IOTA Eyes Q1 2026 Launch for TWIN, Unlocking Real-World Trade Activity

- An IOTA enthusiast has disclosed that the mainnet launch of the TWIN and TLIP could occur in Q1 2026.

- IOTA has also been tipped to process a massive share of the millions of containers moved by the AfCFTA region.

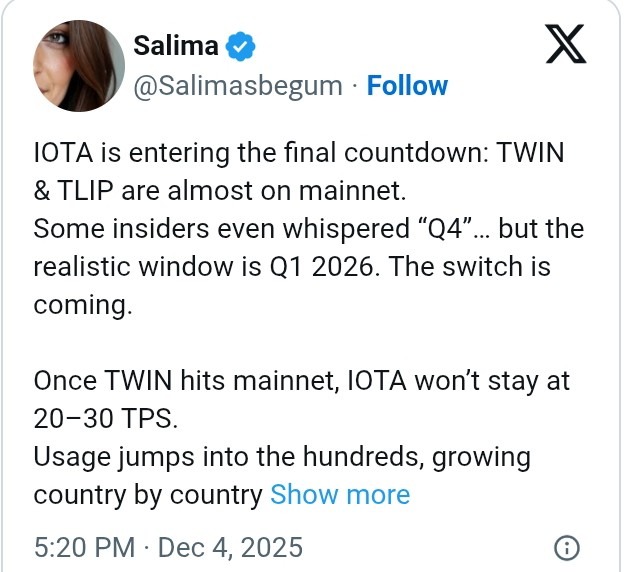

A renowned IOTA enthusiast known as Salima has put an ongoing speculation to rest, clarifying that the Trade Worldwide Information Network (TWIN) and the Trades and Logistics Information Pipeline (TLIP) could be ready for mainnet launch in the first quarter of 2026 (Q1 2026).

According to her, a successful deployment would complement other projects in the pipeline and significantly move its Transaction Per Second (TPS) from 20-30.

Source: Salima on X

Source: Salima on X

Things to Expect After the IOTA’s TLIP and TWIN Mainnet Launch

In her post, Salima highlighted that usage would increase into the hundreds. Additionally, she disclosed that this would continue to grow country by country after TWIN launches on the mainnet. Specifically, Salima expects Africa alone to “drive 2000 to 3000 TPS in the coming years.”

The IOTA’s TWIN Foundation was unveiled on May 8 at the African Continental Free Trade Area (AfCFTA) Digital Trade Forum in Lusaka, Zambia. The idea was to encourage a more inclusive, transparent, and efficient global trade system.

Just recently, the AfCFTA secretariat, World Economic Forum, Tony Blair Institute for Global Change, and IOTA collaborated to launch ADAPT. According to reports, this is to ensure that African trade becomes faster, safer, and transparent.

With these initiatives and collaborations, Salma believes that TWIN or ADAPT could be involved and process a meaningful share of the 20 million containers moved by the AfCFTA region annually. Most importantly, this would be the first real-world economic activity that would run on the blockchain, as claimed by Salma. Meanwhile, she further disclosed that these would be “just ignition”.

Per her observation, the mainnet launch would unlock other layers, including “tokenized bills of lading, invoice finance, and trade-backed Real-World Assets (RWAs).” From this point, she expects the ecosystem to record more liquidity, Decentralized Finance (DeFi), RWAs, and TPS.

Already, TLIP is reported to be making progress in East Africa with pilot initiatives, as noted in our earlier post. In the report, TLIP was highlighted to have reduced transaction costs by 80% among Kenyan traders in one of its pilot programs. Amid the backdrop of this, the IOTA community is pushing the staking ratio to 50%, as also indicated in our recent publication.

]]>You May Also Like

Dogecoin, HBAR Rank High On Watchlists But One Crypto Is Stealing The Show

Top Altcoins to Buy Today Ahead of Major Price Moves