Zcash (ZEC) Nosedives After RSI Breakdown – More Pain Ahead?

Zcash is under pressure after a steep price decline, falling more than 32% over the past week. The token is trading around $365 after dropping over 20% in the last 24 hours. The move follows the loss of key support levels, with traders watching whether the downtrend will continue.

ZEC had recently posted strong gains, rallying from $40 to $700 in just a few months. The current pullback, however, suggests that the trend may have shifted, with momentum now favoring the downside.

Key Technical Levels Breached

ZEC lost several important levels in a short period. The breakdown below the 50-day simple moving average, the $480 horizontal support, and the 38.2% Fibonacci retracement opened the door to further declines. As a result, the asset fell into the first major liquidity area around $400.

Crypto analyst Ardi had warned of growing weakness, pointing to a failed breakout in the RSI trend. “Repeated warnings of structure being broken” were noted after the loss of early support. He also cautioned that overexposed long positions were creating risk, adding, “5% moves were causing a cascade of liquidated long positions,” leading to even larger drawdowns.

Zcash price chart. Source: Ardi/X

Zcash price chart. Source: Ardi/X

Moreover, Zcash continued lower, reaching a second liquidity zone near $370. Ardi noted that he closed half his short position at this level. He added that if this zone breaks, the next area to watch is between $297 and $311, which includes the 61.8% Fibonacci level and a large pool of previous liquidity.

Trading volume has spiked, crossing $1 billion in the past 24 hours. ZEC has traded between $356 and $457 in the last day, with the broader 7-day range showing a high of $585 and a low near $358 (per CoinGecko data).

Momentum Indicators Show Further Weakness

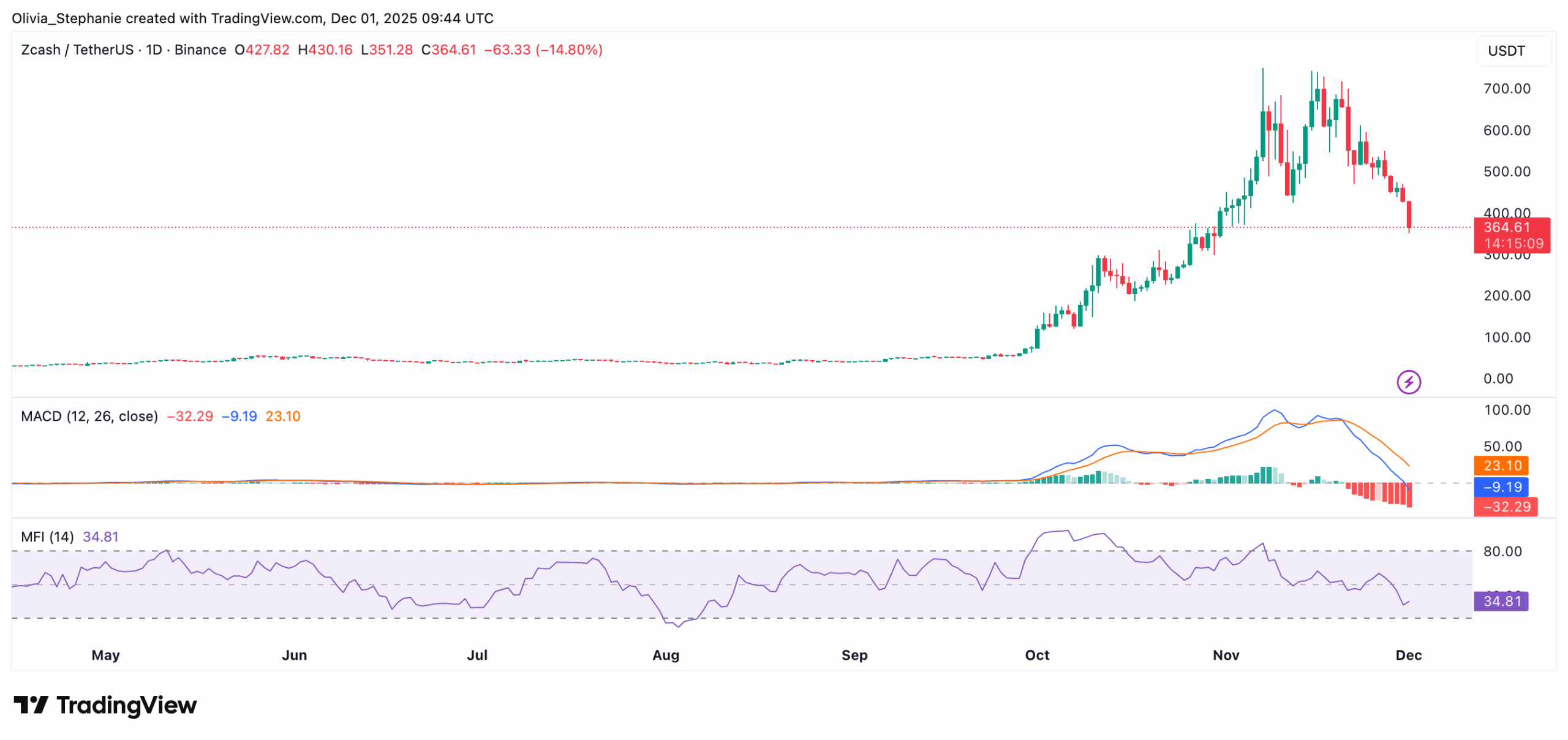

Technical indicators support the current downtrend. The MACD continues to move lower, with the signal line confirming negative momentum. Red histogram bars are increasing in size, showing strong selling pressure.

Meanwhile, the Money Flow Index now stands at around 35, pointing to continued outflows, though nearing levels where past reversals have occurred.

ZEC/USD. Source: TradingView

ZEC/USD. Source: TradingView

Analyst Ali Martinez noted that ZEC had returned to a known support zone near $440.

That level has now broken, confirming lower lows and maintaining the bearish structure.

Uncertainty Over Long-Term Direction

Market opinion remains divided. Max Keiser commented,

His view reflects growing skepticism after the recent drop. Separately, it was recently reported that Grayscale has plans to convert its Zcash Trust into an exchange-traded fund (ETF). If approved, the ETF could make it easier for investors to gain exposure to ZEC without needing to hold the asset directly.

The post Zcash (ZEC) Nosedives After RSI Breakdown – More Pain Ahead? appeared first on CryptoPotato.

You May Also Like

US Prosecutors Seek 12-Year Prison for Do Kwon Over Terra Collapse

Highlights: US prosecutors requested a 12-year prison sentence for Do Kwon after the Terra collapse. Terraform’s $40 billion downfall caused huge losses and sparked a long downturn in crypto markets. Do Kwon will face sentencing on December 11 and must give up $19 million in earnings. US prosecutors have asked a judge to give Do Kwon, Terraform Labs co-founder, a 12-year prison sentence for his role in the remarkable $40 billion collapse of the Terra and Luna tokens. The request also seeks to finalize taking away Kwon’s criminal earnings. The court filing came in New York’s Southern District on Thursday. This is about four months after Kwon admitted guilt on two charges: wire fraud and conspiracy to defraud. Prosecutors said Kwon caused more losses than Samuel Bankman-Fried, Alexander Mashinsky, and Karl Sebastian Greenwood combined. U.S. prosecutors have asked a New York federal judge to sentence Terraform Labs co-founder Do Kwon to 12 years in prison, calling his role in the 2022 TerraUSD collapse a “colossal” fraud that triggered broader crypto-market failures, including the downfall of FTX. Sentencing is… — Wu Blockchain (@WuBlockchain) December 5, 2025 Terraform Collapse Shakes Crypto Market Authorities explained that Terraform’s collapse affected the entire crypto market. They said it helped trigger what is now called the ‘Crypto Winter.’ The filing stressed that Kwon’s conduct harmed many investors and the broader crypto world. On Thursday, prosecutors said Kwon must give up just over $19 million. They added that they will not ask for any additional restitution. They said: “The cost and time associated with calculating each investor-victim’s loss, determining whether the victim has already been compensated through the pending bankruptcy, and then paying out a percentage of the victim’s losses, will delay payment and diminish the amount of money ultimately paid to victims.” Authorities will sentence Do Kwon on December 11. They charged him in March 2023 with multiple crimes, including securities fraud, market manipulation, money laundering, and wire fraud. All connections are tied to his role at Terraform. After Terra fell in 2022, authorities lost track of Kwon until they arrested him in Montenegro on unrelated charges and sent him to the U.S. Do Kwon’s Legal Case and Sentencing In April last year, a jury ruled that both Terraform and Kwon committed civil fraud. They found the company and its co-founder misled investors about how the business operated and its finances. Jay Clayton, U.S. Attorney for the Southern District of New York, submitted the sentencing request in November. TERRA STATEMENT: “We are very disappointed with the verdict, which we do not believe is supported by the evidence. We continue to maintain that the SEC does not have the legal authority to bring this case at all, and we are carefully weighing our options and next steps.” — Zack Guzmán (@zGuz) April 5, 2024 The news of Kwon’s sentencing caused Terraform’s token, LUNA, to jump over 40% in one day, from $0.07 to $0.10. Still, this rise remains small compared to its all-time high of more than $19, which the ecosystem reached before collapsing in May 2022. In a November court filing, Do Kwon’s lawyers asked for a maximum five-year sentence. They argued for a shorter term partly because he could face up to 40 years in prison in South Korea, where prosecutors are also pursuing a case against him. The legal team added that even if Kwon serves time in the U.S., he would not be released freely. He would be moved from prison to an immigration detention center and then sent to Seoul to face pretrial detention for his South Korea charges. eToro Platform Best Crypto Exchange Over 90 top cryptos to trade Regulated by top-tier entities User-friendly trading app 30+ million users 9.9 Visit eToro eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Cashing In On University Patents Means Giving Up On Our Innovation Future