Top 5 Best Crypto Presales to Buy in 2025: $DSNT Investors Pour Almost $1 Million as 3 out of 5 Agents Go Live Ahead of January Launch

The launch of Monad’s ICO on Coinbase just transformed the presale world. What used to be a niche playground for crypto natives is now drawing attention from big institutions.

Now investors are looking for the best crypto presale to buy in 2025. For many investors, the answer is DeepSnitch AI.

It’s a trading intelligence platform designed to protect profits in bear markets and amplify gains in bull runs. With $670K raised and a 70% presale rally, DSNT is a true 100x opportunity.

DeepSnitch AI

DeepSnitch AI is not just promising an intelligence hub; it’s already running it. The team’s been running SnitchFeed behind the scenes, tracking whale wallet movements and sudden shifts in sentiment before they hit the public eye.

Staking’s already live and seeing strong demand, and the dashboard is up and running as well, making DeepSnitch AI the best crypto presale of 2026.

That’s exactly why traders are jumping in before the next leg up. With the Fed expected to cut rates in December, analysts are starting to get more bullish and dub DeepSnitch AI the best crypto presale to buy now.

And if we really are headed for a 2026 breakout, there’s no sector better positioned than AI x crypto. Gartner’s $1.5 trillion forecast for AI spending next year says it all.

DeepSnitch AI is aiming to be at the heart of that surge. The January launch is closing in fast, and with whispers of Tier 1 exchange listings picking up, the presale buzz is turning into full-blown FOMO.

BlockchainFX

BlockchainFX has a working beta with 20,000+ users. Traders can access all types of assets from one platform as the protocol offers one simple gateway to 500+ assets. BlockchainFX recently secured a verified international license from the Anjouan Offshore Finance Authority.

The presale has already raised $11.2 million, with BFX priced at $0.03 ahead of a $0.05 listing. Tokens are deflationary as unsold supply gets burned and liquidity is locked.

For investors looking at real-world use and compliance, BlockchainFX might be a great choice. But if you’re also looking for immense growth potential, BFX is not the best crypto presale to invest in.

Nexchain

Nexchain handles 400k transactions per second using AI-driven parallel processing. Fees stay ultra-low at just $0.001, making Nexchain one of the most efficient networks in 2026.

Its hybrid consensus blends Proof of Stake with AI validation, boosting both speed and security as one of the best crypto presales of this year.

Energy use stays low thanks to smart resource allocation, proving that scale doesn’t need to sacrifice sustainability. With Testnet 2.0 live, Nexchain adds tools like wallet reputation scoring and real-time analytics.

Bitcoin Hyper

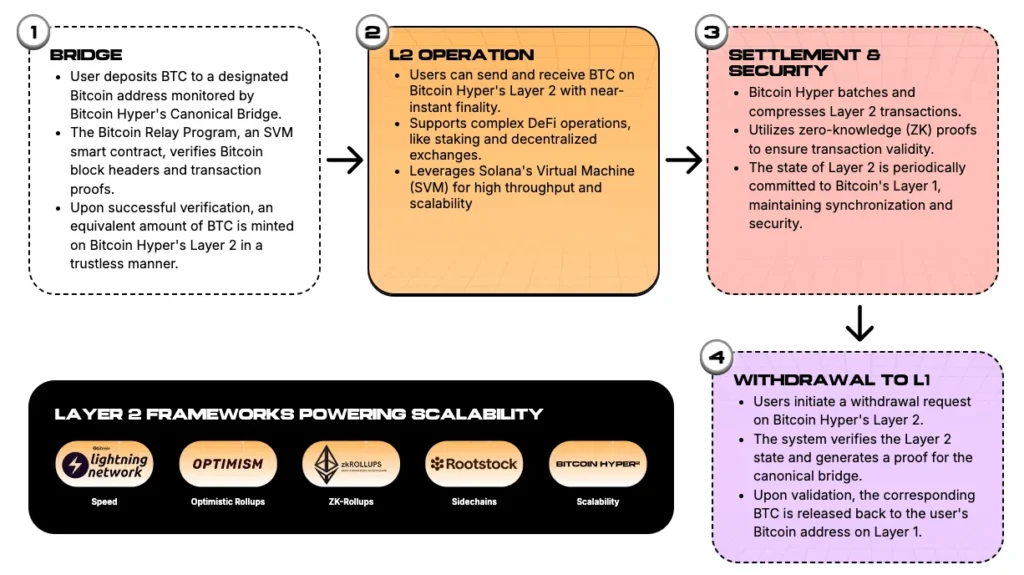

For years, Bitcoin’s base layer has struggled with limitations: capped at just 7 TPS and burdened with high fees. Bitcoin Hyper brings lightning-fast execution and ultra-low fees to the table, while retaining Bitcoin’s Proof-of-Work settlement for unmatched security.

Its modular design allows Bitcoin to remain the source of finality, while a Layer 2 network powered by Proof-of-Stake validators handles scalability and dApp activity at scale.

With $28.9 million already raised, Bitcoin Hyper stands apart in a market where many projects are losing steam. But with the immense competition from other Layer 2s like Base, Bitcoin Hyper is losing its “best crypto presale” status.

Ozak AI

Ozak AI is building real tools that work in the real world. At its core is a sharp tech stack. It runs high-speed prediction engines, real-time signal processing, and cross-chain tracking.

Traders get instant reads on market volatility. HIVE integration sends out sub-30ms trading signals. SINT agents go a step further, turning spoken or typed commands into on-chain actions in seconds.

Investors are taking notice. With over $4.7 million raised and millions of tokens sold, the presale is turning heads.

The bottom line

All five tokens look bullish for the long term, but if you’re after the highest upside with the least risk, DeepSnitch AI is the best crypto presale of 2025.

While Bitcoin Hyper and BlockchainFX have already raised tens of millions, DSNT is still super early at just $0.02629.

With AI spending projected to hit $1.5 trillion next year, and DSNT targeting the booming trading intelligence niche, it’s perfectly positioned for a 100x breakout.

Visit the official DeepSnitch AI website, join Telegram, and follow on X (Twitter) for the latest updates.

FAQs

What are the best upcoming crypto presales in 2026?

DeepSnitch AI is leading the pack among upcoming crypto presales in 2026 thanks to its real-time AI tools, strong audits, and early traction.

Which new cryptos have the highest 100x potential?

Among the top new crypto ICOs, DeepSnitch AI stands out. It’s not a generic Layer 1 or meme token; it’s building practical tools for 100M+ traders.

Why is DeepSnitch AI better than other new cryptos?

Unlike most new cryptos that chase trends, DeepSnitch AI is focused on real utility. Its SnitchFeed and scam scanner give retail traders an edge.

This article is not intended as financial advice. Educational purposes only.

You May Also Like

SOL Treasury Company Forward Industries: Market Turmoil Offers Opportunity to Consolidate Other Treasury Companies

Robinhood US lists CRV token