Bitcoin RSI Hits Lowest Level Since August 2023: Technical Analysis

Bitcoin's daily Relative Strength Index (RSI) has fallen to its lowest reading since August 2023, when the cryptocurrency was trading at approximately $25,000, signaling extreme oversold conditions that historically have preceded significant price movements.

This technical indicator milestone comes as Bitcoin continues its decline to seven-month lows, with the RSI reading suggesting the asset may be approaching capitulation levels or potential reversal zones.

Understanding RSI

What is the Relative Strength Index?

The RSI is a momentum oscillator that measures the speed and magnitude of price changes:

Key Characteristics

- Scale: Ranges from 0 to 100

- Overbought Territory: Generally above 70

- Oversold Territory: Generally below 30

- Extreme Levels: Below 20 or above 80 indicate very strong conditions

- Timeframe: Can be calculated for various periods (daily, weekly, hourly)

How RSI Works

The indicator calculates:

- Average gains over a specified period (typically 14 days)

- Average losses over the same period

- Ratio between these averages

- Normalized to 0-100 scale

RSI Formula

RSI = 100 - [100 / (1 + RS)] Where RS = Average Gain / Average Loss

Current RSI Reading

Historical Context

Bitcoin's daily RSI has reached levels not seen since August 2023:

August 2023 Conditions

- Price Level: Approximately $25,000

- Market Sentiment: Bear market continuation fears

- RSI Reading: Extreme oversold territory

- Subsequent Action: Marked beginning of recovery rally to $73,000+ by early 2024

Current Situation (November 2025)

- Price Level: Seven-month lows

- Market Sentiment: Bearish momentum intensifying

- RSI Reading: Matching August 2023 extreme oversold levels

- Implication: Potential exhaustion of selling pressure

Technical Significance

What Extreme RSI Levels Indicate

Low RSI readings suggest several market conditions:

Oversold Conditions

- Selling momentum may be exhausting

- Price decline may be overdone relative to fundamentals

- Potential for mean reversion

- Historically associated with buying opportunities

Capitulation Signals

- Weak hands exiting positions

- Panic selling reaching climax

- Maximum pessimism in market

- Often marks or precedes market bottoms

Divergence Potential

- If price makes new lows but RSI doesn't, bullish divergence

- Suggests weakening downward momentum

- Can signal trend reversal

- Increases probability of bounce

Historical RSI Analysis

Previous Extreme Oversold Events

Bitcoin's history shows patterns around extreme RSI readings:

March 2020 COVID Crash

- RSI dropped below 20

- Bitcoin fell to $3,800

- Marked generational buying opportunity

- 1,800% rally followed over next year

December 2018 Capitulation

- RSI reached extreme oversold levels

- Bitcoin bottomed around $3,200

- Beginning of accumulation phase

- 350% rally to $13,800 by June 2019

August 2023 Reference Point

- RSI hit similar current levels

- Bitcoin at $25,000

- Preceded 192% rally to $73,000+

- Multi-month recovery period

September 2015 Bear Market Bottom

- Extreme RSI oversold reading

- Bitcoin around $200

- Marked end of 2014-2015 bear market

- Beginning of 2016-2017 bull cycle

Comparative Analysis

Then vs. Now

Comparing August 2023 to current conditions:

Similarities

- Identical RSI oversold levels

- Extended downtrends preceding

- Market pessimism prevalent

- ETF-related dynamics (2023: anticipation, 2025: reality)

- Institutional interest present but cautious

Differences

- Price Levels: $25,000 (2023) vs. current seven-month lows

- Market Maturity: More institutional participation now

- Regulatory Clarity: More developed framework in 2025

- Macroeconomic Context: Different interest rate and inflation environments

- Market Structure: Established Bitcoin ETFs now trading

Trading Implications

For Technical Traders

Extreme RSI readings inform various strategies:

Contrarian Approach

- View oversold as buying opportunity

- Accumulate during fear and capitulation

- Position for mean reversion

- Risk: catching falling knife if downtrend continues

Confirmation-Based Strategy

- Wait for RSI to start rising from extreme levels

- Look for bullish divergences

- Confirm with other indicators

- Enter on reversal signals rather than absolute levels

Risk Management Considerations

- Extreme oversold can become more extreme

- RSI can remain low during extended downtrends

- Use stop losses regardless of indicator readings

- Position sizing crucial in volatile conditions

Additional Technical Factors

Supporting or Contradicting Indicators

RSI should be analyzed alongside other metrics:

