Selling Storm: Bitcoin Whales Could Drive Prices Down Further, Experts Warn

According to exchange data, inflows to trading venues topped 9,000 Bitcoin on Nov. 21 as prices slid to $80,600 on Coinbase — the weakest showing in seven months.

Reports show that about 45% of those deposits came in chunks of 100 BTC or more, and on one day large transfers reached 7,000 BTC.

The average deposit size in November rose to 1.23 BTC, the largest monthly figure in a year. Those numbers point to more than casual rebalancing; they point to coins being moved where they can be sold.

Binance Stablecoins Hit Record

According to market coverage, Binance’s stablecoin holdings climbed to a record $51 billion. At the same time, BTC and Ether inflows to exchanges swelled to roughly $40 billion this week, with Binance and Coinbase leading the move.

Traders often park funds in dollar-pegged tokens when they want to wait on the sidelines. That build-up means cash is available, but it is sitting idle until sellers either step back or buyers turn up again.

Analysts Eye Further Pullback

Some market watchers warn the recent recovery could be only a pause, flagging remaining margin positions and suggested a test of lower levels.

They said a wick into the $70k–$80k zone would be one way to clear out the last pockets of exposure.

10x Research put resistance levels at $92,000 and $101,000 as the key ranges to watch during any rebound.

For context, Bitcoin had clawed back above $90,000 and was trading slightly higher at the time of reporting, but it remains down about 28% from the all-time high north of $126,000 reached in October.

Meanwhile, market moves in stocks and crypto have shown mixed signals. The S&P 500 and the Nasdaq were pushing gains as investors bet on a US Fed rate cut, and that helped risk assets.

Yet reports from strategists show the usual close link between Bitcoin and the Nasdaq has weakened, with Bitcoin’s decline steeper in recent weeks.

Ether and many altcoins also faced higher exchange inflows, and several tokens returned to bear-market lows as selling pressure widened.

What This Means NextLiquidity is present but it is parked in stablecoins, and big holders are still moving assets toward exchanges. A meaningful rally will likely need either heavy buying demand or a clear catalyst that draws those stablecoins back into risk assets.

For now, the market sits in a waiting mode: a short rally could continue, but a deeper dip remains possible as positions get cleared and sellers complete their rotations.

Featured image from Unsplash, chart from TradingView

You May Also Like

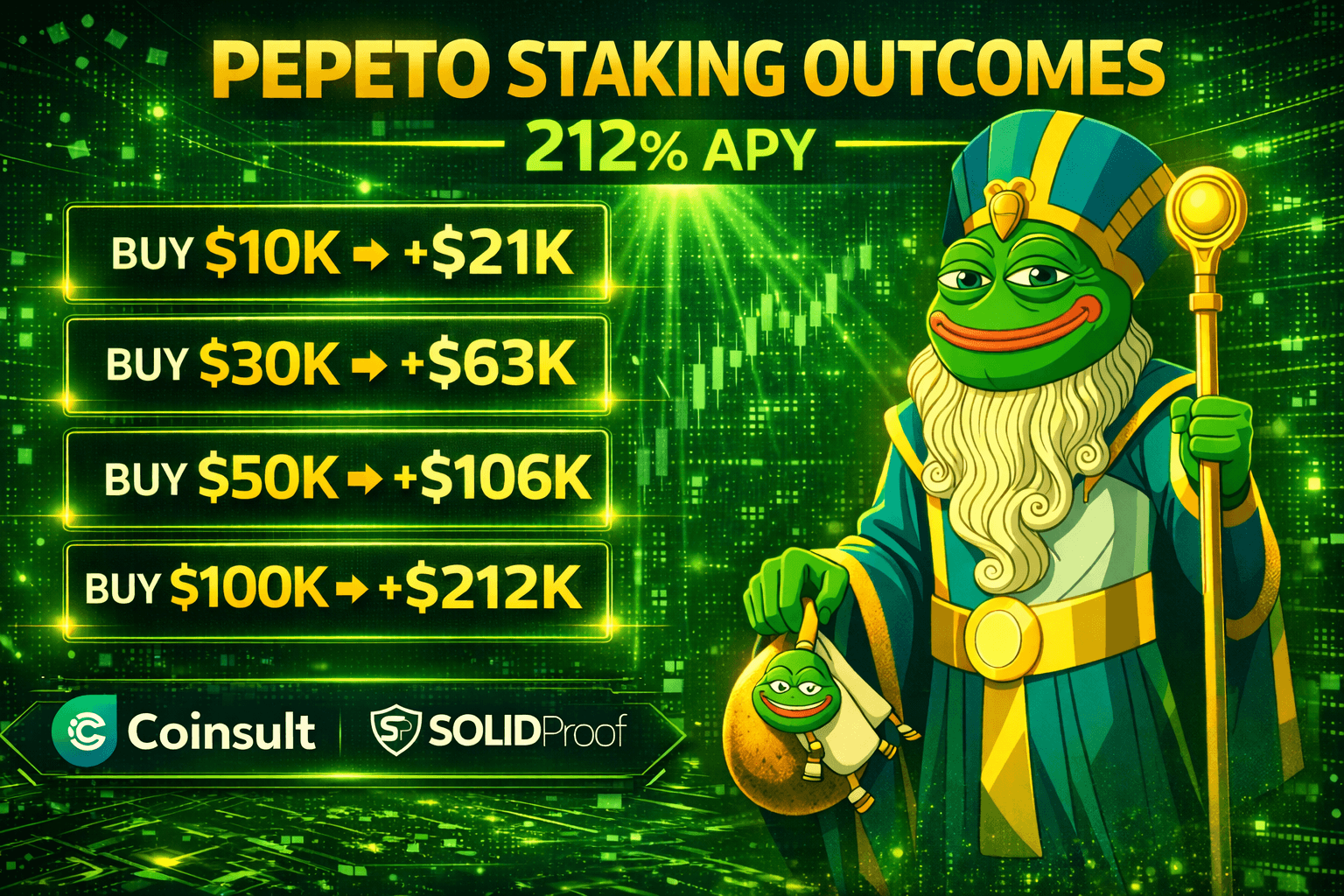

Top 100x Coin to Buy: Pepeto, XRP, Dogecoin, and Solana Lead the Market Pulse This February

Top 4 Altcoins to Buy Before the Next Bull Run: Pepeto, Shiba Inu, MemeCore, and Pepe