US Investors Are Pulling Back From Crypto And Risk-Taking, Study Shows

FINRA’s new study now shows a drop in US investor appetite for new crypto purchases and high-risk behaviour as economic worries rise.

A recent study from FINRA shows that many US investors are stepping back from crypto.

The report points to trend toward safer choices as worries about rates, prices and general economic stability rise. The trend marks a clear cooling from the speed seen during the pandemic years.

US investor interest cools

FINRA surveyed thousands of adults between July and December last year. At the end of the study, the data painted a steady picture of who already holds crypto, but a weaker appetite for buying more.

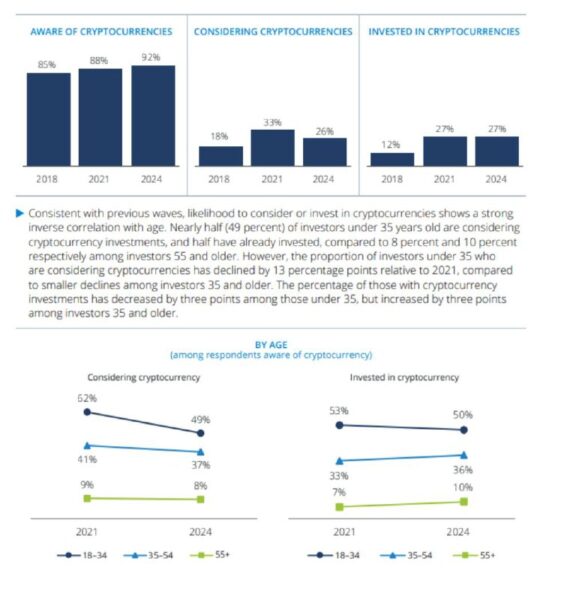

Roughly 27% of investors have held crypto in the last four years. That rate did not grow, which shows that the surge from earlier years did not continue.

US investor interest appears to have cooled | source- FINRA

US investor interest appears to have cooled | source- FINRA

The drop also appeared in a different place. Investors who considered buying crypto fell from 33% in 2021 to 26%. That fall points to a calmer market. It also shows that many people are watching the conditions before taking further action.

The study also examined risk levels. Only 8% of investors placed themselves in a high-risk category. That was a four-point dip from 2021. Adults under 35 showed the sharpest decline as their high-risk score dropped from 24% to 15%.

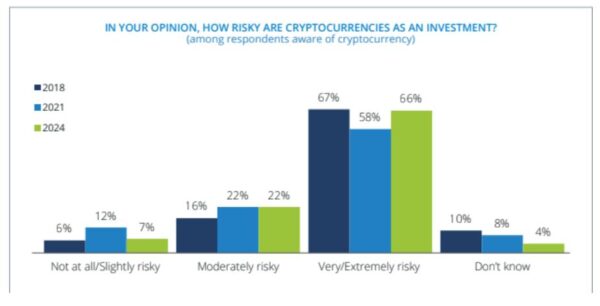

How investors judge crypto risk

FINRA asked respondents to describe how they view crypto. A total of 66% said the asset class feels risky. That was up from 58% three years earlier, and the trend indicates more caution as economic signals remain mixed.

Yet a large group still believes large swings are worth the reward. About one-third of all investors said they must take big risks to reach their financial goals.

Among adults under 35, one half agreed. That divide shows that age affects attitudes more than crypto itself.

Risk appetite has cooled among more than half of respondents | source: FINRA

Risk appetite has cooled among more than half of respondents | source: FINRA

The study also touched on behaviour tied to online hype. Roughly 13% of investors admitted buying meme stocks and viral trades.

For adults under 25, the share was close to one-third. This behaviour contrasts with the overall move toward caution. The result thus shows how different groups respond to market signals.

Slower arrival of new investors

The flow of new investors cooled after the pandemic. FINRA reported that only 8% of current investors joined the market between 2021 and 2023. The share stood at 21% during the pandemic.

That earlier spike reflected more free time, stimulus payments and a strong online trading culture.

Once daily life stabilised, the surge faded. The share of adults under 35 who invest returned to the level last seen in 2018. The reversal shows that the pandemic effect had an endpoint.

Many young adults slowed down or paused their investment activity as routines normalised.

The study concluded that investors now show more caution than in 2021. The rise in crypto risk perception, the fall in new buyers and the decline in high-risk behavior all point in the same direction.

investors are not fleeing crypto. They are simply approaching it with more patience.

Related Reading: Bitcoin Premium Shifts Positive, Signaling U.S. Investor Strength

Summary

Overall, FINRA’s latest findings show that US investors are taking a calmer approach to crypto.

Holding rates stayed the same, while buying interest fell. High-risk behaviour declined, especially among younger adults. New investor growth also slowed to older levels.

All of these signs point to a careful and measured stance as people wait for clearer economic signals.

The post US Investors Are Pulling Back From Crypto And Risk-Taking, Study Shows appeared first on Live Bitcoin News.

You May Also Like

CME Group plans to launch SOL and XRP futures options on October 13

Vanguard Reverses Crypto ETF Ban, Triggers $200 Billion Market Surge