Your Gen Z Loved Ones Are Stressed About Money, An AI Coach Might Actually Help

\ Gift guides love to push budgeting apps and beginner finance books every December, but let’s be honest: Gen Z doesn't need another dashboard reminding them their checking account is starving. They already live inside the spreadsheet.

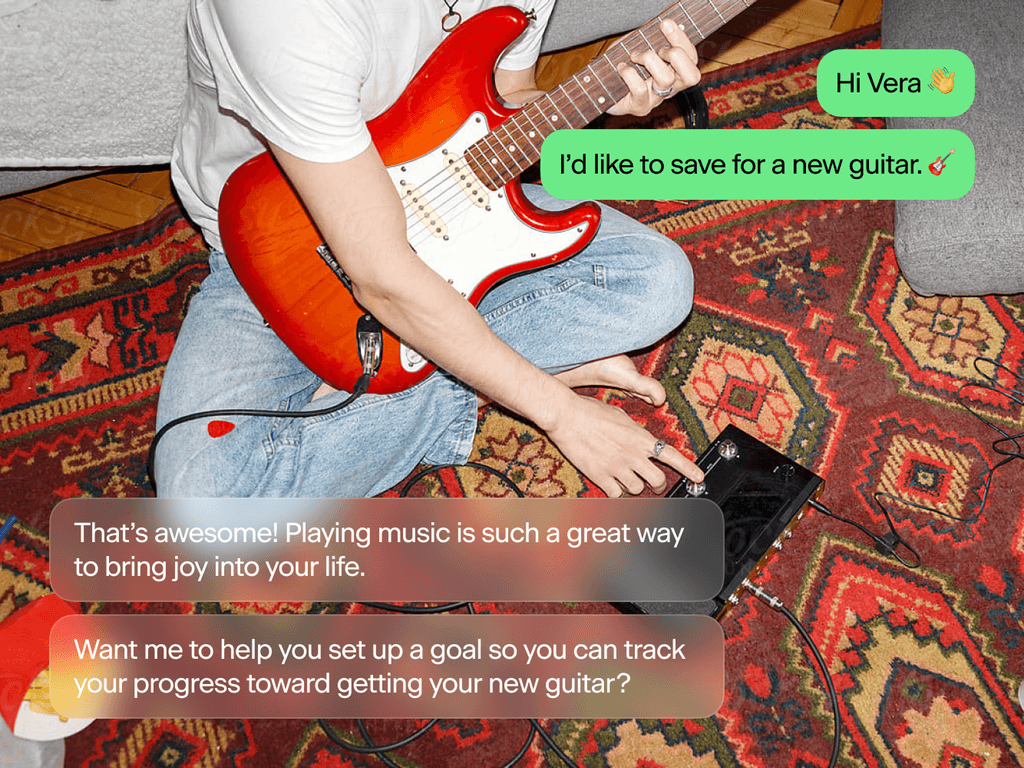

What they don’t have is technology that understands the emotional noise underneath their financial decisions—fear, shame, confusion, and fatigue. A new entrant called Vera, an AI-driven financial coach, is attempting to go after that psychological layer instead of competing with Mint clones and robo-advisors. Whether it succeeds is an open question, but the shift it represents is worth paying attention to.

\

\

The Economic Reality Gen Z Is Navigating (It’s Not Just “Stop Buying Lattes”)

\ If you’ve talked to anyone born roughly between 1996 and 2010, you already know the baseline: anxiety. \n But the backdrop matters:

\

- Gen Z’s real wages have lagged inflation for most of the last four years, according to multiple Federal Reserve analyses.

- Pew Research reports that Gen Z adults carry more education-related debt relative to income than Millennials did at the same age.

- Deloitte’s 2024 Gen Z Tracker finds financial stress is the No. 1 contributor to declining mental health for this cohort.

- And yes—the stereotype is real—they’re far more likely to piece together income from gig work, which introduces irregular earnings most budgeting apps are notoriously bad at handling.

\ So when less than one-third of Gen Z say they feel financially secure (per EY’s segmentation study), it’s not immaturity, it’s structural volatility.

