SpaceX Moves $105M In Bitcoin As Custody Shift Toward Coinbase Prime Continues

Bitcoin has finally broken above the $90,000 mark after days of struggling to reclaim this key psychological level. The move comes during a period of sharp volatility and persistent selling pressure that continues to dominate market sentiment.

Analysts remain divided, but a growing number are calling for the official start of a bear market as BTC trades nearly 30% below its all-time high and fails to establish a convincing recovery structure. Fear remains elevated, and confidence among both retail and institutional investors is weakening.

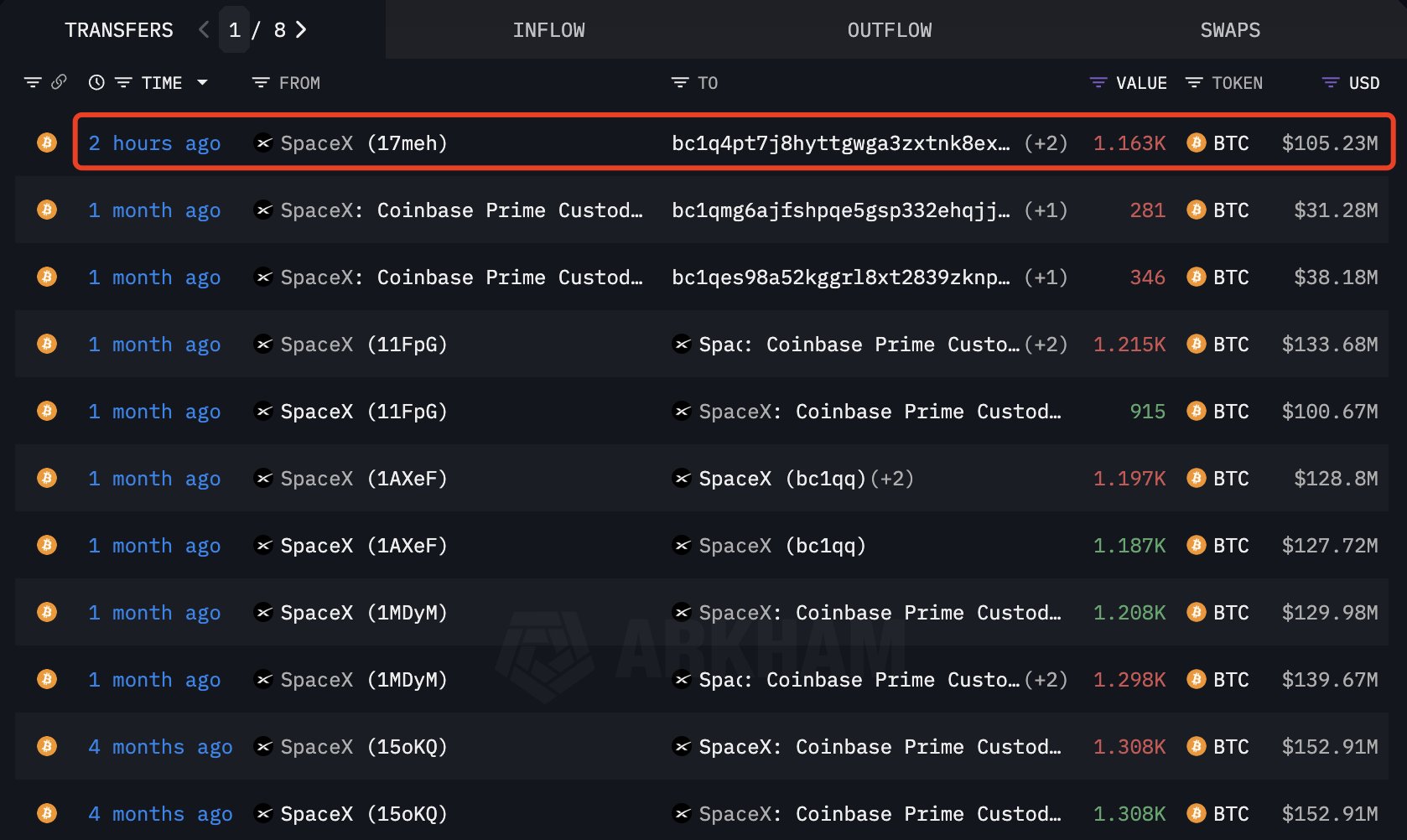

Adding to the uncertainty, new data from Arkham reveals that SpaceX transferred out another 1,163 BTC—worth approximately $105.23 million—just a few hours ago. The transfer appears to have been routed to Coinbase Prime, suggesting a potential custody shift by the company. Such large movements often spark concern in the market, as they may signal repositioning, selling preparation, or treasury adjustments by major corporate holders.

While Bitcoin’s push above $90K provides temporary relief, it does little to change the broader narrative: the market remains under pressure, liquidity is thinning, and macro-driven uncertainty continues to shape price action. The coming sessions will determine whether BTC can build momentum or slip back into deeper correction territory.

SpaceX’s Bitcoin Movements Add New Layer of Market Uncertainty

According to data from Arkham, SpaceX currently holds 6,095.45 BTC, valued at roughly $550 million at today’s prices. This substantial treasury position places the company among the larger corporate Bitcoin holders, and its recent on-chain activity has quickly drawn attention across the market.

The latest transfer—1,163 BTC moved just hours ago—marks a meaningful shift in activity for SpaceX, especially considering the company has been largely inactive in terms of BTC movements for months.

Arkham reports that this is SpaceX’s first notable transaction since October 29, when the company transferred 281 BTC to a new wallet address. While the motives behind these transfers remain unknown, traders typically monitor such moves closely, as large corporate holders can influence market sentiment.

Transfers to Coinbase Prime—as suspected in the latest movement—often suggest custody adjustments, treasury restructuring, or preparations for strategic repositioning.

For now, there is no clear indication that SpaceX is reducing its Bitcoin exposure. However, the renewed on-chain activity comes at a sensitive moment for the market, which is struggling with selling pressure, fear, and broad speculation about an emerging bear phase.

As long as major smart-money entities remain active, Bitcoin’s short-term direction may continue to experience heightened volatility.

Attempted Recovery but Still Under Pressure

Bitcoin is showing signs of recovery after plunging to new local lows last week, with the price now pushing back above $91,000. The chart shows a sharp bounce from the sub-$82,000 zone, which acted as a temporary support during the capitulation phase. However, despite this rebound, BTC remains below all major moving averages—the 50-day, 100-day, and 200-day—which reinforces the broader bearish structure.

The recent upswing reflects short-term relief rather than a confirmed trend reversal. Volume spiked heavily during the sell-off, indicating forced liquidations and panic selling. But the current bounce is happening on lighter volume, suggesting that buyers are cautious and not yet committing with strong conviction.

Structurally, Bitcoin must reclaim the $95,000–$98,000 zone, where the 50-day and 100-day moving averages converge.

This area represents the first major resistance cluster and will determine whether the market is transitioning into a recovery or simply forming a lower high before another leg down. Failure to break above this band could invite renewed selling pressure.

Featured image from ChatGPT, chart from TradingView.com

You May Also Like

Vitalik Buterin Reaffirms Original 2014 Ethereum Vision With Modern Web3 Technology Stack

CME Group to Launch Solana and XRP Futures Options