YZi Labs issued a rectification notice to 10X Capital, warning BNC shareholders of its "disruptive behavior".

PANews reported on December 3 that YZi Labs, a major shareholder of CEA Industries, Inc. (NASDAQ: BNC), announced today that it has issued a formal notice and requirements for rectification to 10X Capital, the asset manager of BNC. The notice stems from 10X's mismanagement and lack of transparency regarding BNC assets, as well as potential breaches of its strategic service agreement with YZi Labs. The notice outlines what YZi Labs considers to be material and potential breaches of contract, serious breaches of fiduciary duty, and deficiencies in transparency and governance by 10X and its key personnel.

The notice states that YZi Labs has received reliable information that 10X is threatening to force BNC to abandon its BNB asset management strategy. Just three months prior, BNC announced a $500 million PIPE investment to "build the company's BNB asset management business." Agreements between 10X and YZi Labs stipulate that, market conditions permitting, a majority of BNC's capital will be allocated to the BNB asset management strategy. However, the company's management has informed market participants of its plan to abandon the BNB ecosystem and instead invest in other cryptocurrencies such as Solana, violating its commitments to investors. Furthermore, the company's CEO and board members are accused of conflicts of interest, failing to disclose key information such as BNB holdings and share counts, and refusing to amend the allegedly unreasonable terms of the asset management agreement.

You May Also Like

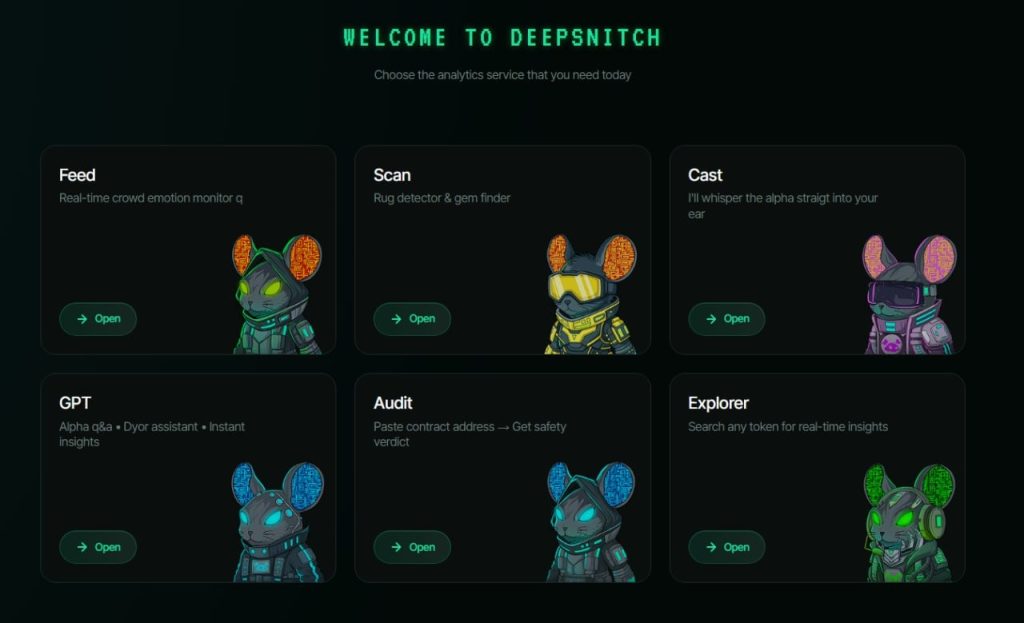

WLFI Token Price Prediction for March Is Ahead of Bitcoin, as TRX Is Stable; But DeepSnitch AI Is Moving to a New Level of Explosive 250x Returns

SEI Technical Analysis Feb 24