Bitcoin ETF inflows surged on December 2, 2025, with BlackRock’s IBIT leading at $120 million, driving an 8% price increase to over $93,000. This marks the fifth straight day of positive flows, stabilizing Bitcoin above $80,000 amid improving macro conditions.

-

BlackRock’s iShares Bitcoin Trust (IBIT) recorded $120 million in net inflows, boosting investor confidence.

-

Fidelity’s FBTC and Bitwise’s BITB saw $22 million and $7.4 million inflows, respectively, reflecting broad institutional interest.

-

Despite ARK Invest’s ARKB outflow of $91 million, total daily net inflows reached $58.5 million, supporting price recovery with historical data showing rebounds after similar events.

Bitcoin ETF inflows fuel 8% surge to $93K: BlackRock leads with $120M. Discover how institutional money and macro shifts signal potential Santa rally. Stay ahead in crypto—explore now!

What Caused the Recent Bitcoin Price Surge to Over $93,000?

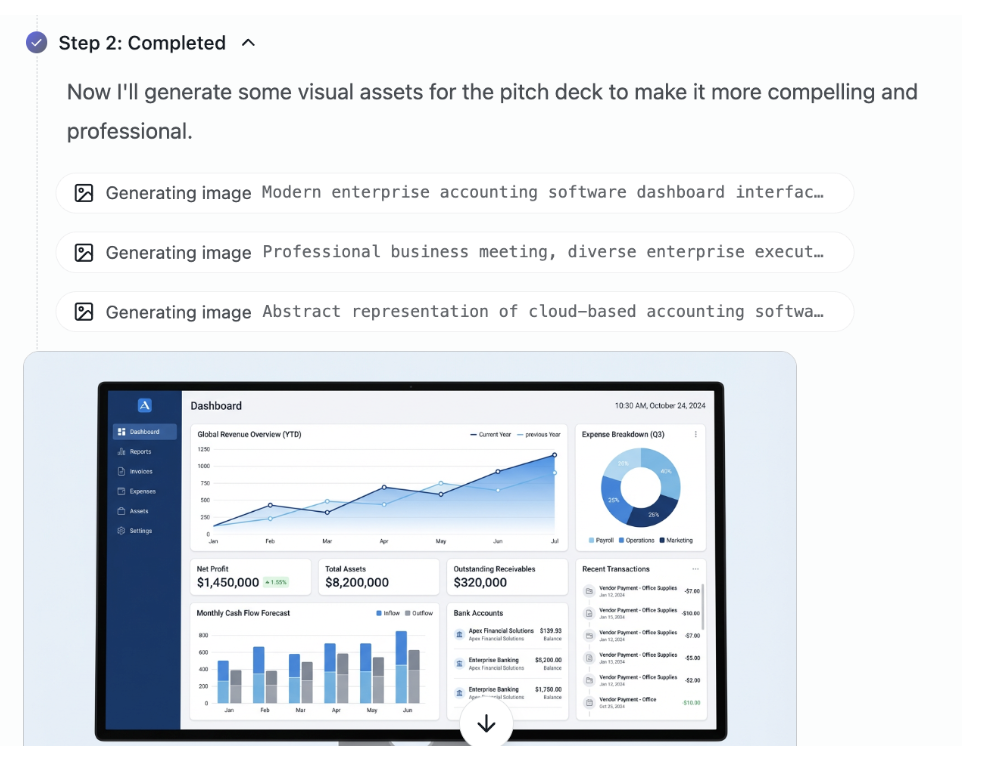

Bitcoin ETF inflows have been a primary driver behind the cryptocurrency’s sharp 8% rise to above $93,000 in the last 24 hours as of December 3, 2025. Led by major players like BlackRock, these inflows totaled $58.5 million on December 2, marking five consecutive days of net positive activity that has helped stabilize prices above the critical $80,000 level. This resurgence comes amid renewed institutional participation and favorable macroeconomic signals, countering recent dips and reigniting optimism among traders.

The influx of capital into spot Bitcoin exchange-traded funds (ETFs) underscores growing mainstream adoption. According to data from SoSo Value, BlackRock’s iShares Bitcoin Trust (IBIT) alone attracted $120 million in daily net inflows, a figure that propelled broader market momentum. Fidelity’s Wise Origin Bitcoin Fund (FBTC) followed with $22 million, while Bitwise Bitcoin ETF (BITB) added $7.4 million. Although ARK 21Shares Bitcoin ETF (ARKB) experienced outflows of about $91 million, the overall positive balance highlights a net bullish sentiment from institutional investors.

