Grayscale Research believes Bitcoin may set fresh all-time highs in 2026, challenging the usual four-year cycle pattern. The firm notes that this cycle lacks the typical retail-driven parabolic surge, with institutional inflows taking the lead instead. Expected interest-rate cuts and progress on U.S. crypto regulation could further support a departure from past cycles, positioning Bitcoin for stronger, more sustained growth.

Crypto News Today [Live] Updates On December 2,2025 : Federal Reserve News, Bitcoin Price Today, Ethereum Price And XRP Price

The post Crypto News Today [Live] Updates On December 2,2025 : Federal Reserve News, Bitcoin Price Today, Ethereum Price And XRP Price appeared first on Coinpedia Fintech News

December 2, 2025 07:43:44 UTC

Bitcoin News Today: Grayscale Says BTC Could Break Tradition and Hit New Highs in 2026

December 2, 2025 07:24:45 UTC

Why Did Bitcoin’s Price Crash to $86K?

Bitcoin slid from $91,000 to $86,000 amid a wave of pressure from Asia. Concerns over the Bank of Japan’s hawkish stance, China’s weak PMI, and fears of possible BTC sales if mNAV levels are breached added to the decline. Still, some tailwinds remain — the end of QT, rising odds of rate cuts, and renewed ETF inflows.

December 2, 2025 07:03:25 UTC

Fusaka Upgrade Keeps Bitcoin Upside Intact Despite Rejection at 3K

Bitcoin faced resistance at 3,000 and pulled back, but the Fusaka upgrade keeps the bullish narrative alive. Once volatility calms, upward momentum could return. Current pullbacks may offer attractive long-bias opportunities, provided market conditions stabilize. Traders watching for consolidation could find favorable entries before the next leg higher, with the upgrade serving as a key catalyst for renewed strength.

December 2, 2025 06:56:35 UTC

Aptos Leads Stablecoin Inflows, Surpassing Ethereum and BNB Chain

On-chain data from Artemis shows Aptos absorbed $426.8M in stablecoin inflows over the past 24 hours — more than any other blockchain, including Ethereum and BNB Chain. This isn’t a one-off spike: in recent weeks, Aptos recorded $528M and $545.7M on certain days, consistently outperforming long-time leaders in stablecoin liquidity. The data highlights Aptos’ growing prominence in the crypto ecosystem and signals increasing adoption and capital concentration on the network.

December 2, 2025 06:56:35 UTC

Bitcoin Mirrors 2022 Bear Market as $220M Flows Into Crypto ETFs

Bitcoin’s price is now moving with 98% correlation to the 2022 bear market, showing a striking repeat of past patterns as the year nears its end. November turned out to be one of the worst months historically for BTC price action. Meanwhile, $220 million is flowing back into cryptocurrency ETFs, signaling that institutional investors are gradually returning. As stock market inflows pick up, crypto is starting to see renewed interest from professional money managers.

December 2, 2025 06:53:57 UTC

XRP Ledger Activity Surges as Major Upgrades Approach

The XRP Ledger is showing a sudden burst of on-chain activity. XRPL Metrics reports more than 40,000 AccountSet transactions the highest level seen in years along with a sharp rise in AMM bids following November 23. This looks like clear preparation for upcoming upgrades. With RLUSD approvals, the AMM rollout, and growing institutional onboarding, the XRPL appears to be entering a new phase of activation. The network is waking up — and fast.

December 2, 2025 06:49:22 UTC

Hoskinson Praises Cardano’s Resilience After Successful Soft Fork

Cardano founder Charles Hoskinson says the recent soft fork proved the network’s strength, highlighting that “no other PoS chain could survive an attack like this without shutting down or needing a manual restart.” He credited Cardano’s recovery to its Nakamoto-style PoS design and strong engineering. According to Hoskinson, the event showcased why Cardano’s architecture is built for resilience, stability, and real-world reliability — reinforcing its position as one of the most robust PoS networks in the industry.

December 2, 2025 06:40:07 UTC

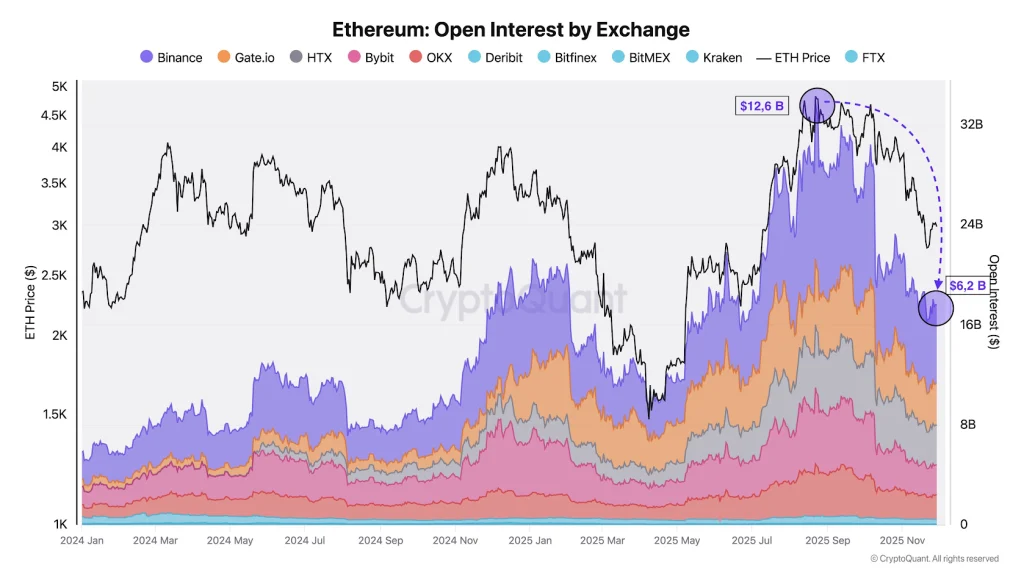

Ethereum Leverage Resets as Open Interest Plunges Across Exchanges

Ethereum’s open interest has dropped sharply across major exchanges, with Binance down 51% from its August peak. Similar declines on Gate.io and Bybit show a broad reset in leverage and speculative positioning. ETH’s fall from $4,830 to $2,800 has unfolded alongside this unwind, signaling that the market is flushing out excess risk. This kind of reset often clears the way for a healthier, more durable price structure to form in the next phase.

December 2, 2025 06:38:03 UTC

Cardano Secures ETF Inclusion as 2026 Starts With Major Momentum

Cardano has been officially added to the Franklin Crypto Index ETF (EZPZ), marking a major step toward institutional adoption. With ADA now part of a regulated index fund, institutional inflows are already underway. Even bigger news is coming: the decision on a dedicated Spot Cardano ETF from Grayscale and others is expected on January 10, 2026. If approved, it could ignite one of ADA’s strongest years yet — and 2026 is already looking bullish for Cardano

December 2, 2025 06:34:28 UTC

Cardano Nears Key Breakout as Momentum Strengthens

Cardano (ADA) is trading at $0.39125, up 1.77% in the last 24 hours with a market cap of $14.29B and strong trading volume of $947M. Momentum remains bullish, supported by an RSI of 67.9 and a positive MACD crossover. Rising volume confirms growing buyer interest. If ADA can break above the $0.40 resistance, it may trigger a stronger upside move and signal the start of a broader bullish breakout.

December 2, 2025 06:24:20 UTC

Fed Injects $13.5B Into Banks as Liquidity Stress Returns

The Federal Reserve injected $13.5 billion into U.S. banks overnight — the second-largest support move since the COVID crisis and bigger than anything seen during the Dot-Com peak. The surge in emergency liquidity signals rising stress inside the banking system. With funding pressure building, the Fed is stepping in to stabilize institutions and prevent a wider shock. The move raises fresh questions about bank health — and highlights how quickly liquidity can flip when conditions tighten.

December 2, 2025 06:06:21 UTC

Bank of America Signals Early Rate Cuts but Limited Room Ahead

Bank of America expects the Fed to deliver a rate cut next week but warns this front-loads most of the easing. If the Fed cuts a total of 0.75% by year-end, only about 0.5% of room would remain for 2026. BofA says early cuts could push policy into accommodative territory just as new fiscal stimulus kicks in, reducing the Fed’s flexibility later. The message: more easing now means less available later.

December 2, 2025 05:57:01 UTC

Bitrue Lists ESPORTS Token

Bitrue is adding $ESPORTS to its spot market, with deposits now open through the BSC network. Trading for the ESPORTS/USDT pair begins on December 1 at 12:00 UTC. The token is part of Yooldo, a multi-chain Web3 gaming platform designed to make onboarding easier with a CEX-style interface while still offering true digital ownership through NFTs and token-based assets. A fresh opportunity for gamers and Web3 users arrives this week.