Moving Averages

- Death crosses suggesting continued bearish momentum

- Distance from key averages indicates severity

- Golden crosses would confirm reversal

Volume Analysis

- High volume on decline suggests capitulation

- Low volume may indicate lack of conviction

- Volume on reversal crucial for confirmation

Support/Resistance Levels

- RSI oversold at major support strengthens signal

- Breaking support despite oversold RSI bearish

- Confluence of technical factors improves probability

On-Chain Metrics

- MVRV ratios showing under/overvaluation

- Holder behavior and accumulation patterns

- Exchange flows indicating selling exhaustion

- Miner capitulation or accumulation signals

Market Sentiment Context

Psychology of Extreme Readings

Current RSI levels reflect market psychology:

Fear and Capitulation

- Long-term holders questioning conviction

- New investors experiencing first major drawdown

- Media narrative turns extremely negative

- Social sentiment at pessimistic extremes

Historical Pattern Recognition

- Investors remembering August 2023 recovery

- Comparisons to previous bear market bottoms

- Debate over whether "this time is different"

- Tension between hope and fear

Expert Perspectives

Technical Analyst Views

Professional traders offer varied interpretations:

Bullish Interpretation

"RSI at August 2023 levels is screaming oversold. History shows these extremes mark excellent long-term entry points. The parallel to $25,000 bottom is striking—similar setup, similar RSI, potentially similar outcome."

Bearish Caution

"While RSI is oversold, remember it can stay oversold during prolonged downtrends. August 2023 worked out, but other extreme readings led to further declines. Don't fight the trend based solely on RSI."

Balanced Perspective

"Extreme RSI is one piece of the puzzle. It signals potential exhaustion but needs confirmation. Watch for bullish divergence, volume reversal, and price structure change before concluding bottom is in."

Timeframe Considerations

Daily RSI vs. Other Timeframes

The daily RSI reading should be contextualized:

Weekly RSI

- Provides longer-term perspective

- Less prone to short-term noise

- Weekly oversold readings more significant

- Currently may not be as extreme as daily

Hourly RSI

- Shows short-term momentum

- May already show oversold relief

- Useful for timing entries

- More volatile and less reliable

Multiple Timeframe Analysis

- Daily oversold confirms short-term extreme

- Weekly context shows broader trend

- Alignment across timeframes strengthens signals

- Divergences between timeframes provide nuance

Potential Scenarios

Possible Outcomes from Current Levels

Several paths forward from extreme oversold RSI:

Scenario 1: V-Shaped Recovery

- Strong bounce from oversold levels

- Quick return above key moving averages

- Similar to August 2023 pattern

- Requires catalyst or capitulation event

Scenario 2: Grinding Bottom

- Extended consolidation at low levels

- RSI normalizes through time rather than price rise

- Slow accumulation phase

- Base building for future rally

Scenario 3: Bear Market Continuation

- Brief oversold bounce followed by new lows

- RSI reaches even more extreme levels

- Extended capitulation process

- Deeper bottom before recovery

Scenario 4: Divergence Setup

- Price makes new low but RSI doesn't

- Classic bullish divergence forms

- Signals weakening downward momentum

- Higher probability reversal setup

Practical Applications

For Different Investor Types

How various market participants might use this information:

Long-Term Holders

- Extreme RSI validates "HODL" strategy

- Historical precedent for recovery

- Potential to accumulate more at discount

- Reinforces conviction during drawdown

Active Traders

- Entry signal for swing trades

- Risk/reward potentially favorable

- Tight stop losses still required

- Monitor for confirmation signals

New Investors

- Educational opportunity about market cycles

- Understanding technical indicators

- Importance of historical context

- Risk management lessons

Institutional Investors

- Systematic signal in quantitative models

- Risk assessment framework input

- Historical probability analysis

- Portfolio rebalancing considerations

Limitations and Warnings

What RSI Doesn't Tell You

Important caveats about relying on RSI:

Not Predictive

- Indicates conditions, doesn't guarantee outcomes

- Oversold can become more oversold

- No crystal ball for exact bottom timing

- One indicator among many

Context Dependent

- Effectiveness varies by market conditions

- Works better in ranging vs. trending markets

- Crypto volatility can produce false signals

- Fundamental factors may override technical

Timing Uncertainty

- Can remain extreme for extended periods

- Doesn't specify when reversal will occur

- Early entry risk if downtrend continues

- Patience required for setup to play out

Conclusion

Bitcoin's daily RSI reaching its lowest level since August 2023—when BTC traded at $25,000—marks a significant technical milestone. This extreme oversold reading historically has coincided with major buying opportunities and market bottoms, though it doesn't guarantee immediate reversal.

The parallel to August 2023 is striking: similar RSI levels preceded a substantial recovery rally that eventually took Bitcoin to all-time highs above $73,000. However, investors must remember that technical indicators provide probabilities, not certainties.

