Bitcoin Faces More Downside After Recent Crash, Data Shows

Bitcoin suffered a sudden and deep drop in November, losing nearly a quarter of its value and wiping out over $1 trillion across the crypto market.

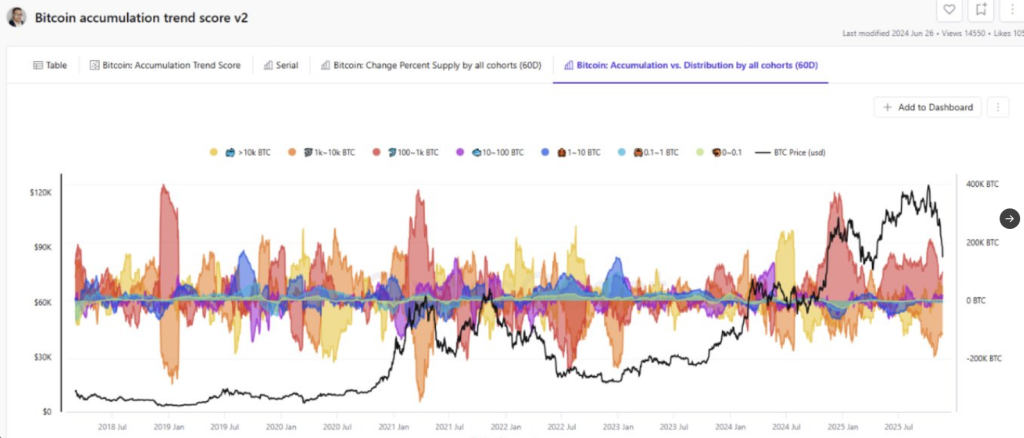

Whales Trim Positions Before Crash

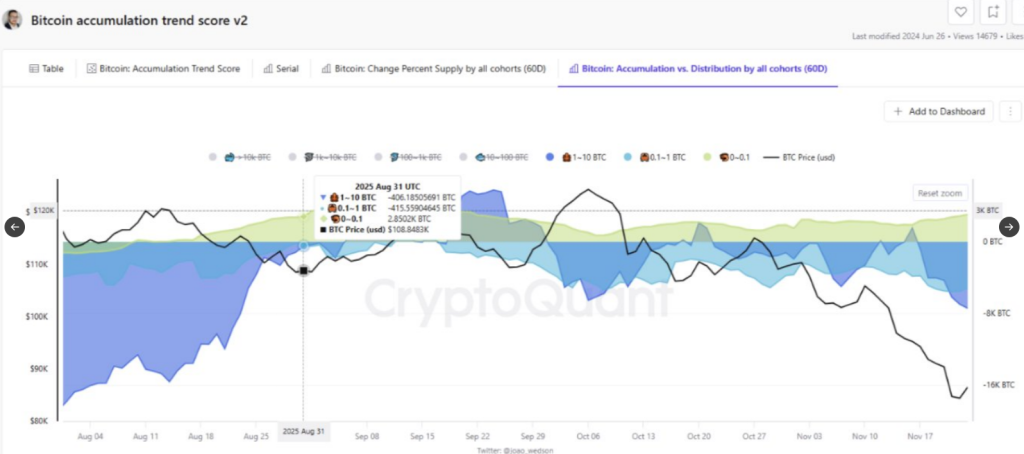

According to on-chain data from CryptoQuant, large holders played a central role. Wallets holding between 1,000–10,000 BTC pared back their stakes in the weeks leading up to the fall.

Those big sellers took profits after the October rally, and in many cases selling was steady rather than panicked. When large players step back like that, market depth can vanish quickly.

A quick overview of Bitcoin’s price decline shows prices slid from record highs above $126,000 in October to roughly $81,000 at the lowest point, before a partial bounce to $87k was recorded. Traders and funds were caught off guard by the speed of the move.

At the time of writing, Bitcoin was trading at $87,086, up 1.5% in the last 24 hours.

Retail Selling Added To Pressure

Based on reports, small wallets also leaned toward safety. Holders under 10 BTC and groups up to 1,000 BTC reduced positions, removing another layer of potential buyers.

Buying interest from casual investors was weaker than expected. Mid-sized holders — those with 10–100 and 100–1,000 BTC — did buy during the correction, and their activity helped slow the slide. Still, their buying power was not enough to match the large outflows.

Futures Liquidations Intensified The Drop

Futures Liquidations Intensified The Drop

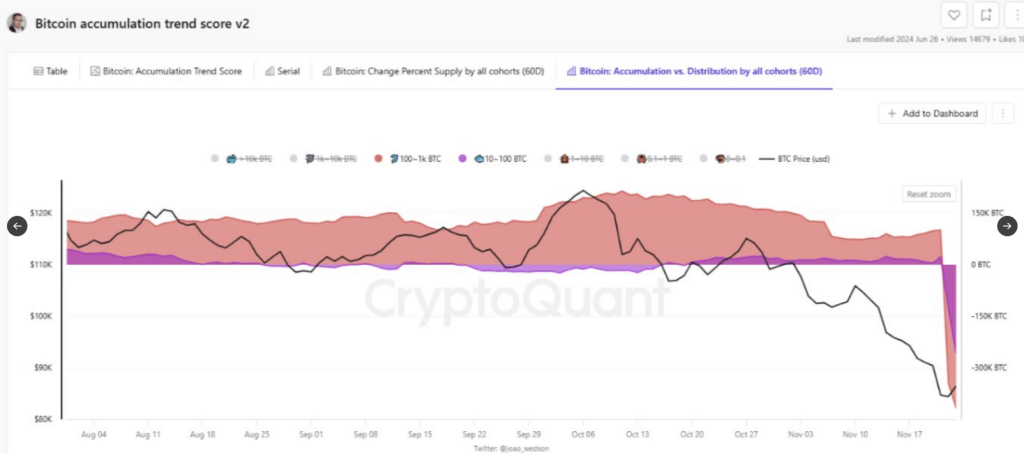

Reports show that futures market dynamics turned a correction into a crash. Over a 13-day stretch, long positions were forcefully closed out.

That cascade removed bids and created a chain reaction of selling that pushed Bitcoin from around $105K down to $81K. Liquidations were heavy, and the selling pressure was compounded as each forced sale fed into the next.

A Tentative Rebound Shows Life

A Tentative Rebound Shows Life

After the lows were hit, Bitcoin climbed back to about $87,500. This rebound has been taken by some as a sign that a local bottom might be forming.

According to CryptoQuant, however, the recovery cannot be considered secure while the 1,000–10,000 BTC group keeps reducing holdings. The market’s health was being tested by who chose to sell and who chose to buy.

Market watchers say a true reversal needs selling from large wallets to stop. If those whales pause, mid-sized buyers might build a firmer floor and confidence could return.

If selling continues, lower levels may be explored once again. The coming sessions will be watched closely by traders who want to see whether large holders change course or keep cashing out.

For now, the situation is simple and tense at the same time: prices have recovered slightly, but the structural weakness that allowed a 25% fall was exposed.

Bitcoin could face further losses after its recent crash, if CryptoQuant’s data is anything to go by. Large holders have been taking profits, while retail investors have also been selling, leaving fewer buyers to support the market.

Analysts say the next move will depend on whether these big holders continue selling or if mid-sized buyers step in to stabilize prices.

Featured image from Vecteezy, chart from TradingView

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Why Institutional Capital Chooses Gold Over Bitcoin Amid Yen Currency Crisis