Crypto Treasury Underwriter Clear Street Eyes $12B IPO Led By Goldman Sachs

Clear Street, the New York financial services firm underwriting crypto-treasury services, is preparing for a public listing that could land as early as next month. The IPO could value the rapidly expanding broker between $10 billion and $12 billion, marking one of Wall Street’s most significant market debuts tied directly to crypto-linked corporate balance-sheet strategies.

While Clear Street’s listing is unlikely to happen before January, the Financial Times reported on December 5 that Goldman Sachs is positioned to lead the offering.

Founded in 2018, Clear Street became one of the most prominent beneficiaries of the crypto-treasury model that gained traction in the US over the past year. Regulators’ softening stance under the Trump regime has triggered a wave of demand for BTC among publicly traded companies in the US. According to BitcoinTreasuries.net the top 100 publicly traded Bitcoin firms have acquired 1,062,021 BTC valued at approximately $94 billion as of December 6.

Michael Saylor-led IT firm kicked off the trend, raising billions in debt and equity from 2020 to amass a record 650,000 BTC reserve, according to SaylorTracker.

Clear Street has underwritten major crypto treasury deals, including offerings for Strategy and for Trump Media & Technology Group. The firm has advised on or underwritten roughly $91 billion in equity, debt, and M&A transactions this year alone, according to its website. Its star-studded clientele includes prominent crypto analyst Anthony Pompliano and former presidential candidate Vivek Ramaswamy.

Crypto-treasury stocks have come under pressure as digital assets retreated from peak valuations. Strategy’s (MSTR) shares also dipped 60% over the past six months. Amid concerns of possible delisting from key equity index benchmarks, CEO Phong Lee told CNBC that the firm is not at risk of selling BTC until 2065, emphasizing that Strategy’s ability to meet dividend obligations to its shareholders remains unimpaired.

Clear Street’s upcoming listing will test investor appetite for the crypto-treasury model amid uncertain US Fed policy and other macro-driven volatility risks heading into 2026.

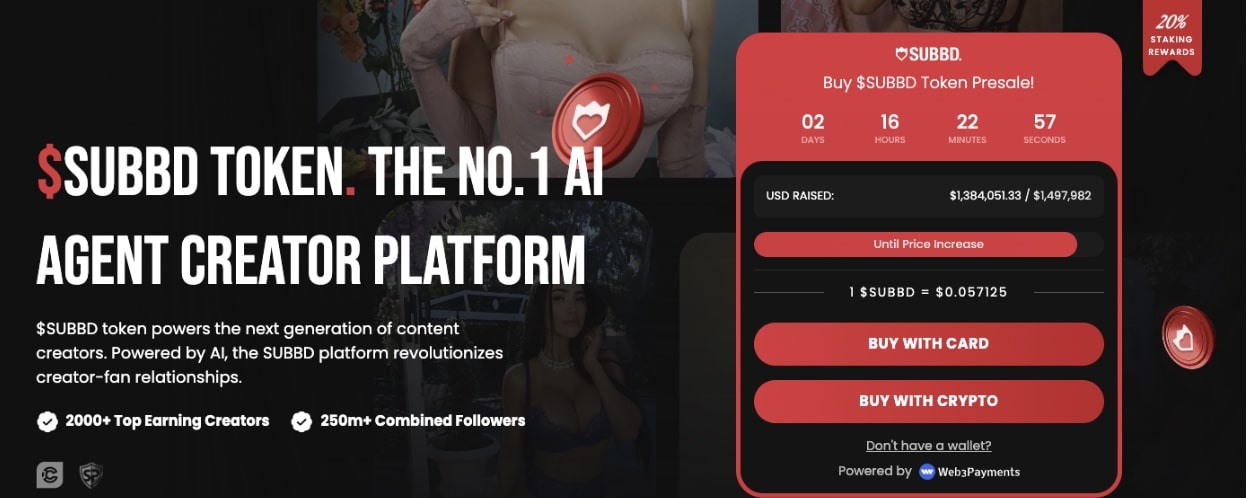

SUBBD Presale Nets $1.4M as Traders Position For Next Bull Cycle

While crypto market sentiment remains in the balance, investors are switching focus towards early-stage projects like SUBBD ($SUBBD).

SUBBD integrates AI-driven personalization with creator monetization, enabling influencers and brands to build fan communities.

SUBBD Presale

The SUBBD presale has now surpassed $1.4 million of its $1.5 million fundraising target, with tokens currently priced at $0.057 each. With less than 24 hours before the next price tier, Interested participants can visit the official SUBBD presale website to unlock early-entrant rewards.

nextThe post Crypto Treasury Underwriter Clear Street Eyes $12B IPO Led By Goldman Sachs appeared first on Coinspeaker.

You May Also Like

Wormhole launches reserve tying protocol revenue to token

When Your Mom Can Use DePIN, Mass Adoption Has Arrived