Solana Price Prediction: SOL Slips 6% as Its Open Interest Dwindles Amid Low Retail Demand

Highlights:

- SOL has started the week in the red zone, plunging 6% to $127, as the cryptocurrency market tumbles.

- The Fed Chair, Jerome Powell, is expected to deliver a speech today, as investors anticipate further volatility in the cryptocurrency market.

- The SOL technical outlook indicates bearish sentiment as bears target the $123-$96 support zones.

The Solana price is trading at $127, with the sell-off continuing, down 6.91% today. The high-speed blockchain is experiencing a risk-off mood in the derivatives market, as investors withdraw capital at risk, and bears are paying a premium to maintain short positions. Technically, Solana may continue to fall since bearish momentum remains on the rise.

SOL is losing investor interest amid a broader sell-off in the cryptocurrency market, as Bitcoin (BTC) falls below $ 87,000. This has resulted in more than $600 million in liquidations within the market over the past 24 hours. Meanwhile, Jerome Powell is expected to give a speech today at Stanford University.

Often, when the Fed Chair is about to speak, investors become cautious. Many pull out of the market and wait for his comments before taking new positions, as many anticipate volatility.

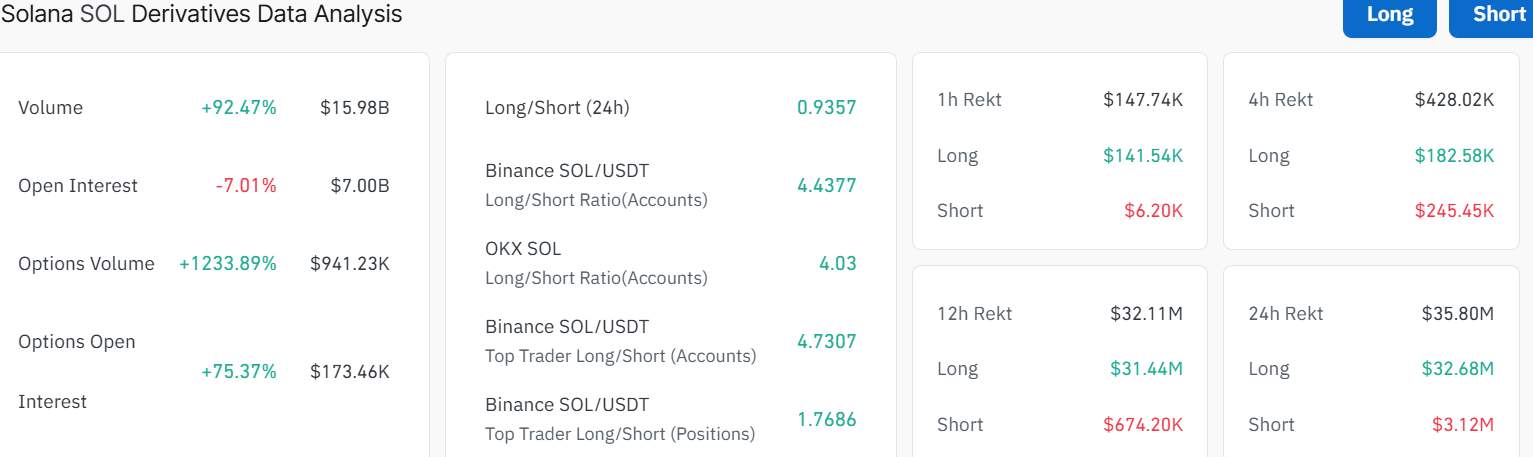

According to CoinGlass data, the SOL futures Open Interest (OI) has decreased by 7.01% over the past 24 hours, reaching a notional value of $7.00 billion for all outstanding contracts. This reduction in capital exposure implies that investors are becoming risk-averse, which is fueling market fear.

