Best Meme Coins to Buy – Dogecoin Price Prediction

Dogecoin enters a potential recovery phase as the New York Stock Exchange approves a new DOGE ETF.

This approval arrives during a deep red period in the crypto market, raising questions about whether Dogecoin can mount a rebound. Traders are watching closely to see if Wall Street can reignite interest in the original meme coin.

While institutional capital often moves slowly, aggressive traders are shifting toward high-alpha presales that offer large, guaranteed discounts rather than waiting for DOGE to react to the ETF.

Maxi Doge (MAXI) is quickly emerging as the best meme coin to buy in this environment.

Source – The Crypto Mark YouTube Channel

Dogecoin Spot ETF Goes Live, Signaling Rising Institutional Interest

Dogecoin gains fresh attention after the NYSE approves the Grayscale Dogecoin Trust ETF (GDOG). NYSE Arca filed the approval with the U.S. Securities and Exchange Commission, clearing the way for GDOG and Grayscale’s XRP ETF (GXRP) to begin trading today, Monday.

Bloomberg ETF analyst Eric Balchunas shared the approval on X and confirmed that Grayscale’s Chainlink ETF (GLNK) will arrive the following week. This marks the final step for Dogecoin’s first spot ETF to launch on a major U.S. exchange.

Grayscale is converting its existing Dogecoin Trust into a full ETF that tracks DOGE. The listing gives Dogecoin exposure to traditional finance and encourages institutional investors to take a closer look at the asset.

In addition, 21Shares announced the launch of its 2x Long Dogecoin ETF (TXXD) on X, giving traders a way to double their exposure to DOGE. More products mean more liquidity, more volume, and more attention directed toward Dogecoin.

Wall Street appears to be warming up to DOGE, and each new listing adds stronger momentum to the meme coin’s path toward mainstream exposure.

Dogecoin Price Prediction

The broader crypto market now sits at a $2.88 trillion valuation, almost 50% lower than its recent peak, creating an environment filled with fear and uncertainty.

The Fear and Greed Index is at 12, the average RSI is near oversold at 40, and major assets such as Bitcoin and Ethereum remain below $90,000 and $3,000.

These signals point to a deep market reset where many altcoins trade far below their highs, giving long-term believers strategic dip-buying opportunities.

Even with recent developments like ETF approvals, Dogecoin continues to show weakness. It is up 2% on the day but still down 15% on the week and 26% on the month, sitting about 85% below its all-time high.

Analyst Ali explains that large holders sold or redistributed 7 billion DOGE in the past month, adding steady sell pressure that limits upward momentum.

Analyst KrissPax also notes that DOGE quickly fell back to the $0.144 level after a brief recovery, showing how fragile its trend is. Despite this pressure, the question remains whether Dogecoin is preparing for a new cycle.

The long-term outlook remains supported by growing institutional access, including new trust products, and the appeal of buying near the $0.10 level, helped by ongoing interest from figures such as Elon Musk.

The upcoming NYSE listing may help build momentum if market sentiment shifts from fear to accumulation, and the next few weeks will show how much support Wall Street brings to the Dogecoin market.

If you want to position yourself for a possible Dogecoin rebound, here’s a guide on how and where to buy DOGE.

Why This New Meme Coin Could Outperform Dogecoin

Maxi Doge is a new meme coin that is going viral by building on Dogecoin’s style while adding real utility and an active community. The project brings back the meme coin energy and moves investors from hype-only coins to tokens that actually offer useful features.

It includes staking, trading contests, partner events, and plans to link with high-leverage futures platforms.

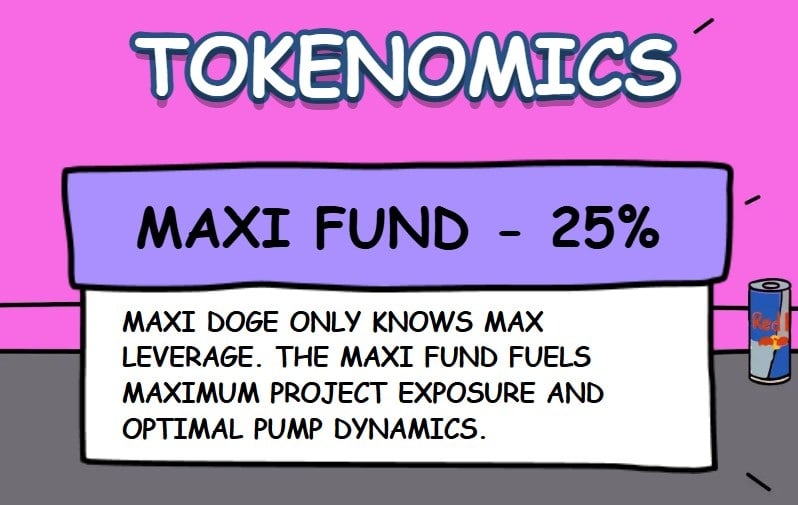

Its tokenomics match the “max” theme, with 40% of the supply going to marketing with top influencers and 25% going to the Maxi Fund to boost exposure and liquidity.

Dogecoin already proved what early investors can achieve with a strong meme coin. But because DOGE is now a large and established asset, it no longer has room for explosive growth.

Its $25 billion market cap makes big moves much harder, and the new DOGE ETFs also place it under the influence of large institutional traders. Maxi Doge offers the same fun DOGE theme but with modern humor and far more upside potential.

The numbers behind Maxi Doge show real momentum. The presale has already raised about $4.1 million, making it one of the best meme coins to buy now.

Each $MAXI token sells for $0.0002695. Maxi Doge also gives presale buyers a high staking reward, offering up to 73% APY, which motivates long-term holding and increases demand.

Anyone who wants to buy $MAXI can visit the Maxi Doge official website and connect a wallet like Best Wallet. Users can pay with USDT, ETH, or even with a bank card in just a few seconds.

Visit Maxi Doge

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Digitap Raises Over $4M: A Comparison with DeepSnitch AI

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise