Bitcoin Miners Hit by Record Low Margins as Hashprice Drops to $35

TLDR

- Hashprice drops to $35 per PH/s, below $44 median production cost.

-

Miner payback periods exceed 1,000 days, above 2024 halving timeline.

-

Small miners face capitulation risk if BTC falls under $85,000 again.

-

BTC market stabilizes near $87K, but lacks miner or whale support.

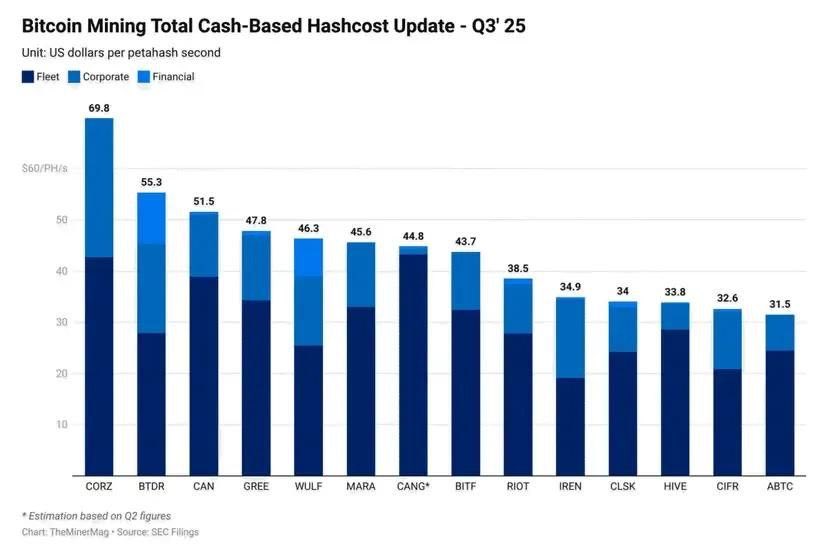

Bitcoin miners are now facing their toughest conditions ever recorded. According to data from BRN, the current hashprice has dropped to $35 per PH/s, far below the median all-in cost of $44. The all-in cost includes not only electricity but also hosting, labor, cooling, hardware depreciation, and capital investment.

This ongoing squeeze is particularly affecting public mining companies. Timothy Misir, BRN’s Head of Research, noted in a statement that these figures put even the most efficient miners near breakeven. With the network hash rate hovering near 1.1 zettahash, competition has remained high, adding pressure to already strained operations.

Source: X

As revenue per PH/s falls, miners struggle to maintain profitability. Any further decline in BTC price could accelerate selling, especially among smaller operators without scale advantages or capital reserves.

Payback Periods Now Exceed 1,000 Days

The drop in hashprice has caused payback periods for new generation mining equipment to stretch beyond 1,000 days. During the 2017 bull market, these periods were just 3 to 6 months. This shift places miners in a challenging position, especially with the next Bitcoin halving expected in 2026.

With reduced revenue and longer equipment ROI, many miners may be unable to justify new hardware purchases or sustain operations. Misir warned that a return to sub-$85,000 BTC levels could lead to distressed selling and potential exits for smaller firms.

Meanwhile, larger mining operations are absorbing the losses but show limited activity in accumulation. This lack of support from miners, combined with soft flows from institutions, is creating a fragile environment.

Market Steadies After Flash Crash but Momentum Stalls

Bitcoin recovered slightly to around $87,300 after Monday’s sharp drop, yet analysts say the bounce lacks support. Daily trading volume remains weak, and most major altcoins are moving sideways. Ethereum is trading near $2,800, with BNB at $830 and SOL at $125.

Although the Federal Reserve injected $13.5 billion into the banking system, crypto markets responded with caution. Analysts from Derive.xyz report that volatility is increasing, with short-term BTC options showing elevated demand for protective puts, especially around the $84K and $80K strike levels.

Spot ETF flows show a mixed picture. On December 1, U.S. Bitcoin ETFs recorded $8.48 million in inflows, while Ethereum products saw a $79.06 million outflow. XRP funds added nearly $90 million, suggesting select interest remains.

Traders Brace for Year-End Volatility as Bitcoin Miner Sentiment Weakens

Options traders are now positioning for further downside, although extreme fear is slightly easing. Derive’s volatility models indicate a 15% chance of BTC closing below $80,000 in 2025, slightly lower than the previous week’s 20% probability.

At the same time, the odds of BTC ending next year above $100,000 have risen to 21%, while Ethereum’s odds of closing above $3,500 sit at 23%.

Still, the lack of strong buying from miners, whales, or institutional investors signals caution. Without a shift in trend or clear accumulation, traders remain focused on downside protection heading into the final weeks of the year.

The post Bitcoin Miners Hit by Record Low Margins as Hashprice Drops to $35 appeared first on CoinCentral.

You May Also Like

Japan-Based Bitcoin Treasury Company Metaplanet Completes $1.4 Billion IPO! Will It Buy Bitcoin? Here Are the Details

InvestCapitalWorld Updates Platform Features to Support Broader Multi-Asset Market Access