SOL Derivatives Data Analysis: CoinGlass

SOL Derivatives Data Analysis: CoinGlass

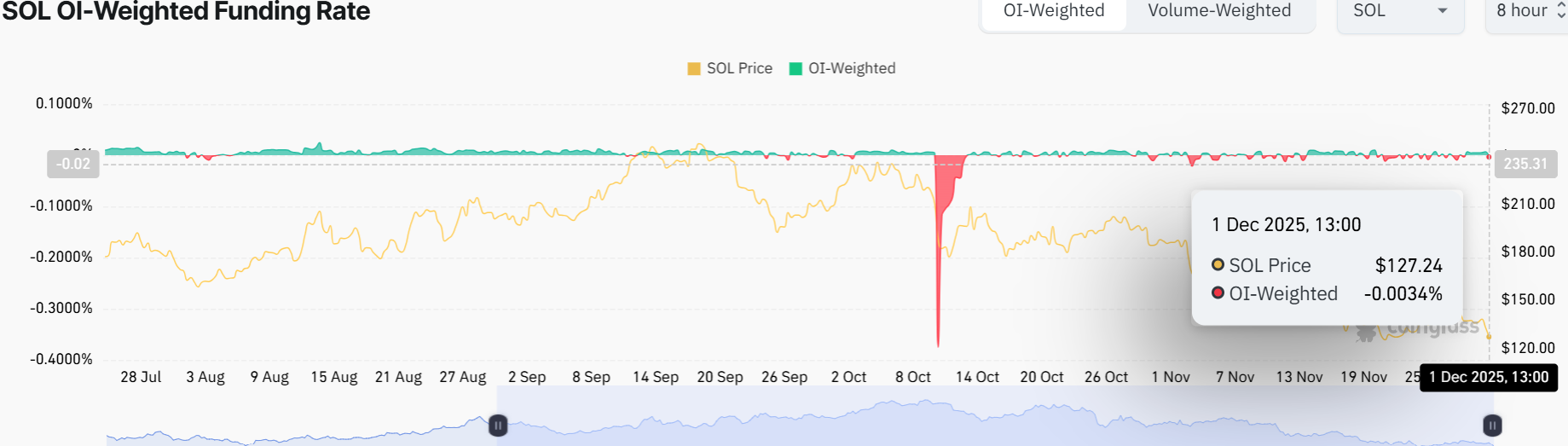

In line with the risk-off mood, the OI-weighted funding rate remains negative at -0.0034% on Monday, indicating more strength in the bears. Additionally, the long liquidations of $ 32.68 million surpassed the short liquidations of $3.12 million in the past 24 hours. In other words, this indicates a high bearish dominance that has overshadowed bullish positions in the SOL market.

SOL OI-Weighted Funding Rate: CoinGlass

SOL OI-Weighted Funding Rate: CoinGlass

SOL Price Risks Further Downside Towards $123-$96

The chart for SOL/USDT on the 1-day timeframe shows a rollercoaster that has hit a rough patch. The price recently climbed above $144, but it’s currently trading at $127, down 6% today. The 50-day Simple Moving Average (SMA) at $163 and the 200-day SMA at $178 are both trending downward, with a death cross in the picture. This suggests that the bears are gaining the upper hand, indicating some long-term bearish strength.

However, the recent drop has pushed the Solana price below key resistance levels, with the token hovering in a falling wedge pattern. Digging into the indicators, the Relative Strength Index (RSI) at 34.08 is flirting with oversold territory, indicating a potential downside.

SOL/USD 1-day chart: TradingView

SOL/USD 1-day chart: TradingView

Meanwhile, the Moving Average Convergence Divergence (MACD) shows a slight bullish crossover, signaling some short-term strength. In the short term, the SOL price could test support around $123 (the lower end of the falling channel) if this dip continues. A break below that might send it toward $96, a level to watch keenly.

On the other hand, if the bulls push SOL past $145, there could be a charge toward $163 or higher, potentially reaching $178. The current buy signal from the MACD suggests a potential bounce. However, the 6% drop serves as a cautionary red flag.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Zero Knowledge Proof (ZKP) vs DOGE, SHIB, and PEPE: Good Crypto to Buy Now for Structure-Driven Gains

LayerZero and TRON Unlock New Power for PYUSD Across Blockchains