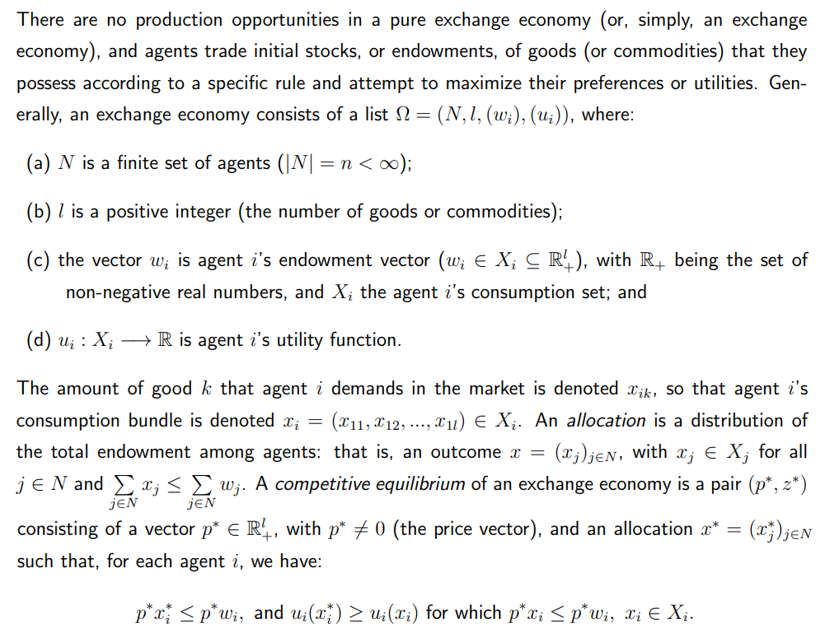

Starting from July, Strategy (MSTR) has posted negative returns for five consecutive months.

Its terrible streak began with a minor 1% loss in August and escalated significantly into the fall.

The company is on track to record the deepest drawdown of the year (so far) in November with a 37% decline. This would be the company’s second-worst month since revealing its first Bitcoin purchase back in August 2020.

Strategy’s dark streak

Strategy (formerly MicroStrategy) used to trade at a premium relative to the net asset value (NAV) of its Bitcoin holdings.

That premium has narrowed significantly, meaning investors are less willing to pay extra for its stock over simply owning Bitcoin.

Because its NAV premium has shrunk, capital via equity is now more difficult.

There’s been a broader market rotation in November, with tech and growth stocks (especially AI-linked) remaining under pressure.

Investors are reducing risk exposure more generally, and Strategy is particularly vulnerable in risk-off environments.

Uncertainty around Federal Reserve policy is weighing on risk assets, with Bitcoin slipping below the $80,000 level.

Strategy’s current purchasing price stands at $74,433, which is not far off from where BTC is trading right now.

Source: https://u.today/strategy-mstr-having-second-worst-month-since-buying-bitcoin