December 2, 2025 05:54:47 UTC

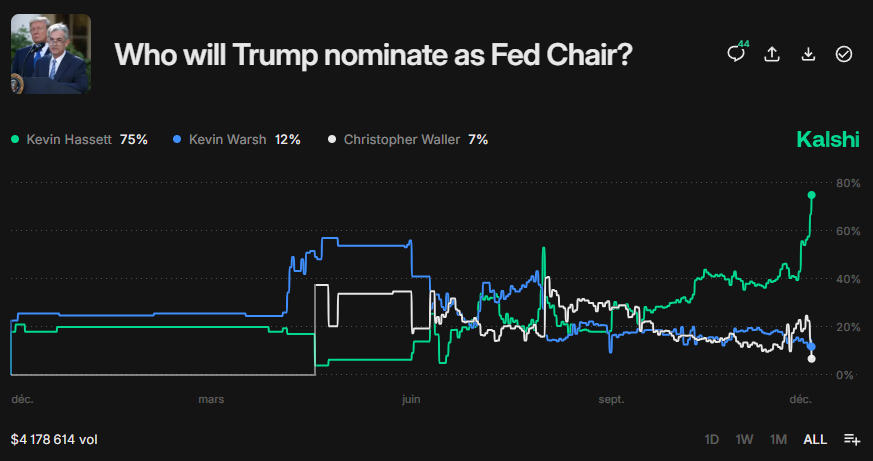

Trump Poised to Announce New Fed Chair This Week

Trump is expected to reveal his Fed Chair pick before Christmas, with sources — including Treasury Secretary Scott Bessent — saying the decision is already made. Trump hinted on Air Force One that the announcement could come as early as December 2–3. Betting markets place Kevin Hassett at roughly 75% odds. If chosen, Hassett would bring a pro-growth, dovish approach favoring quicker rate cuts, higher inflation tolerance, and a softer dollar — a setup historically bullish for stocks and crypto.

December 2, 2025 05:39:17 UTC

Fed Moves to Neutral: Data Dependency Opens Door for Crypto Upside

Powell emphasized that policy is now data-dependent rather than biased toward tightening. With the economy holding up, inflation falling, and no urgency to restrict credit, the Fed has shifted from defense to neutral. His references to historical policy discipline hint at a long period of stability ahead. For crypto, this is the sweet spot: steady growth, easing financial pressure, and a more predictable macro environment, conditions that typically fuel stronger momentum and adoption.

December 2, 2025 05:38:03 UTC

Liquidity Tailwind Returns: What Ending QT Means for Crypto

Powell’s announcement marks a major pivot: liquidity is no longer being pulled from the system. Banks and funds can expand positions again, and financial conditions should naturally ease. Risk assets depend on liquidity — and crypto is the most sensitive to it. With QT over and reserves set at “ample” levels, the environment flips from restrictive to supportive. This macro turn could trigger stronger flows into digital assets as capital becomes more flexible.

December 2, 2025 05:36:51 UTC

Fed Ends QT After Shrinking Balance Sheet by $2.4 Trillion

The biggest reveal was Powell confirming that quantitative tightening ended on December 1. The Fed’s balance sheet runoff from $9T to $6.6T is now paused. He said reserves will stabilize around $3 trillion, calling it “ample liquidity.” This shift is huge. Ending QT stops liquidity drain and stabilizes funding. For risk markets, especially crypto, this removes a major headwind and replaces it with the first real liquidity tailwind in over a year.

December 2, 2025 05:35:25 UTC

Fed Signals Stability: Powell Says Economy Now “On Firmer Ground”

Jerome Powell opened by declaring the U.S. economy stronger than it has been in years. Growth held near 2.5% in Q3, unemployment sits at 4.1%, and recession risks have faded. With stability returning and no justification for further tightening, markets finally get clarity after two years of uncertainty. For crypto, a steady macro backdrop removes one of the biggest headwinds and sets the stage for renewed confidence and healthier risk appetite.

December 2, 2025 05:33:37 UTC

Coinbase 50 Index Adds Six New Tokens in Latest Rebalancing

Coinbase Institutional has updated its Coinbase 50 Index for the fourth quarter, adding six new assets: HBAR, MANTLE, VET, FLR, SEI, and IMX. At the same time, six tokens were removed from the index, including SKL, AKT, LPT, SNX, HNT, and CVX. The COIN50 Index tracks the top assets on Coinbase by market size and liquidity, and the latest changes reflect shifting market demand and trading activity.

December 2, 2025 05:32:45 UTC

Bitcoin’s History Sends a Clear Warning

Bitcoin has gone through five major bull cycles, and every single time the main parabolic run has broken, a big correction followed — at least 75%. There has never been an exception. If the current move breaks its long-term trend, history suggests a similar deep pullback could follow. Betting against this pattern means assuming Bitcoin will behave differently this time, and that’s a tough case to make without a very strong reason.

December 2, 2025 05:21:18 UTC

Vanguard Finally Opens the Door to Crypto ETFs

Vanguard has reversed its long-standing stance and will now allow clients to trade spot crypto ETFs on its brokerage platform. Investors can access Bitcoin, Ethereum, XRP, and Solana ETFs for the first time through Vanguard. However, the company made one thing clear: it has no plans to launch its own crypto ETFs. This move simply gives users more flexibility while Vanguard maintains its conservative approach to managing digital-asset products.

December 2, 2025 05:21:18 UTC

Bitcoin Price Analysis

Bitcoin is sitting on a crucial support level, the same kind it lost back in 2022 before a bigger drop followed. The key number to watch now is $88,000. Staying above it keeps the market healthy. Falling below it could push BTC toward $76,800, or even $71,250 if pressure increases. These are areas where buyers usually step in. One long-term indicator also shows deep support around $47,450, which could matter in the next major market cycle.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Pastor Involved in High-Stakes Crypto Fraud