Bitcoin’s $170K Target Could Become Reality—Yet Ozak AI Forecast Shows Higher ROI

Bitcoin is entering one of its strongest phases of market momentum in years as institutional inflows rise, network fundamentals strengthen, and long-term investor conviction grows across the board. Analysts are becoming increasingly confident that Bitcoin’s path toward $170,000 is not only possible but likely if macro conditions remain supportive and liquidity continues to deepen across the crypto space.

Yet even with Bitcoin’s powerful setup and its historically reliable growth trajectory, analysts now widely agree that Ozak AI carries a far steeper ROI potential for the 2025–2026 cycle—thanks to its early-stage market entry, AI-native utility, and accelerating global demand.

Bitcoin (BTC)

Bitcoin (BTC), trading near $86,304, maintains one of the healthiest structural setups in the market. Strong accumulation continues above support at the $84,520, $82,340, and $79,980, levels where long-term holders and institutional investors consistently step in during moments of volatility. Each of these zones reinforces Bitcoin’s role as the market’s dominant anchor asset, attracting capital during both risk-on and risk-off phases.

To trigger a deeper breakout and move closer to six figures, Bitcoin must clear resistance at $88,440, $91,210, and $94,800. These thresholds have historically acted as gateways to multi-week expansions, where liquidity surges and upside volatility multiply. With ETF inflows rising and broader macro sentiment stabilizing, Bitcoin’s $170K target is becoming increasingly realistic. However, even such a move—while massive—still offers a smaller ROI relative to what early-stage AI-native tokens can deliver.

Why Ozak AI Holds the Steeper ROI Curve

While Bitcoin remains the king of long-term stability and macro-driven upside, Ozak AI (OZ) is increasingly viewed as the strongest high-growth contender of the coming cycle. Ozak AI’s value proposition is fundamentally different: it is an emerging intelligence layer designed to introduce real-time AI automation, prediction, and decision-making across Web3 ecosystems.

Its architecture includes millisecond-speed AI prediction engines, cross-chain intelligence infrastructure that operates across multiple networks simultaneously, and lightning-fast 30 ms market signal capabilities through its partnership with HIVE. These features position Ozak AI as a next-generation analytics and automation tool—not just a token riding speculative hype.

In addition, Ozak AI integrates SINT-powered autonomous AI agents capable of running trading strategies, interpreting voice commands, analyzing on-chain data, executing workflows, and functioning as intelligent digital assistants within decentralized systems. This places Ozak AI directly at the intersection of two of the world’s fastest-growing sectors: artificial intelligence and blockchain automation.

Early-Stage Positioning Amplifies Long-Term Potential

The biggest reason analysts expect Ozak AI to outperform Bitcoin in ROI is its early-stage pricing. Small-cap tokens with deep utility historically produce the strongest multipliers during bull cycles, especially when tied to transformative narratives. With over $4.8 million raised and more than 1 million tokens sold, the Ozak AI presale momentum mirrors the early accumulation phases of previous 50x–100x performers.

AI is dominating global tech investment, and crypto projects with real AI-native foundations are attracting enormous interest. Ozak AI stands out among them because it delivers actual utility today—not hypothetical future promises.

Bitcoin Looks Strong

Bitcoin’s journey toward $170K is becoming increasingly achievable as institutional adoption expands and macro conditions align in its favor. It remains the market’s most stable and dependable long-term asset.

But Ozak AI offers a much sharper ROI opportunity, driven by early-stage affordability, powerful AI-native infrastructure, and a rapidly accelerating presale that signals strong global demand. While Bitcoin may double or triple from here, Ozak AI is positioned to deliver exponential gains—potentially emerging as one of the cycle’s top-performing tokens. In the 2025–2026 investment landscape, Bitcoin may lead the market—but Ozak AI has a real chance to lead the returns.

About Ozak AI

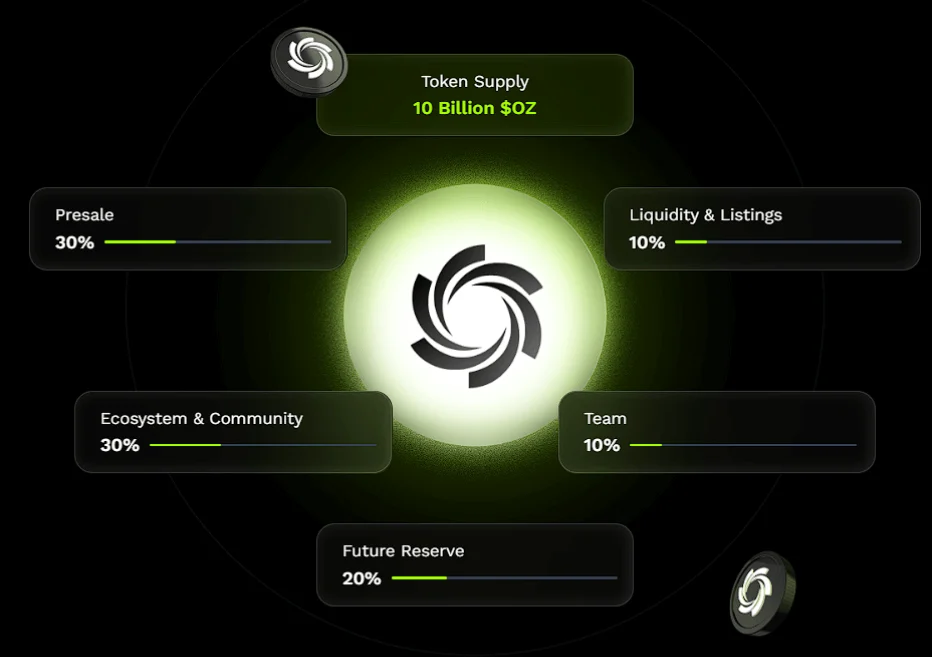

Ozak AI is a blockchain-based crypto assignment that provides a generation platform that specializes in predictive AI and superior information analytics for financial markets. Through machine learning algorithms and decentralized network technology, Ozak AI permits real-time, correct, and actionable insights to assist crypto enthusiasts and businesses in making the proper decision.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

XRP Treasury Firm Evernorth Prepares Public Listing to Boost Institutional Exposure