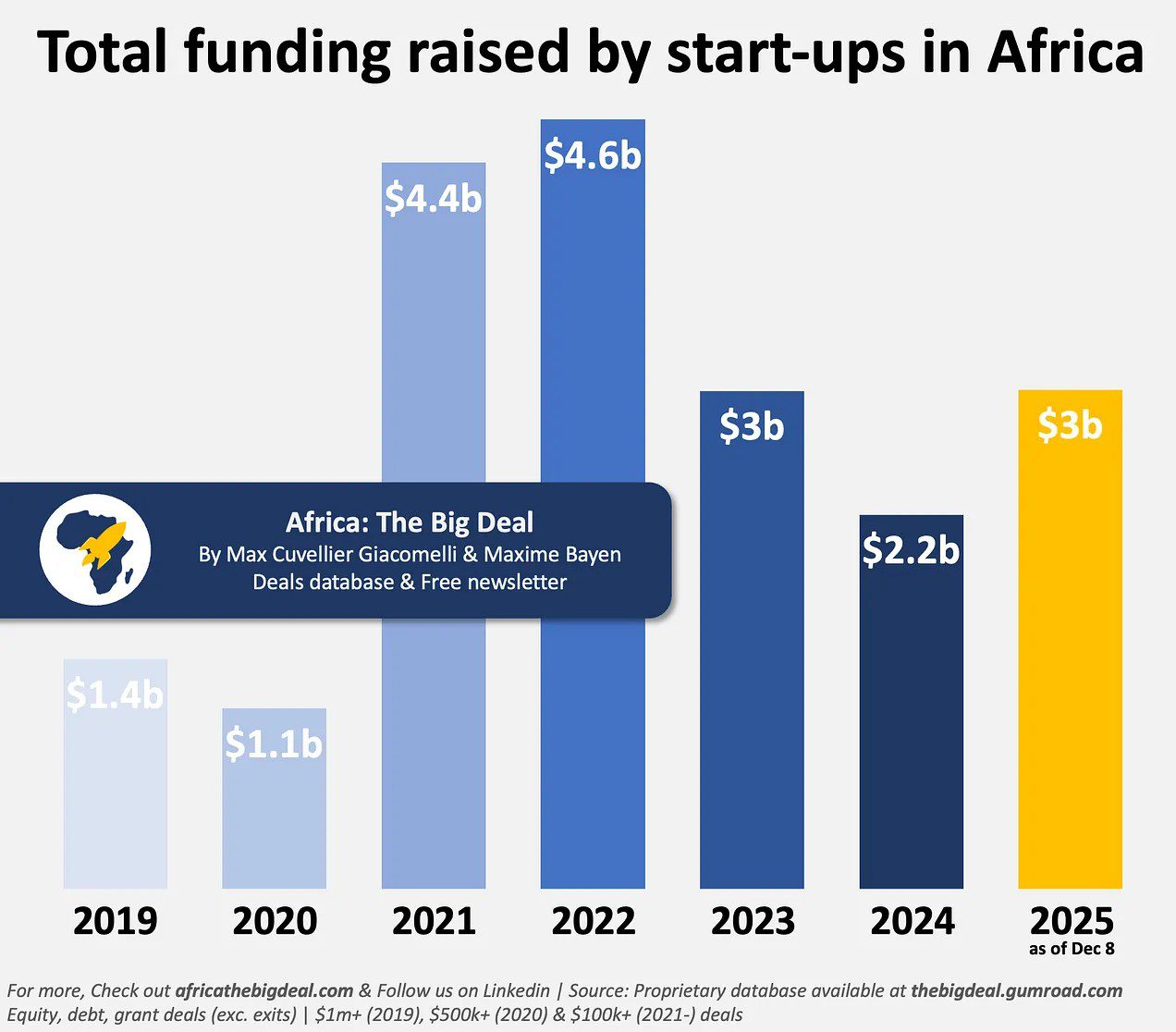

African startup funding crosses $3bn in 2025, the highest in 3 years

African startup funding for 2025 has crossed the $3 billion mark as of December 8. This is according to the African tech startup funding analytics company, Africa the Big Deal. Per the report, this total means 2025 surpasses 2024 and 2023 in total investments, with 2025 still counting.

More specifically, African startups raised $2.9 billion in 2023 before dropping to $2.2 billion in 2024, according to Technext reports. Both years are generally considered the middle of the venture funding winter.

Thus, with numbers looking up again, it’s probably summertime again, or at least springtime.

See also: African tech startups raised $2.9 billion in 2023 as funding declined by 39% YOY

The 2025 numbers also represent the first year-on-year growth recorded over the last 3 years. Startup funding fell from $4.6 billion in 2022 to $2.9 billion in 2023, representing a colossal 37 per cent decline. Startup funding would further drop to $2.2 billion in 2024, representing a 24.1 per cent decline.

With the total crossing the $3 billion mark for 2025 so far, the increase rate would be nothing less than 36.3 per cent, cementing the year as a truly remarkable one for investments into tech startups on the continent.

Major funding rounds behind the 2025 performance

Crossing $3 billion in 2025 is quite an impressive feat. But behind the impressive number are startups and investors involved in funding rounds throughout the year. While the total comprises rounds that are at least $100,000, we thought it was good at this point to highlight some of the major funding rounds that supported the haul.

Nigerian cross-border payment startup LemFi raised $53 million in a Series B round in January to expand its remittance offerings into Europe and Asia. This was followed by Kenya-based PowerGen, which secured $50 million in the same month.

Both startups led the pack, powering African startups to a $289 million raise in January.

Gozem, a Togo-based ride-hailing platform, was the standout performer in what was the slowest February since 2019, raising $30 million in a Series B funding round. In April, hearX, a Pretoria-based healthtech that provides affordable access to hearing care through smart, digital health solutions, landed the first mega deal of 2025, securing $100m through its merger with U.S.-based Eargo.

Gozem

Gozem

Egypt-based property technology company, Nawy, raised $75 million in a record-breaking deal in May. In June, Wave, a Senegalese fintech, secured the second mega deal of the year, raising $137 million in debt financing led by Rand Merchant Bank (RMB).

Kenyan clean energy startups were on a roll in July, one of them being Sun King, which closed a $156 million securitisation to scale an affordable solar energy supply. Spiro secured a $100 million raise in October, considered the largest e-mobility raise on the continent, and only the fourth mega deal on the continent.

South African solar electricity company, SolarSaver, raised $60 million in equity funding in November. These are some of the startups that have contributed largely to the 2025 funding total from January to November.

We would provide a more comprehensive list in the days to come.

You May Also Like

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim

Vitalik Buterin Reveals Ethereum’s Long-Term Focus on Quantum Resistance