Here’s why the crypto market is going up today (Dec. 8)

The crypto market is going up today, Dec. 8, with Bitcoin and most altcoins being in the green.

- The crypto market is going up ahead of the Federal Reserve rate decisions.

- Polymarket odds of a Federal Reserve interest rate cut rose to 95%.

- These coins jumped as futures open interest resumed the uptrend.

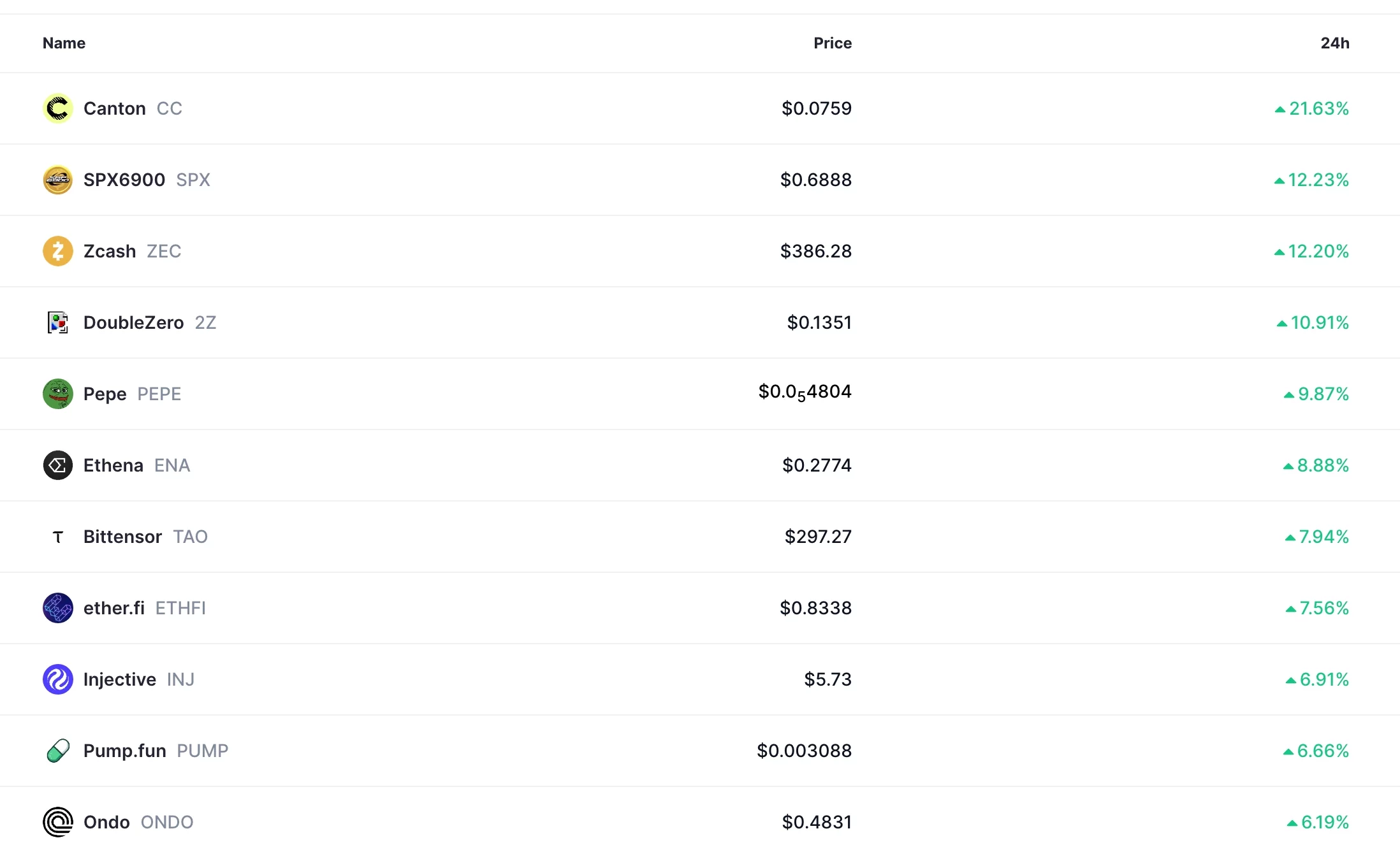

Bitcoin (BTC) price rose to $92,000, while the market valuation of all tokens jumped by 2.63% in the last 24 hours to $3.12 trillion. Some of the most notable gainers were tokens like Canton, which jumped by 23%, and SPX6900, Zcash, and Pepe. All the other tokens rose by over 10%.

Crypto market going up ahead of the Federal Reserve interest rate decision

One potential reason behind the ongoing crypto market rally is the upcoming Federal Reserve interest rate decision, which will happen on Wednesday.

Polymarket traders have boosted their odds that the bank will cut interest rates by 0.25% in this meeting, a move that, in theory, should boost risky assets like stocks and the crypto market.

A poll with over $290 million in assets shows that the odds of a cut have jumped to 95%, much higher than last month’s low of below 50%.

Odds that Trump will nominate Kevin Hassett have also jumped to 80%. Hassett is seen as a Trump loyalist who will champion more rate cuts in a bid to boost the economy.

Strategy Bitcoin purchases

The crypto market continued rising as Strategy continued its Bitcoin accumulation.

The company acquired 10,624 coins worth ~$962 million last week, its biggest purchase in months. This purchase helped to calm the market, which has been concerned about the company.

In a recent statement, the CEO noted that the company would be comfortable selling Bitcoin to pay dividends and debts if its mNAV turned negative. The company then announced that it had set aside over $1.2 billion in reserves to cover these payments in case of a prolonged Bitcoin bear market.

Soaring bearish liquidations and futures open interest

The crypto market is going up as third-party data showed that the futures open interest rose by over 4% in the last 24 hours to $129.9 billion. A rising open interest is a sign that investors are adding leverage, which is normally a sign of high demand.

Meanwhile, data shows that short sellers were highly liquidated. Shorts liquidations rose by 14% in the last 24 hours to over $323 million. Ethereum and Bitcoin shorts worth over $116 million and $96 million were liquidated in the same period.

Still, there is a risk that the ongoing crypto market comeback is a dead-cat bounce, a situation in which a token rises briefly before resuming its downtrend.

You May Also Like

Indonesia approves $70 million-backed ICEx as the country's second official cryptocurrency exchange.

Homeland Security to send hundreds more officers to Minnesota, Noem says