U.S. Prosecutors Seek 12-Year Sentence for Do Kwon

U.S. prosecutors request a 12-year sentence for Do Kwon, citing massive losses, global fallout, and strong deterrence needs.

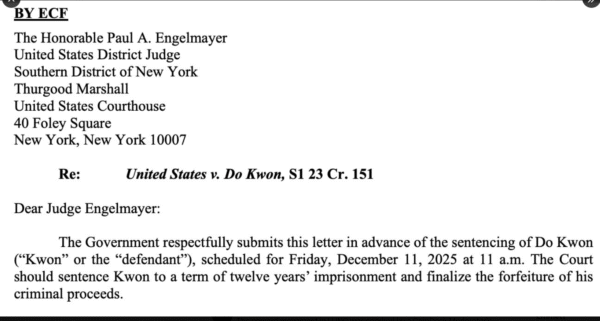

Prosecutors in the United States have urged a New York federal judge to impose a 12-year prison sentence on Terraform Labs co-founder Do Kwon. They claimed that his moves in the collapse of TerraUSD caused widespread disruptions in the markets. Moreover, they emphasized the episode hastened failures of various major crypto platforms.

Prosecutors Link Terra Collapse to Wider Market Damage

According to filings reviewed by Bloomberg, the request reached the court on the 4th of Dec. The filing came in advance of an upcoming sentencing hearing that would be held on December 11. Additionally, prosecutors said the magnitude of the losses of investors surpassed a number of other high-profile crypto failures. They brought up numbers that show an estimated $40 billion wiped out across the world’s markets.

Related Reading: Do Kwon Pleads Guilty in U.S. Fraud Case Over $40 Billion TerraUSD Collapse | Live Bitcoin News

Furthermore, authorities emphasized that Kwon’s actions were among the most harmful in other cases in recent financial fraud cases. Reports said that they compared their fallout to the collapse of FTX. They also mentioned losses associated with Celsius and OneCoin. As a result, they contended that the magnitude warranted the imposition of a stiff penalty. They said losses were bigger than those associated with Sam Bankman-Fried’s case.

Source: X

Source: X

In August 2025, Kwon pleaded guilty to two conspiracy charges of fraud and wire schemes. Under his plea agreement, the prosecutors agreed to recommend a 12-year term. Nevertheless, Judge Paul Engelmayer retains full discretion to impose as long as 25 years. As a result, legal observers look forward to close attention on sentencing arguments to be presented next week.

Defense Cites Harsh Detention Conditions in Mitigation Effort

Kwon’s defense team has been seeking a more lenient five-year sentence. They claimed that his nearly three-year detention in Montenegro had severe conditions. In addition, they stressed that he is still facing prosecution in South Korea where authorities are seeking a 40-year term. Because of this, the defense was urging the court to consider aggregating punishments across jurisdictions.

Defense statements also cited the fact that Kwon cooperated in the plea deal. In addition, they indicated their agreement to give up substantial assets. Court documents verified that he agreed to give up more than $19 million in gains. The forfeiture also covers a number of properties associated with the proceeds from the scheme. Therefore, attorneys argued that there should be continued proportionality of additional penalties.

Even so, prosecutors insisted that the long sentence was necessary to send a market signal. They maintained that accountability plays a central role in restoring trust. They went on to say that the Terra collapse was a turning point for some institutions. According to the referred blogs and industry reports, liquidity failures accelerated across exchanges following the decline of Terra.

Regulators May Tighten Rules as Terra Fallout Sparks Liquidation Fears

Analysts point out that the sentencing verdict could be relevant to forthcoming regulatory debates. They believe that the strict penalties may influence how future cases of crypto fraud go. In addition, they imply that regulators might increase oversight to avoid similar crises. Due to the heightening of liquidation risks that occurred after Terra’s fall, there are several observers recommending deeper scrutiny of algorithmic stablecoins.

As this Dec. 11 hearing approaches, markets are still watching for possible implications. Industry participants are afraid that extended uncertainty will trigger further enforcement across related entities. However, they also expect that the strong judicial actions could help to stabilize the standards. Consequently, investors and policymakers await some final determinations that may see future liquidation procedures.

The post U.S. Prosecutors Seek 12-Year Sentence for Do Kwon appeared first on Live Bitcoin News.

You May Also Like

When Is ‘Five Nights At Freddy’s 2’ Coming To Streaming?

STRF Has Performed Best During the Recent Bounce