Bitcoin Faces Potential Drop to $77.4K as Wall Street Targets MSTR

Bitcoin Faces Downside Risks Amid Technical Weakness and Institutional Scrutiny

Bitcoin is currently exhibiting signs of vulnerability, with technical formations suggesting a potential decline toward key support levels. Concurrently, uncertainties surrounding major corporate Bitcoin holders, such as Strategy, are adding pressure on the digital asset’s outlook.

Key Takeaways

- Bitcoin’s consolidation within a bear flag signals potential for a decline if support fails.

- A decisive break below the flag’s lower trendline could target a drop to around $77,400.

- Meanwhile, positive movement above critical resistance levels could invalidate the bearish outlook.

- Institutional risks linked to Strategy’s exposure and MSCI index reviews are weighing on sentiment.

Tickers mentioned: none

Sentiment: Bearish

Price impact: Negative. The convergence of technical signals and institutional concerns suggests downside pressure may intensify.

Market context: Broader macroeconomic conditions and institutional index reviews are amplifying volatility in Bitcoin’s price.

Technical Breakdown and Market Dynamics

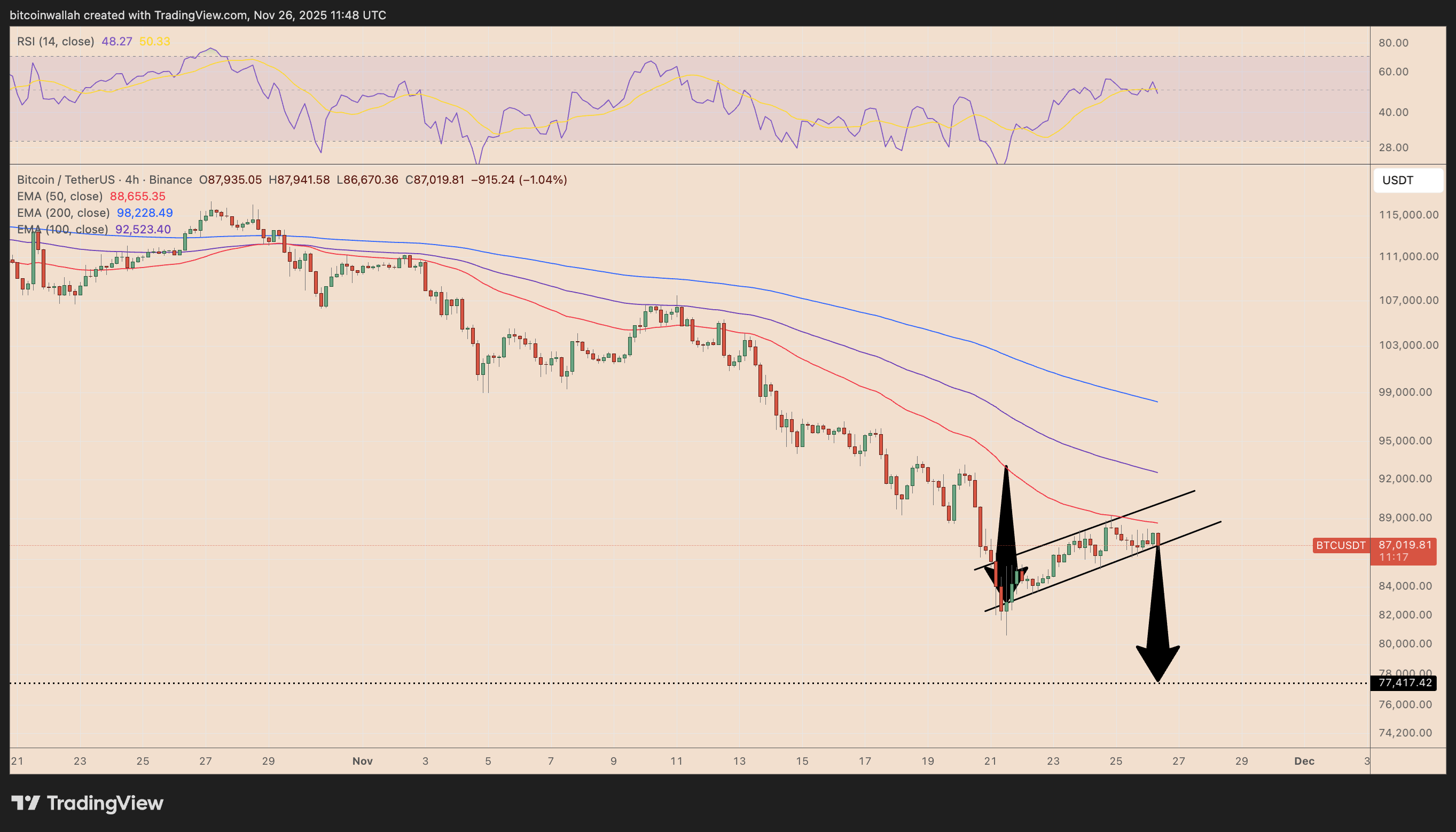

Bitcoin has recently stabilized within a bearish flag pattern, a technical formation that often indicates a continuation of prior downtrends. The cryptocurrency remains below its declining 100-day and 200-day exponential moving averages, reinforcing the bearish bias. A break below the flag’s lower trendline could trigger a move toward $77,400, representing a significant downside target.

Conversely, a strong rally past the 50-4H exponential moving average at roughly $88,655 and the upper trendline of the flag near $90,000 would cast doubt on the current bearish scenario and could signal a trend reversal.

BTC/USD four-hour chart. Source: TradingView

BTC/USD four-hour chart. Source: TradingView

Beyond technical considerations, confidence in Bitcoin faces headwinds from institutional viewpoints. Strategy, one of the largest corporate Bitcoin holders, is under scrutiny as the MSCI prepares to decide whether to exclude firms with significant digital asset holdings from its indexes, with a decision expected by January 15, 2026.

CryptoQuant analyst GugaOnChain warns that such an exclusion could induce mass selling by passive funds, potentially triggering a sharp decline in Bitcoin’s price. He noted, “If Strategy is excluded from indexes like MSCI, billions in automatic sales of its shares would be triggered, and it could be perceived as an institutional attack on Strategy’s Bitcoin strategy.”

JPMorgan has echoed concerns that an exclusion of Strategy from MSCI’s benchmarks might force passive funds to liquidate holdings worth billions of dollars. Some analysts suspect that certain interests may be attempting to influence market movements by pressuring major corporate holders, including Strategy.

In response, Strategy has emphasized its financial resilience, stating that even if Bitcoin retreated to its average cost basis of approximately $74,000, its assets would still cover its convertible debt by a factor of 5.9, maintaining a strong debt rating.

This confluence of technical signals and institutional risks underscores the current cautious outlook for Bitcoin, with potential downside risks mounting amid ongoing market macroeconomic and regulatory developments.

This article was originally published as Bitcoin Faces Potential Drop to $77.4K as Wall Street Targets MSTR on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

XCN Rallies 116% — Can Price Hold as New Holders Gain?