\ During Vera’s internal focus groups, a phrase reportedly surfaced again and again:

\

\ That sentiment tracks with broader research: young adults report high financial curiosity and high discomfort with traditional institutions. They don’t want a lecture; they want a translator.

\

\ \

Why Standard Finance Apps Don’t Resonate

\ Most personal finance tools were designed for people with predictable W-2 salaries, stable expenses, and enough slack in their budgets to “optimize.”

\n Gen Z is playing a different game:

\

- Income fluctuates weekly.

- Cost-of-living pressures shift monthly.

- Side hustles come and go.

- Financial literacy content online is a mix of brilliant and borderline fraudulent.

\ So when a tool tells them to “just follow a 50/30/20 budget,” it’s not just unhelpful—it’s irrelevant.

\

What Vera Is Attempting (And Where It Deviates From Traditional Fintech)

\ Rather than being a budgeting app with AI sprinkled on top, Vera positions itself as an AI financial coach, not an advisor. Meaning:

\

- It asks questions instead of issuing commands.

- It focuses on confidence-building rather than compliance.

- It prioritizes emotional context rather than transaction categorization.

\ Participants in early tests described it as “the first tool that makes me feel understood,” which—marketing aside—signals a gap in the fintech ecosystem: empathy.

\ This “emotional banking” framing aligns with an emerging trend in behavioral finance research. Studies from the University of Chicago’s Center for Decision Research highlight that financial avoidance (ignoring money tasks, delaying decisions) isn’t driven by ignorance—it’s driven by shame. Tools that reduce emotional friction often outperform those that increase informational precision.

\ Whether AI can sustain that level of empathy is the open technical challenge.

\

The Tech Angle: AI as a Translator, Not a Tactician

\ What’s genuinely interesting from a HackerNoon perspective is the inversion of the typical fintech stack:

\

- Traditional apps → data pipelines → dashboards → advice.

- Vera → conversational layer → psychological model → prompts → user-generated insights.

\ This is less “optimize my budget” and more “interrogate my financial behavior.”

\ Think: Socratic method meets LLM with guardrails.

\ It’s an experiment in whether AI can nudge humans toward better decision-making without pretending it can fully automate their finances.

\

Who This Approach Actually Serves

\ Likely useful for:

- Gen Z adults juggling gig income, unstable schedules, or multi-source cash flow

- People who want a nonjudgmental space to learn the basics

- Users overwhelmed by traditional budgeting frameworks

- Anyone skeptical of finfluencers but lost in the noise

\ Probably not for:

- Spreadsheet maximalists who believe every dollar should be categorized

- Users who want investment recommendations or hardcore automation

\

Why Gifting an AI Coach Might Be More Thoughtful Than Another Finance Book

\ Most “money gifts” telegraph a subtext: you’re doing this wrong. An AI tool that offers reflection rather than reprimand lands differently.

\

\ More importantly, Vera represents a broader movement inside fintech—one where managing money is treated as an emotional system, not just a computational one. That framing mirrors what behavioral economists have been arguing for years: better information doesn’t automatically produce better behavior.

\ If the best tech gifts show you actually understand someone’s lived reality, then something that addresses financial anxiety—not just financial math—may land more meaningfully than yet another subscription to a budgeting app they’ll abandon in February.

\

The Bigger Picture: Fintech Is Finally Confronting the Emotional Layer of Money

\ The more interesting story here isn’t whether one startup nails the execution—it’s that fintech is finally acknowledging a blind spot that’s been obvious to users for a decade. Budgeting tools got faster, dashboards got cleaner, but the emotional cost of engaging with money didn’t budge. For Gen Z, that cost is often the entire barrier.

\ If tools like Vera gain traction, it won’t be because they offered a sleeker interface or cleverer categorization system. It’ll be because they treated money management as a psychological process shaped by income instability, social pressure, and the lingering stigma of “not knowing enough.”

\ Fintech’s next wave may hinge less on analytics and automation, and more on whether technology can make financial decision-making feel safe enough for people to actually participate in it.

\ \

You May Also Like

SEC issues investor guide on crypto wallets and custody risks

Pudgy Penguins will run an advertising campaign on Sphere in Las Vegas during the Christmas season, spending approximately $500,000.