the futures open interest.

This implies increased hedging during swings, as traders change their exposure. Recently, the total futures volume has been climbing to $5.32 billion, and spot trading has taken place at 605 million.

The situation is mixed in terms of long and short positioning across exchanges. Although the net market position is rather underweight (0.91), Binance and OKX have a high long bias population.

Leading traders, though, introduce more balanced positions, which means that there is confusion regarding the next directional movement of BNB.

The data on liquidation also proves the existence of unequal trader exposure. Long positions were heavily losing more than 8 million dollars over 24 hours, whereas short liquidation was not high.

Key exchanges that are fueling this movement include Binance, OKX, Bybit, and Bitfinex, and leveraged trading helps increase the intraday volume.

Support Zones Forge a Staircase Structure

The combination of the three zones of 853, 660, and 564 zones forms a staircase-like pattern that can be used to determine the direction of BNB in case of corrections.

These levels are regarded as battlegrounds, as BNB trades about $820. Defending such support by buyers might stabilize the market, and their inability may further pullbacks.

This framework proposes the overall perspective on BNB and the potential to recover and reach greater heights should the support be good. On the other hand, violation of these levels can result in added selling pressure during the current volatility.

The post BNB News: BNB Key Supports Spark Speculation as Derivatives Heat Up appeared first on Live Bitcoin News.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Why Institutional Capital Chooses Gold Over Bitcoin Amid Yen Currency Crisis