Source: SoSo Value

How Are Institutional Inflows Impacting Bitcoin’s Market Stability?

Institutional inflows into Bitcoin ETFs are significantly enhancing market stability by providing a steady stream of capital that cushions against volatility. On December 2, 2025, the combined efforts of major funds like BlackRock’s IBIT not only reversed recent outflows but also aligned with historical patterns where sustained inflows precede price recoveries. Bloomberg ETF analyst Eric Balchunas described this as the “Vanguard effect,” noting that Vanguard’s decision to lift its crypto ban on the same day opened access to over 50 million users, potentially channeling new investments into products like IBIT.

Balchunas highlighted the rapid response, stating, “Also $1B in IBIT volume in first 30min of trading. I knew those Vanguardians had a little degen in them, even some of the most conservative investors like to add a little hot sauce to their portfolio.” This influx from conservative investors has helped Bitcoin maintain support levels above $80,000, as evidenced by the fifth consecutive day of net inflows reported by SoSo Value. Furthermore, Coinbase analysts emphasized the role of easing macroeconomic pressures, explaining that the end of quantitative tightening by the Federal Reserve is reinjecting liquidity into risk assets like cryptocurrencies.

“With quantitative tightening ending, the Fed is back in the bond market, and the drain of cash from markets may be behind us. That’s usually good for risk-on assets like crypto,” the Coinbase team noted. They advised focusing on breakout opportunities rather than attempting to catch falling prices, a strategy supported by on-chain data from Glassnode showing reduced selling pressure from long-term holders. Swissblock analytics further corroborates this, projecting a tactical recovery starting mid-December based on past liquidity events that led to 1-3 week rebounds, with Bitcoin’s current capitulation mirroring those precedents.

Source: Coinbase/Glassnode

Reclaiming the $98,000-$100,000 range, previously a key support turned resistance due to bull cost bases, remains a pivotal target. Clearing this zone could draw in additional demand, though it might also prompt profit-taking if holders exit at breakeven. Despite these positives, external risks persist, such as the potential unwinding of the Yen carry trade, with an 86% probability of a 25-basis-point rate hike by the Bank of Japan on December 19, 2025, which could introduce fresh volatility.

Source: Swissblock

Frequently Asked Questions

What Are the Latest Bitcoin ETF Inflows and Their Impact on Price?

Bitcoin ETF inflows reached $58.5 million on December 2, 2025, with BlackRock’s IBIT contributing $120 million despite some outflows elsewhere. This has directly fueled an 8% price jump to over $93,000, signaling renewed institutional trust and potential for further gains if inflows persist.

Is the Bitcoin Price Recovery Signaling a Santa Rally in 2025?

Yes, the recent Bitcoin ETF inflows and price surge to $93,000 suggest the early stages of a Santa rally, historically driven by year-end optimism and institutional buying. With five days of positive flows and macro improvements, Bitcoin could target $100,000, though Yen carry trade risks warrant caution.

Key Takeaways

- Strong ETF Inflows Lead Recovery: BlackRock’s $120 million influx on December 2 drove Bitcoin’s 8% rise, stabilizing it above $80,000 after weeks of pressure.

- Macro Factors Boost Liquidity: Ending quantitative tightening and Vanguard’s policy shift are enhancing risk asset appeal, as noted by Coinbase analysts.

- Watch $100K Resistance: Reclaiming this level could spark broader demand, but monitor Bank of Japan actions for potential volatility.

Conclusion

The resurgence in Bitcoin ETF inflows, spearheaded by BlackRock and supported by improving macroeconomic conditions, has propelled Bitcoin to over $93,000, fostering hopes for a sustained recovery. As institutional participation deepens and liquidity returns, the asset appears poised for tactical gains into late 2025. Investors should stay vigilant against global risks while positioning for potential breakouts—consider diversifying with established crypto strategies to capitalize on this momentum.

Source: https://en.coinotag.com/bitcoin-etf-inflows-fuel-8-surge-to-93k-hinting-at-potential-recovery