Coinbase opens up full Solana token trading through in-app DEX for its 120 million users

Coinbase has just unveiled a major upgrade to its trading platform. In a move that could reshape how retail users access decentralised finance, the US-based exchange announced that all Solana-based tokens can now be bought and sold through its in-app decentralised exchange (DEX). The feature rolls out to more than 120 million monthly active users of the Coinbase app worldwide.

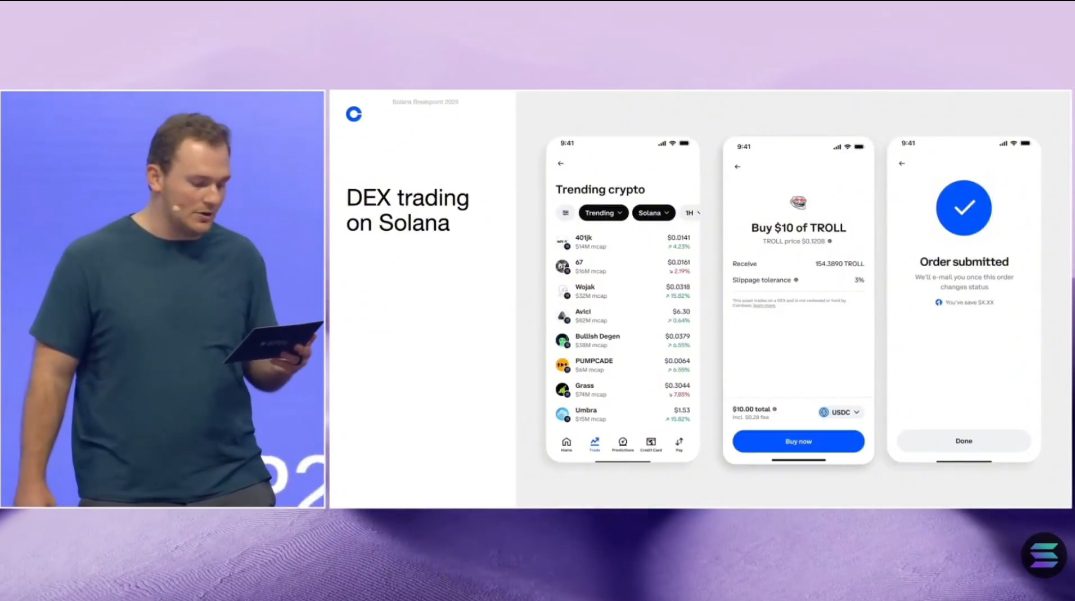

The announcement was made at the Solana Breakpoint 2025 Conference in Abu Dhabi and shared by Solana’s official X handle this morning, signalling a significant shift for the platform’s approach to Solana assets. Until now, trading Solana tokens directly through Coinbase has been limited by traditional listing processes. This new DEX integration breaks that barrier. It lets users swap Solana tokens at source, without waiting for individual listings on the centralised exchange.

The DEX feature works by connecting the Coinbase app with liquidity across Solana’s decentralised markets. Users will be able to discover and trade tokens as soon as they exist on the Solana network, sidestepping the lengthy review and listing procedures that have characterised centralised exchanges. Crypto analysts believe this could close a long-standing gap in Coinbase’s native support for Solana and its growing ecosystem. Earlier in the year Coinbase had been rolling out DEX trading for other networks, with Solana support teased as coming next.

Many in the crypto community see this as a natural extension of the company’s broader strategy. Base has been building out decentralised trading tools and on-chain access across its platform. In November, it acquired Vector, a Solana-native trading platform and DEX, with plans to fold that technology into its own apps. Analysts see the deal as a key enabler of deeper Solana support.

What Coinbase integration with Solana means for their users

For traders and holders of Solana tokens, the update promises lower hurdles and faster access. Tokens that previously sat outside Coinbase’s centralised listings can now be accessed through the integrated DEX. That includes meme coins, DeFi tokens, and other assets that spring up on Solana’s fast-moving network.

This is significant because Solana itself has become one of the most active ecosystems in crypto. It has drawn millions of users and litres of liquidity, especially in decentralised exchanges and automated market-making platforms. Solana’s on-chain activity and DEX volume have grown sharply, making it a hub for new token launches and community-led markets in 2025.

From a practical standpoint, users will not need to leave the Coinbase app or use external wallets to interact with these tokens. Trading can happen seamlessly inside the familiar Coinbase interface. For many retail investors, this removes the complexity of connecting separate wallets or navigating third-party DEX sites.

Institutionally, the move underscores Coinbase’s ambition to be more than a traditional exchange. By embedding DEX capabilities, the company positions itself at the intersection of centralised and decentralised finance. Market watchers have noted that its strategy increasingly blends regulated trading with on-chain access, attracting users who want both security and breadth of assets.

The DEX rollout will continue to expand in phases, with Coinbase monitoring regulatory and technical factors as it integrates more networks and liquidity sources. Users interested in Solana tokens should check the latest app update and Coinbase support pages for details on availability in their region.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise