Do Kwon Sentencing: Judge Demands Clarity on Looming 40-Year South Korea Prison Term

US District Judge Paul Engelmayer has asked prosecutors and defense lawyers for detailed clarification on a series of unresolved issues ahead of Terraform Labs co-founder Do Kwon’s sentencing.

This includes the possibility of the crypto entrepreneur facing an additional 40-year prison term in South Korea after serving time in the United States.

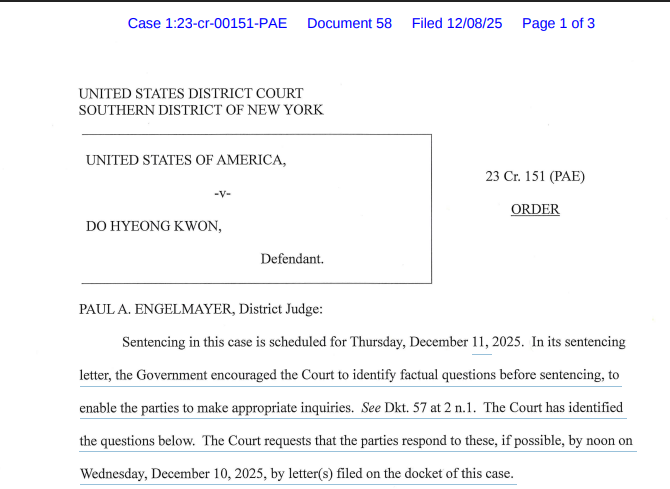

The judge issued the order on December 8, laying out multiple questions that he wants answered before the December 11 hearing.

Source: Court Document

Source: Court Document

The filing shows that the court is weighing how Kwon’s foreign legal exposure, previous detention, and the mechanics of international prisoner transfer programs may affect the punishment imposed in New York.

Court Seeks Clarity on Kwon’s Potential 40-Year Korean Prison Term

The judge’s first set of questions focuses on South Korea’s ongoing criminal case against Kwon.

He asked both parties whether they have any reliable information about the likely outcome of the charges he faces there, whether any agreements have been made with Korean authorities, and what sentencing ranges apply if he is convicted.

South Korean prosecutors previously said they would seek up to 40 years in prison for the same conduct that forms the basis of the US case.

The court also asked whether a Korean sentence could run concurrently or consecutively with a US sentence, a detail that could influence the final terms.

The order also seeks clarification on how to treat the nearly two years Kwon spent in custody in Montenegro. He was arrested in March 2023 while traveling under a false passport and remained detained until extradition.

The judge wants to know whether the Bureau of Prisons will credit any portion of that 21-month period toward his US term and whether the government’s recommendation of a 12-year sentence was based on the assumption that none of that time will count.

Federal prosecutors have already urged the court to impose the full 12 years permitted under Kwon’s plea agreement.

Defense Pushes Back as Prosecutors Call TerraUSD Collapse “Colossal”

They described the TerraUSD collapse as “colossal in scope,” citing the broader market chain reaction that contributed to the downfall of major firms, including Sam Bankman-Fried’s FTX.

Kwon pleaded guilty in August to conspiracy and wire fraud, admitting that he made false statements about TerraUSD’s stability mechanisms and concealed Jump Trading’s role in supporting the stablecoin during a 2021 depeg event.

Kwon’s lawyers have asked for a five-year term instead, arguing that the time he spent in Montenegro was served in “brutal conditions” and should weigh heavily in the court’s decision.

They also point to the likelihood that he will be extradited to South Korea after completing his US sentence, where he faces a much longer potential punishment.

The defense says that imposing the full recommended term would result in an excessively long combined period of imprisonment.

Judge Seeks DOJ Clarification on Victim Compensation and Asset Forfeiture

The judge’s order shows he is taking that possibility seriously. He asked both sides to explain whether supervised release would even matter if Kwon is likely to be removed from the United States.

He also questioned what guarantees the U.S. would have that another country would enforce the rest of Kwon’s sentence if he is transferred overseas.

Prosecutors have already said they will support a transfer request once Kwon serves half of his sentence.

But the judge noted that these transfers usually require detailed recommendations to the Bureau of Prisons before they can move forward.

The filing also points to several administrative problems tied to forfeiture and victim payments.

The judge asked the Justice Department to clarify how its remission process would decide which victims qualify for compensation from the seized assets.

This question is especially important because the losses span multiple countries, and no restitution order was requested in the case.

You May Also Like

Why It Could Outperform Pepe Coin And Tron With Over $7m Already Raised

SOL Rockets 30%, ADA Holds $0.90, BlockDAG Dominates With $407M Presale