XRP’s $8 Target Draws Traders In, But Ozak AI’s Trajectory Looks Far More Parabolic

The post XRP’s $8 Target Draws Traders In, But Ozak AI’s Trajectory Looks Far More Parabolic appeared first on Coinpedia Fintech News

XRP is once again pulling trader attention as bullish sentiment strengthens around its long-term price trajectory, and analysts highlight a realistic path toward an eventual breakout above the $8 region. Renewed institutional interest, expanding global utility in cross-border settlements, and improving technical indicators all support a strong multi-cycle recovery.

Yet even as XRP prepares for a potentially powerful surge, leading analysts say Ozak AI is positioned on a far more parabolic growth curve—driven by early-stage affordability, AI-native utility, and rapidly accelerating ecosystem momentum that gives it a steeper, more explosive ROI outlook for 2025–26.

XRP Strengthens as Key Support Levels Hold Firm

XRP, trading near $2, continues to build a bullish formation supported by strong accumulation levels at $1.94, $1.87, and $1.79. These zones reflect steady confidence from long-term holders and institutional participants who expect XRP to perform strongly as sentiment stabilizes and global demand for settlement-focused solutions expands

Youtube embed:

Inside Ozak AI: How AI and Blockchain Are Powering the Next Digital Revolution  .

.

To move into a full breakout phase, XRP must test and clear the resistance levels at $2.08, $2.16, and $2.28. Each of these zones marks historically important thresholds linked to multi-week upward expansions in previous cycles. As macro conditions improve and liquidity returns to high-conviction altcoins, analysts increasingly view XRP’s $8 target as achievable. However, despite its strong fundamentals, XRP’s large market cap inherently restricts its ability to produce the high-velocity, triple-digit multipliers that smaller and earlier-stage projects can achieve.

Why Ozak AI’s Growth Curve Appears Far More Parabolic

While XRP offers stability and long-term utility, Ozak AI (OZ) delivers unmatched early-stage upside rooted in powerful AI-native technology. Analysts are calling Ozak AI one of the most compelling small-cap contenders of the 2025–26 cycle because its value proposition is built around intelligence, speed, and automation—core drivers of the next decade of blockchain innovation.

Ozak AI functions as a real-time Web3 intelligence layer built on:

- Millisecond-speed AI prediction engines that read market data instantly

- Cross-chain intelligence frameworks scanning multiple blockchains at once

- 30 ms ultra-fast signal flows powered via its partnership with HIVE

- SINT-powered autonomous agents that can execute strategies, process analytics, respond to voice commands, and automate workflows end-to-end

This architecture places Ozak AI at the center of the fastest-growing global technology movement: AI automation. And unlike hype-driven tokens, Ozak AI launches with real utility, giving it a stronger foundation and significantly higher adoption potential.

Early-Stage Positioning and Presale Strength Boost Ozak AI’s ROI Potential

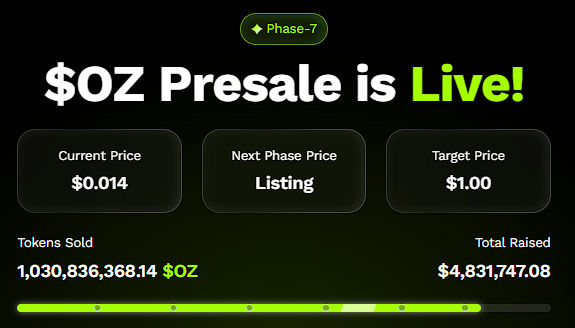

What makes Ozak AI even more compelling is its stage in the market cycle. With over $4.8 million raised and more than 1 million tokens sold, the presale is expanding at a pace typically seen in early-phase altcoins that later delivered 50x–100x breakouts.

Its strategic partnerships make the project even stronger. Working alongside Perceptron Network’s 700K+ nodes, HIVE’s lightning-fast signal technology, and SINT’s autonomous agent infrastructure, Ozak AI is entering the market with institutional-tier technology already integrated. This readiness dramatically increases its potential to scale rapidly after launch. Because of its small-cap valuation and functional ecosystem, analysts consistently rank Ozak AI above large caps like XRP for pure ROI potential.

XRP Looks Strong—but Ozak AI Looks Transformational

XRP’s path toward $8 remains one of the strongest narratives in the large-cap category, supported by real utility, expanding adoption, and a healthy technical structure. It may deliver impressive multi-x gains for long-term holders.

But Ozak AI’s trajectory is far more parabolic, fueled by AI-driven infrastructure, early-stage affordability, high utility, and accelerating presale demand. As the 2025–26 cycle forms, analysts increasingly view Ozak AI as the most explosive ROI project—one capable of outpacing even the strongest large-cap predictions. XRP may lead institutional payments—but Ozak AI is positioned to lead the next wave of exponential growth.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a generation platform that specializes in predictive AI and superior information analytics for financial markets. Through machine learning algorithms and decentralized network technology, Ozak AI permits real-time, correct, and actionable insights to assist crypto enthusiasts and businesses in making the proper decision.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi

You May Also Like

Sushi Solana integration expands multichain DeFi reach

Sushi Solana integration signals strategic DeFi expansion on a fast-growing blockchain