Bitcoin Briefly Breaks $92K: ‘A Good Start,’ Claims Analyst

Bitcoin BTC $91 769 24h volatility: 2.8% Market cap: $1.83 T Vol. 24h: $44.90 B has started the week strongly with a 60% surge in its 24-hour trading volume. The leading cryptocurrency has crossed the key level of $92,000 and gained $50 billion in market cap over the past day.

Analyst Michael van de Poppe noted on X that the CME Gap was filled early on Dec. 8 when BTC dipped to $89,400, but the traders quickly bought the dip. He believes the strong demand could help BTC hold above the $92,000 resistance in the coming days.

The analyst sees a possible rally toward the psychological level of $100,000 before 2025 concludes, given the buying momentum stays firm.

Analyst Ted echoed the caution and noted that the $89,500 CME gap will likely fill this week. This makes the $88,000-$89,000 range very important for Bitcoin bulls to defend.

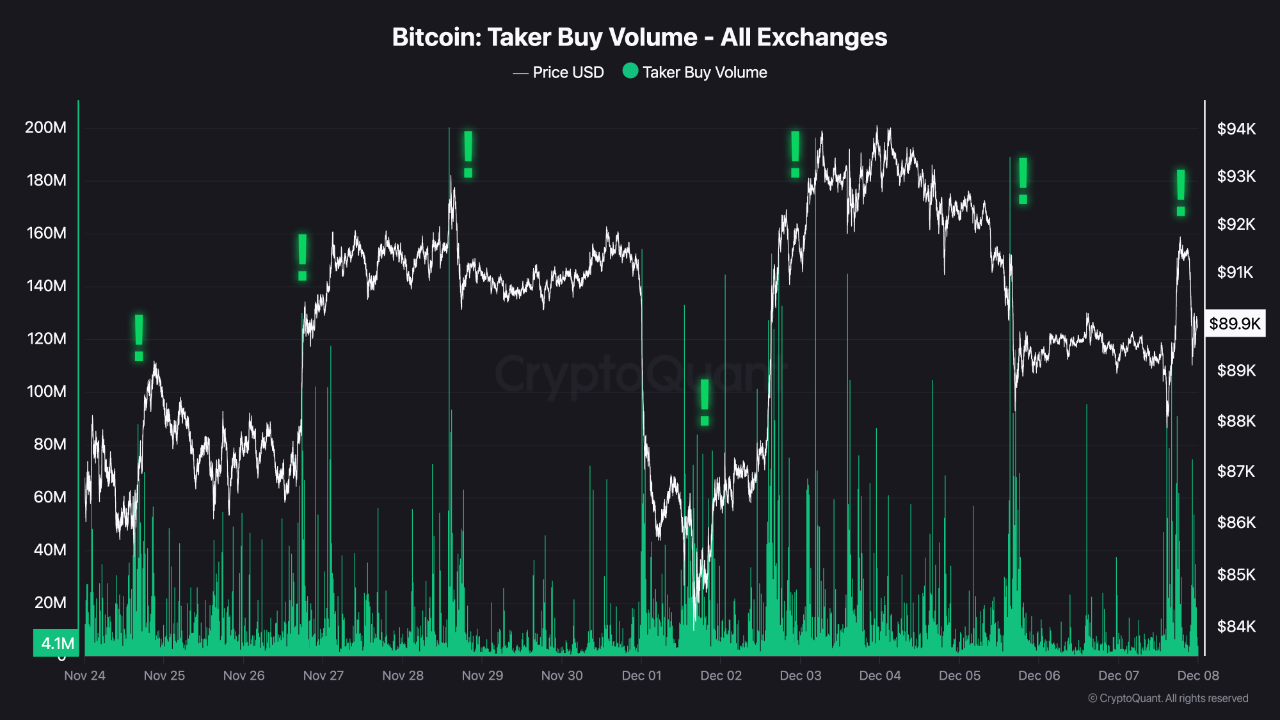

Bitcoin Taker Buy Volume Spikes

Meanwhile, data by CryptoQuant shows repeated bursts in Bitcoin’s Taker Buy Volume over the past two weeks. This further implies steady buying pressure during sharp dips as each recent pullback has led to heavy acquisition.

CryptoQuant analysts suggest bullish signals with strong dip demand and whale activity. However, they caution that buyers may be slowing down as price responses weaken.

Bitcoin’s taker but volume | Source: CryptoQuant

What’s Next for BTC Price?

Meanwhile, traders are also eyeing the Federal Reserve meeting on Dec. 10, with analysts expecting a 0.25% rate cut. Weak jobs data points to a softening labor market, while inflation concerns leave the Fed in a tight spot.

A rate cut would expand liquidity and could support BTC in the near term. Moreover, the market is also due for a year-end Santa rally.

However, not everyone agrees. Analyst Ali Martinez noted BTC recently fell below its Realized Price to Liveliness Ratio. Past cycles show BTC often drops toward its Realized Price after this signal.

That level currently sits at $56,355, which means there is still a possibility of a deeper pullback.

nextThe post Bitcoin Briefly Breaks $92K: ‘A Good Start,’ Claims Analyst appeared first on Coinspeaker.

You May Also Like

SEI to Test Key Resistance at $0.128 Ahead of Potential Bullish Move

RCBC Adds Motorcycle Loans and Biometric Security to Its Pulz App