All-In On XRP: Why This Leading Investor Sold His Entire Bitcoin Stack

According to reports, a well-known crypto commentator/investor who goes by the handle Crypto X AiMan has sold all his Bitcoin and moved the proceeds into XRP. He says four reasons drove his decision, and the move has stirred debate across trading circles.

Investor Dumps Bitcoin For XRP

AiMan, who says he first bought Bitcoin when it traded at $3,000, told followers that legal clarity is the main reason for his shift. He pointed to a July 2023 court ruling by Judge Torres that found certain programmatic XRP sales were not securities.

According to him, that court decision gives XRP a different standing from many other tokens. He also noted that US regulators often treat Bitcoin as a commodity, a stance reiterated by former SEC Chair Gary Gensler. AiMan framed the court outcome as a rare, explicit legal test that favored XRP.

He highlighted another factor: Ripple’s large holdings. Based on company disclosures, Ripple holds close to 40 billion XRP, nearly 40% of the total supply. AiMan argued those reserves could support future use cases if Ripple or its partners chose to deploy the tokens for payments.

He called XRP faster and cheaper to move than Bitcoin, saying it is built for cross-border transfers — a point he used to contrast XRP’s utility with Bitcoin’s role as a store of value. He also ran through a market-size scenario.

Market analysts have projected the cross-border payments market at $250 trillion by 2027, and AiMan suggested that even a 1% share of that volume could mean big gains for XRP.

He admitted the trade is extreme: “If I’m wrong? XRP probably goes to zero, and I lose everything,” he said. He added that if he is right, the payoff would be huge.

XRP’s Legal Advantage

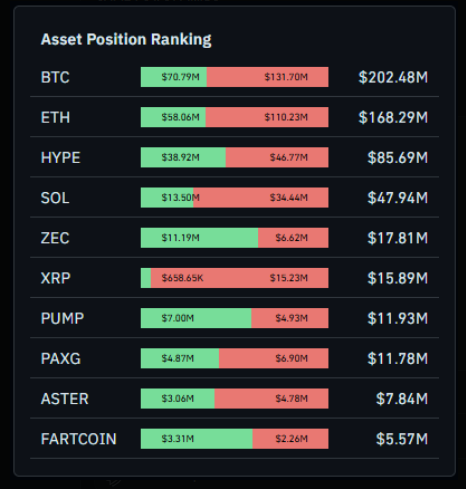

Market reaction has been mixed. Based on reports from data providers, traders are taking large short positions against XRP. Coinglass figures show XRP with $15 million in shorts versus $0.6 million in longs — a roughly 96% short allocation and a shorts-to-longs ratio near 25 to 1.

For comparison, Bitcoin had $131 million in shorts and $70 million in longs; Ethereum showed $110 million shorts and $58 million longs. Despite heavy shorting, XRP has posted daily gains at times, according to recent price movements.

Aggressive Shorts Dominate Positioning

Aggressive Shorts Dominate Positioning

Analysts say heavy short positions can indicate weak near-term sentiment. They also create technical risks, because a squeeze could push prices higher quickly if shorts are forced to cover.

That does not remove the core risks AiMan flagged and others raised: a big token allocation held by one company raises centralization concerns, and banks have not broadly shifted settlement rails to public tokens.

Bitcoin still has a market cap near $1.8 trillion and deeper liquidity, which many investors view as stability in a volatile market.

Featured image from Pexels, chart from TradingView

You May Also Like

The Stark Reality Of Post-Airdrop Market Dynamics

Headwind Helps Best Wallet Token