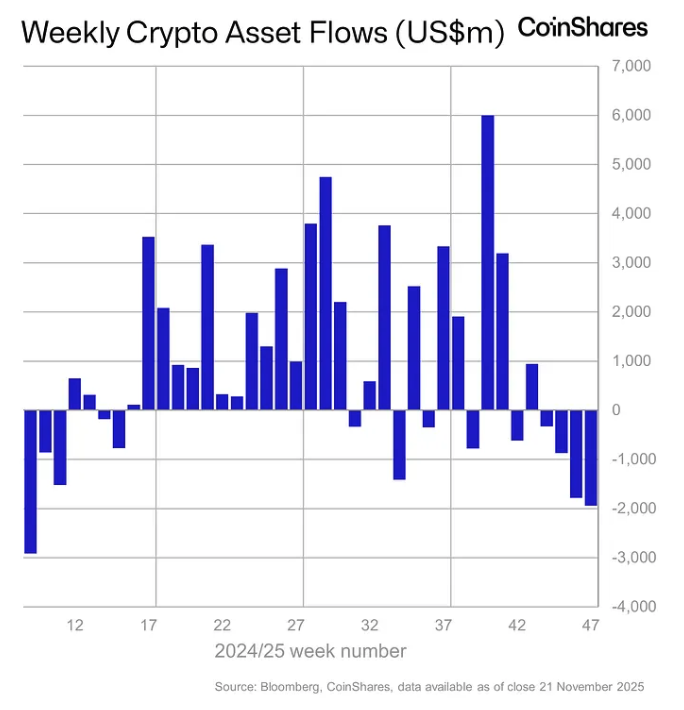

Global crypto ETPs see $1.9 billion in weekly outflows, adding to third-worst run since 2018: CoinShares

Global crypto investment products managed by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares witnessed net outflows of $1.9 billion last week, according to CoinShares' data.

That added to a four-week negative run now totaling $4.9 billion — representing 2.9% of assets under management — CoinShares Head of Research James Butterfill noted in a Monday report, amid the continued crypto market sell-off.

"Proportionally this represents the 3rd largest run of outflows since 2018, beaten only by March 2025 and February 2018, marking a 36% decline in AUM representing the combined impact of inflows and price," Butterfill said.

Weekly crypto asset flows. Image: CoinShares.

BTC and ETH fell 8.3% and 9.4%, respectively, last week, according to The Block's prices page, before staging something of a recovery on Friday and over the weekend. Bitcoin is currently trading for around $86,299, while Ethereum is changing hands for $2,803.

'Tentative signs of a turnaround'

The redemptions were spread broadly across most regions last week. U.S.-based funds dominated with $1.69 billion in net outflows, while crypto investment products in Germany, Switzerland, Canada, and Sweden saw $118.2 million, $79.7 million, $27.1 million, and $26.8 million worth of outflows, respectively. Only crypto funds in Brazil and Australia were positive, registering modest net inflows of $3.5 million and $2 million.

Nevertheless, year-to-date net inflows remain high at $44.4 billion, Butterfill noted, highlighting that Friday signaled "tentative signs of a turnaround in sentiment," as the crypto investment products brought in $258 million following seven consecutive days of net outflows.

Bitcoin-based ETPs again led the outflows in terms of the underlying asset, with $1.27 billion exiting the funds last week, but also witnessed the largest rebound on Friday with $225 million worth of net inflows. Short Bitcoin funds remain popular amid the slide, adding $19 million in net inflows to a three-week run of $40 million that has seen assets under management rise 119%, Butterfill said.

The U.S. spot Bitcoin exchange-traded funds saw $1.2 billion in net outflows alone, according to data compiled by The Block, led by around $1.09 billion exiting BlackRock's IBIT.

Ethereum products also struggled, witnessing net outflows of $589 million globally last week, with the U.S.-based spot Ethereum ETFs accounting for $500.2 million of that figure, again led by BlackRock's ETHA.

Meanwhile, Solana ETPs recorded net weekly outflows of $156 million, while XRP funds bucked the trend, adding $89.3 million amid Bitwise's new U.S. spot XRP ETF launch.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

You May Also Like

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be

Academic Publishing and Fairness: A Game-Theoretic Model of Peer-Review Bias