Bitcoin Munari Price Prediction – Should You Buy BTCM?

Being the king of the crypto jungle, Bitcoin has naturally inspired a steady stream of projects seeking either to tap into its success or refine its underlying design.

Counting itself among them is Bitcoin Munari, a project that maintains Bitcoin’s proven scarcity model while promising to offer 140x faster speeds, DeFi functionality, and low fees.

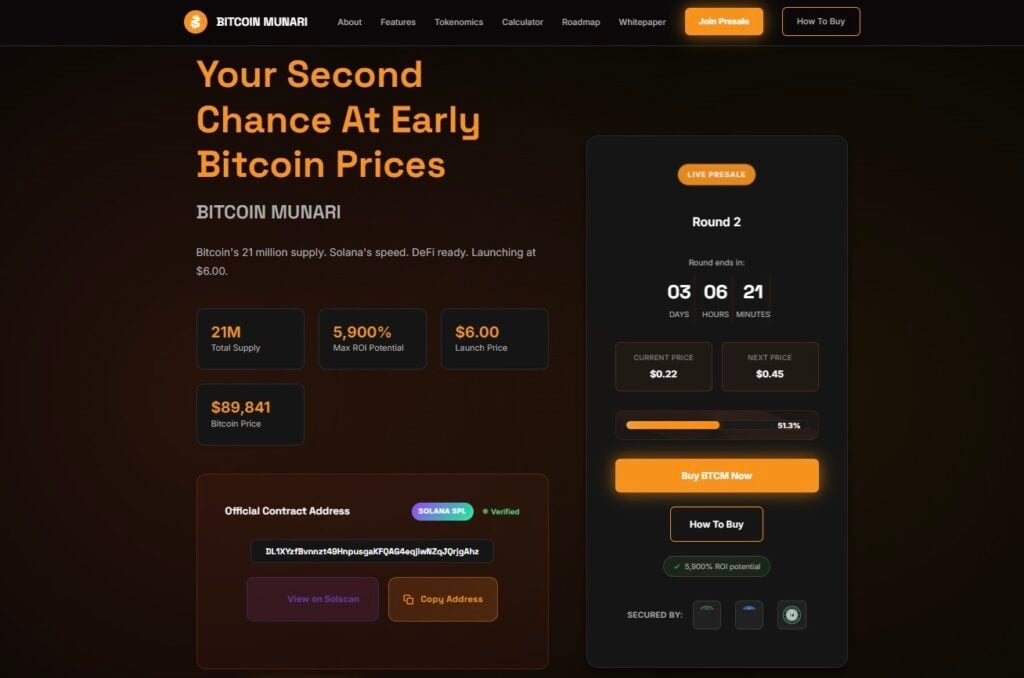

It’s marketed by its whitepaper as a solution that reimagines what Bitcoin could have become had it been built with today’s technological capabilities. Currently, BTCM is in the second round of its presale, with at least 51% of the tokens allocated for this phase already sold. But should you buy this crypto?

What is Bitcoin Munari?

Bitcoin Munari, according to its whitepaper, is built on three core propositions. First, a proven economic model. Basically, the project inherits BTC’s 21 million supply cap but does so without the energy-heavy requirements tied to it, thereby ensuring long-term sustainability.

Second, early opportunity advantage. Bitcoin Munari prides itself as a golden opportunity for those who missed out on BTC’s early entry opportunity a couple of years ago.

Third, modern speed and efficiency. The goal here is to cater to users who value lightning-fast speed and ultra-low fees for trading, staking, and decentralized finance applications. As outlined on the website, it will launch its custom Layer-1 architecture in Q2 2027 to power 5,000+ transactions per second without encountering congestion or delayed settlements.

However, since that timeline is still some distance away, the team plans to launch on Solana first, allowing users to benefit from the network’s high TPS capacity well before the project transitions to its own chain in 2027. Other key features highlighted in the project’s whitepaper revolve around user privacy, with planned settings for transaction obfuscation and resistance to blockchain analysis.

At the core of the Bitcoin Munari’s heart lies the BTCM token. It acts as reward tokens for validators and the main currency fueling the Bitcoin’s Munari economy. During the initial stage of the project, BTCM will operate as a Solana token.

Bitcoin Munari’s Tokenomics & Roadmap

As earlier mentioned, Bitcoin Munari has a total supply of 21 million tokens, of which 53% has been allocated to the public presale which launched barely a week ago. The remaining tokens are dedicated to validator rewards, liquidity, team allocation, and marketing.

In terms of the roadmap, the project team has developed a five-phased development plan, from foundation to ecosystem development in a bid to ensure structured progress and clear accountability.

Bitcoin Munari Price Prediction

Here are our price predictions for Bitcoin Munari, both in the short and long-term, taking into account the broader market outlook as well as its core fundamentals:

Short-Term

With Bitcoin Munari still in stage 2 out of its ten-phase token sale, it’s pretty clear that it still has a long way to go. To date, only about 2.2 million tokens have been sold out from the 11,130,000 tokens allocated for the public sale.

How soon it is able to completely sell out the entire presale tokens will determine the degree of pump it will see after listing on exchanges. Another key factor to keep an eye on is the overall market dynamics at the time of launch.

In the event that the market is bullish by the time the project lands on exchanges, it may ride the wave to register stronger price momentum, although no specific price outcomes can be guaranteed.

Long-Term

If Bitcoin Munari’s roadmap is anything to go by, the rollout of all promised features, including the custom Layer-1 mainnet is expected to be completed by the third quarter of 2027. That could help the project gain more attention from the crypto community, particularly those enthusiastic about fast, low-fees trading, staking, and decentralized finance applications.

However, any delay in the implementation of the items on the roadmap could cause stagnation, potentially sending the token to oblivion.

Should Investors Buy BTCM Token On Presale?

As the spotlight begins to shine on crypto ICOs as safe havens amid market volatility, investors are asking whether BTCM is worth buying and if it represents a good investment?

The answers to these questions hinge on whether the team is genuinely committed to executing the plans highlighted in its roadmap. However, given that several similar projects in the past that promised practical utility ultimately failed, investors considering picking BTCM should also check out comparable projects as well for the sake of diversification.

One of them is Bitcoin Hyper, a brand-new project that aims to make Bitcoin transactions faster and cheaper, all without sacrificing security. Several factors give this project an edge over competitors, including Bitcoin Munari.

First, it’s offering a Layer-2 solution, and not another Layer-1, making it more crucial to the Bitcoin network, particularly in areas of transaction speed, scalability, and cost efficiency.

At the same time, the project is laying the groundwork for the Bitcoin ecosystem to support a range of applications including smart contracts, DeFi, gaming, staking, and NFTs.

There are also staking perks available, giving early adopters a chance to earn passive rewards. So far, the project has raised over $28 million from investors, easily making it one of the most in-demand presales of the year.

Similarly, popular crypto YouTube pages, such as 99Bitcoins, have covered this project in their most recent videos, stating it could be the next big meme coin.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets

Modernizing Legacy E-Commerce Platforms: From Oracle ATG To Cloud-Native Architectures