Bitcoin Realized Losses From Entities Surges To 2022 Levels Following Crash Below $90,000

Bitcoin’s price action in the past two weeks has opened a new phase of stress among traders, with on-chain data showing realized losses climbing to heights last observed in 2022.

Glassnode’s latest Week-On-Chain report shows Bitcoin is trading above an important cost-basis level but is also visibly straining under intensified loss realization, fading demand and weakening liquidity, which has placed short-term investors in a difficult position.

Realized Losses Return To Deep Territory

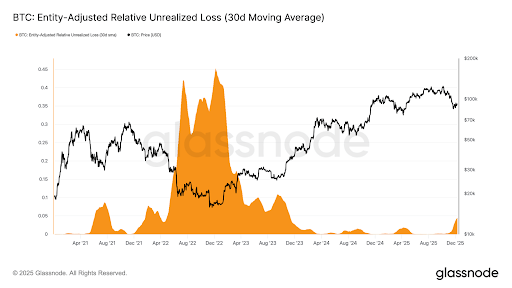

According to Glassnode, realized losses among Bitcoin entities have risen massively, and is now almost at the same magnitudes recorded during the deep retracements of the 2022 bear market. Particularly, the Relative Unrealized Loss (30D-SMA) has climbed to 4.4% after nearly two years below 2%.

The escalation in loss realization reflects how the recent drawdown below $90,000 has forced a large number of market participants to offload coins at prices below their acquisition cost. This, in turn, has disrupted the gradual improvement in profitability seen earlier in the year.

Bitcoin’s recent bounce from the November 22 low to above $92,000 hasn’t eased the strain on holders. Glassnode noted that entities are still locking in losses at an increasing pace, with the 30-day average of realized losses now at around $555 million per day.

These conditions mean that investors are losing confidence in short-term upside prospects for Bitcoin and choose to reduce exposure, even at unfavorable prices. Therefore, the report noted that resolving it will require a renewed wave of liquidity and demand to rebuild confidence.

Glassnode also highlights a sharp rise in profit-taking among long-term holders, whose realized gains have climbed to roughly $1 billion per day and briefly set a new record above $1.3 billion.

Even with this elevated level of distribution, Bitcoin is currently positioned just above the True Market Mean, which is a long-standing cost-basis benchmark that serves as a point of structural support. The recent price downturn below $90,000 has pushed this zone close to its limits, but the glimpse of demand reflected around it suggests that price could revisit the 0.75 quantile near $95,000 and possibly approach the short-term holder cost basis as well.

Spot ETF, Futures, And Options Markets Indicate Weakness

Glassnode’s report points to persistent softness across ETF flows, which have cooled notably after a period of strong inflows earlier in the year. This slowdown represents a reduction in one of the largest and most immediate sources of buy-side liquidity for Bitcoin.

Spot market liquidity has also faded, with order books on major exchanges near the lower bound of their 30-day range. This has created an environment where trading activity has weakened through November and into December, and fewer liquidity flows are available to absorb volatility or sustain directional moves.

Derivatives positioning reflects similar caution, with funding rates pinned near neutral. Futures open interest has also been subdued and has failed to meaningfully rebuild since the breakdown below $90,000.

Across all major venues, the tone is the same: liquidity is lighter, sentiment is softening, and participants are leaning defensive rather than pursuing short-term rallies. The attention is now on how Bitcoin will respond in the aftermath of the Federal Reserve’s recent rate cut.

You May Also Like

WTI Crude Oil Skyrockets: Price Jumps 6% to Surpass $75 Amid Alarming US-Iran War Fears

Uniswap Wins Full Dismissal As SDNY Rejects Claims Over Scam Tokens Lawsuit