Current extreme oversold conditions suggest:

- Selling pressure may be reaching exhaustion

- Risk/reward ratio potentially favorable for long-term investors

- Capitulation or accumulation phase likely

- Historical precedent for recovery from these levels

Yet caution remains warranted:

- Confirmation from price action and other indicators needed

- Oversold can persist during extended bear markets

- Fundamental and macroeconomic factors still crucial

- Individual risk tolerance should guide decisions

As Bitcoin tests both technical and psychological levels, the RSI reading adds to evidence that markets may be approaching an inflection point—whether that proves to be a bottom or temporary pause remains to be seen in coming weeks.

You May Also Like

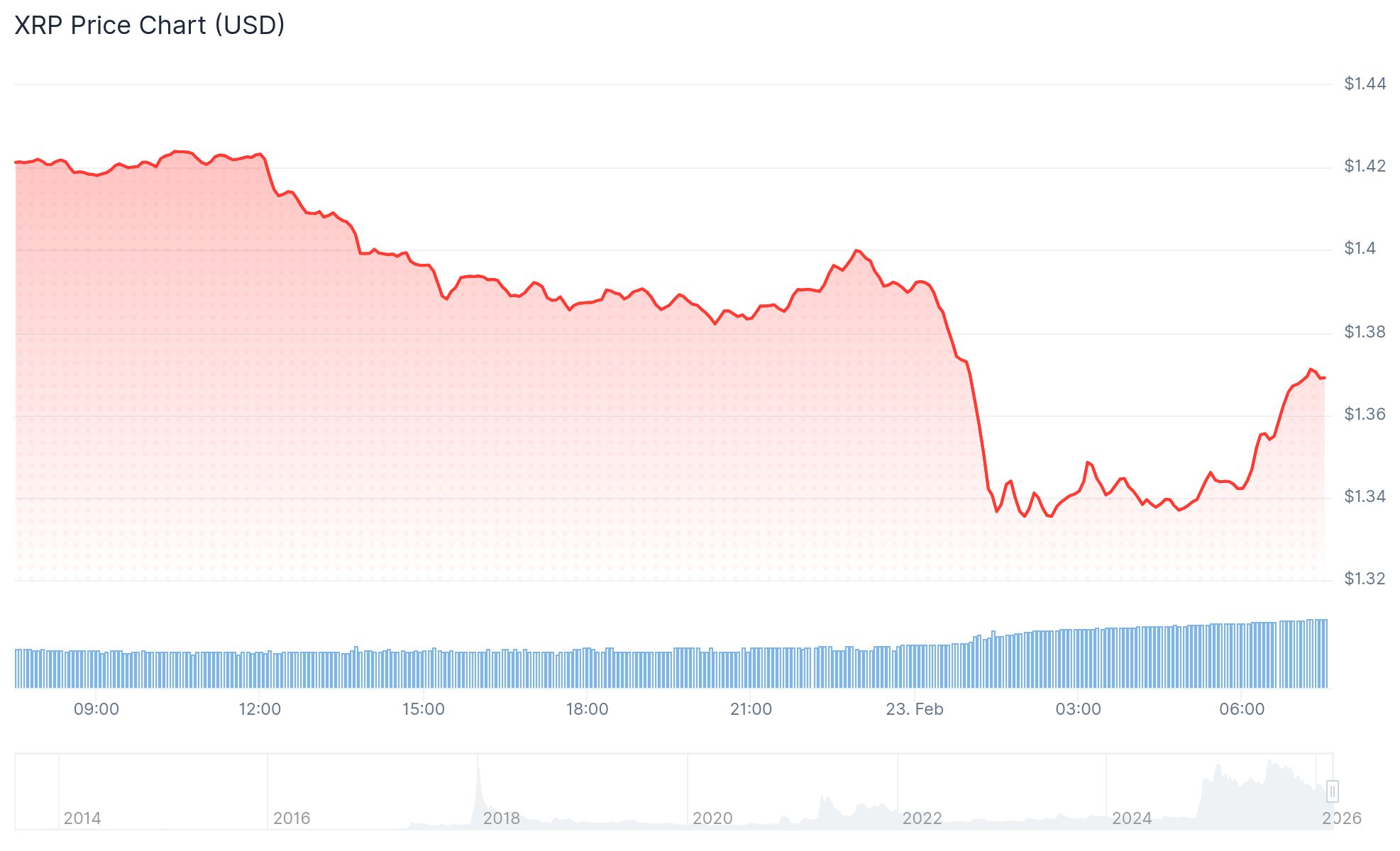

XRP Price Crashed 69% From its Peak

XRP Price: Falls to $1.33 as Realized Losses Hit 39-Month High – Watch These Levels