Grayscale Sui Trust Filing Follows Momentum From 21Shares’ SUI ETF Debut

- Grayscale’s fresh SUI ETF filing trails the new leveraged TXXS debut and signals rising institutional interest.

- SUI price outlook shows rebound prospects above key levels, though weakness remains if support breaks.

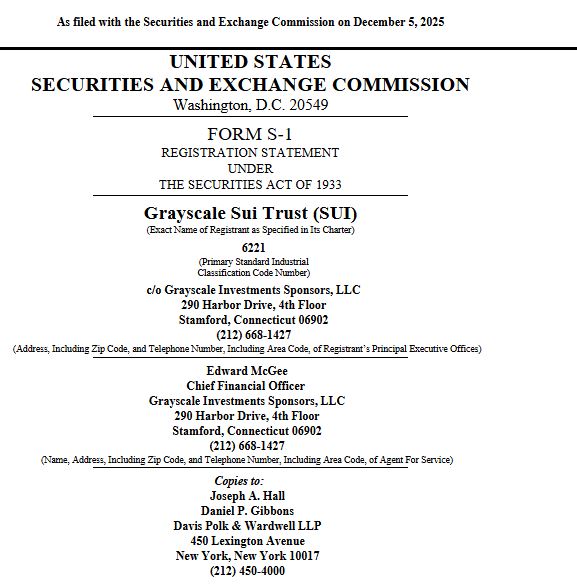

Grayscale has submitted a fresh S-1 registration to the U.S. Securities and Exchange Commission seeking approval to launch the “Grayscale Sui Trust.” The proposed trust will offer exposure to the Sui blockchain through a publicly traded security.

According to the filing, the trust is designed to mirror the price of SUI, subtracting fees and expenses, allowing investors to gain regulated access without directly handling the token.

The filing came shortly after 21Shares introduced the first U.S.-listed leveraged ETF linked to the Sui blockchain. That product, trading under the ticker TXXS on Nasdaq, is designed to offer twice the daily price exposure of SUI using derivatives. The fund saw more than 4,700 shares traded on its first day of launch and ended the session at $24.57.

Source: Sec.gov

Source: Sec.gov

Grayscale’s application adds to its broader expansion of single-asset ETFs in 2025. As we reported, the company introduced a Chainlink ETF earlier this week on NYSE Arca and began trading a Dogecoin ETF on November 24. It has also filed to convert its Zcash Trust into a spot ETF. These steps show an effort to satisfy growing investor demand for access to individual tokens through financial products.

Broader ETF Interest Around SUI

The listing of TXXS came during a time of rising institutional and retail investors’ interest in the Sui network. The token appeal comes from its fast transaction processing, developer-friendly design, and the rising activity of stablecoin transactions on the chain. These factors make SUI a potential candidate for an ETF.

Russell Barlow, CEO of 21Shares, commented on the release of TXXS, stating,

In July, Canary Funds also entered the SEC review process with a separate proposal for a spot SUI fund. While that product has not yet received approval, its filing marked another example of asset managers seeking regulated vehicles tied to this blockchain.

SUI Market Performance

As of latest data, SUI was priced at $1.53, and its market cap stands at $5.75 billion. It saw a daily decline of 5.86%, and the trading volume reached $870 million.

Analysts pointed to a support zone at $1.31 as a level that may allow for recovery toward $1.60. If price strength continues, breaking the $1.64 resistance could create a path toward $1.97, with the next technical ceiling at $2.18. However, if the support at $1.28 does not hold, a drop toward $0.9171 could follow.

Ali Martinez stated in his X post that both the SUI chart and its fundamentals are giving positive buy signals at the moment, suggesting that the recent price drop may be temporary.

]]>You May Also Like

Vàng Cán Mốc Lịch Sử 5.000 USD: Khi Dự Báo Của CEO Bitget Gracy Chen Trở Thành Hiện Thực Và Tầm Nhìn Về Đích Đến 5.400 USD

Why the Bitcoin Boom Is Not Another Tulip Mania