How Far Can Zcash Price Drop After 30% Crash From November Peak?

Market Analysis: Zcash Faces Potential Downtrend Amid Technical Signals and Bearish Sentiment

Zcash (ZEC) has experienced a notable decline, falling approximately 30% from its peak of $750 reached in November. The recent price action has prompted concerns over further downside, with some analysts warning of a possible “pump-and-dump” scenario amid suspicious promotional activities. Despite the recent correction, some long-term investors remain optimistic about Zcash’s prospects, citing its technological strengths and network development.

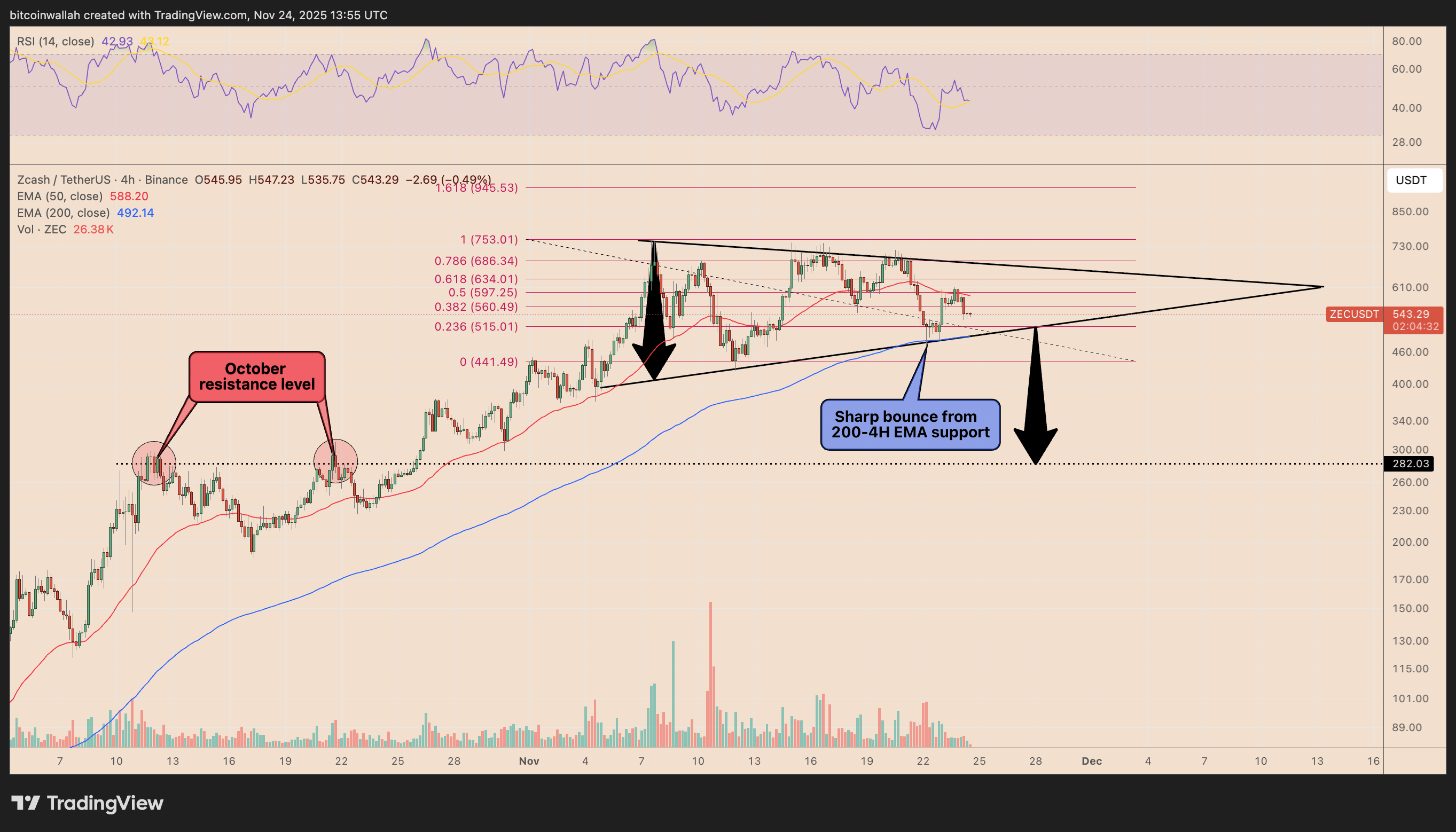

ZEC/USDT four-hour chart. Source: TradingViewTechnical Indicators Signal Possible 50% Decline

Currently, Zcash is trading within a symmetrical triangle pattern on the four-hour chart, indicative of market indecision following a substantial 1,500% rally since late September. The pattern is reinforced by a rebound from the 200-4H exponential moving average (EMA), a critical support level. Analysts suggest this setup could propel the price towards the triangle’s upper boundary near the 0.786 Fibonacci retracement level around $686, anticipated in November.

The symmetry of such patterns leaves the outcome uncertain, contingent on broader market conditions. The sentiment remains fragile, weighed down by macroeconomic factors such as Federal Reserve rate policies and stretched valuations in the artificial intelligence sector, which have exerted pressure on risk assets like Zcash.

If bearish momentum prevails, a breakdown below the triangle’s lower trendline is likely, which could see the price drop to approximately $282—a level that previously marked local tops in early October and aligns with the 20-week EMA line, as seen on weekly charts. This move could signal a decline of nearly 50% from current levels, with projections pointing toward a drop to the $220–$280 range by early 2026.

ZEC/USDT weekly chart. Source: TradingView

ZEC/USDT weekly chart. Source: TradingView

Parabolic Rise and Prospective Correction Highlighted

Recent comparisons to Binance Coin (BNB) hint at a potential 60% correction for Zcash. Market analyst Nebraskangooner pointed out similarities between ZEC’s rally and BNB’s parabolic ascent before its sharp decline. Overextended rallies often precede significant retracements; in ZEC’s case, failure to reclaim key parabola support levels has fueled fears of a steep correction, with some remote targets reaching as low as $220.

Source: X

Source: X

Market Dynamics: Pump-and-Dump Claims and Bullish Divergence

Adding to the bearish outlook, marketing agencies reportedly offered paid promotional campaigns to boost Zcash’s visibility, raising concerns about artificially inflating its price. Crypto influencer Mark Moss shared screenshots of outreach messages promoting paid collaborations, fueling suspicion of coordinated pump efforts. Meanwhile, some industry veterans, including Arthur Hayes of BitMEX and the Winklevoss twins of Gemini, maintain a bullish stance, with Arthur Hayes projecting ZEC could rise to $10,000 in the longer term.

Other analysts warn that recent hype may be driven by a pursuit of exit liquidity, citing false headlines claiming Fidelity’s analysts predicted Zcash could reach $100,000—a narrative deemed misleading by skeptics.

This divergence highlights the ongoing debate within the crypto community about Zcash’s future trajectory, amidst macroeconomic uncertainties and speculative activity.

This article was originally published as How Far Can Zcash Price Drop After 30% Crash From November Peak? on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Will XRP Price Increase In September 2025?