Chainlink price poised to rebound amid LINK Reserve buying spree

Chainlink price was little changed on Thursday, despite some encouraging news regarding its exchange-traded funds and the ongoing accumulation through its Strategic LINK Reserves.

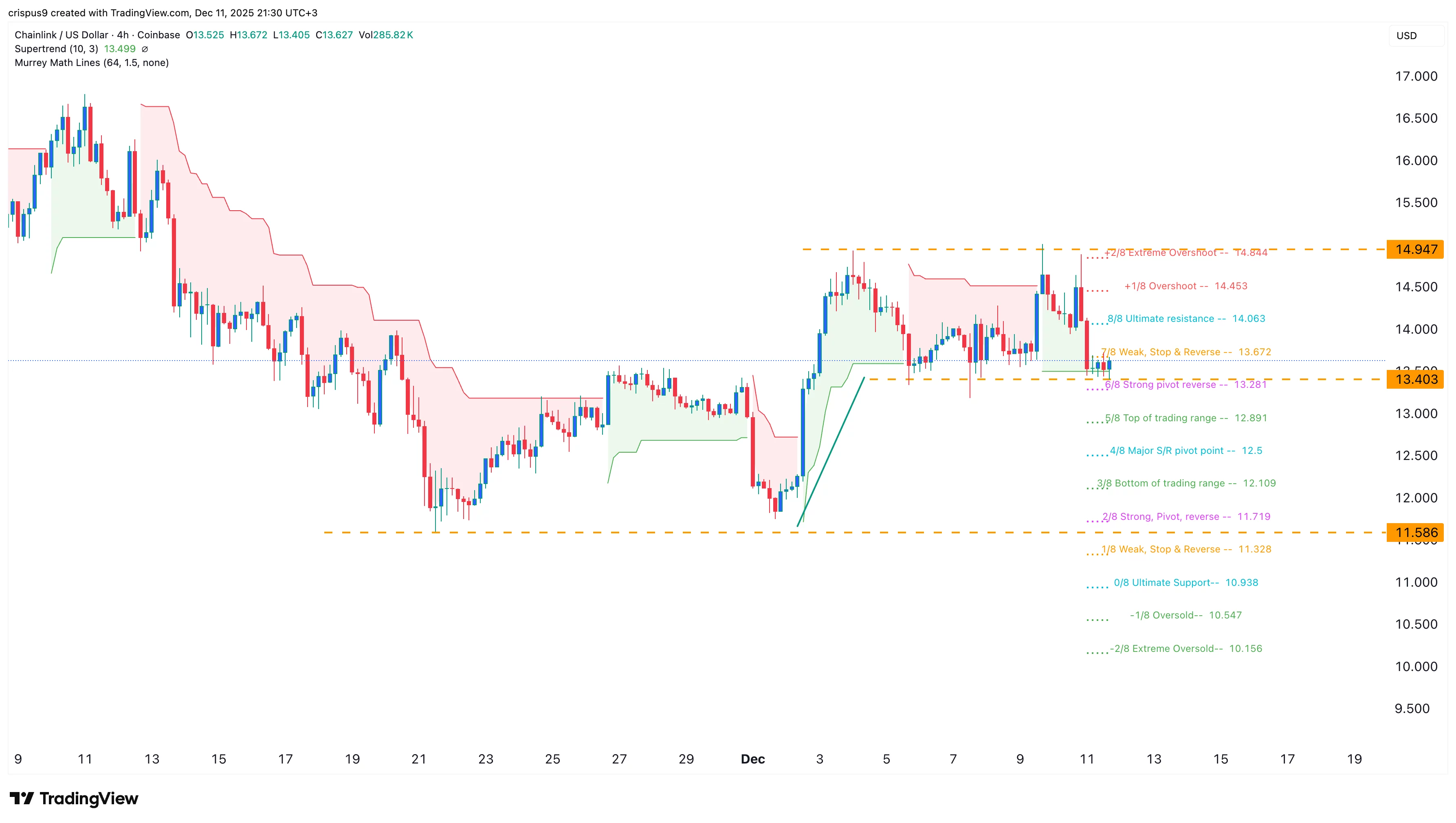

- Chainlink price has formed a bullish flag pattern on the four-hour chart.

- The Strategic LINK Reserves assets jumped by 84,309 tokens to over 1 million.

- The Grayscale LINK ETF added assets on Wednesday.

Chainlink (LINK) was trading at $13.55 today, down from this month’s high of $14.95 and about 17% above its November low.

In a statement, the developers noted that they purchased 84,309 tokens, valued at about $1.3 million. The purchases brought the total assets in these strategic reserves to over 1 million, which is equivalent to over $15.4 million.

The purchases continued even as the network’s fees fell. Data compiled by DeFi Llama shows that Chainlink’s fees dropped to $310,280 in November, down from October’s $394,642. It made over $434,516.

Meanwhile, SoSoValue data shows the Chainlink ETF inflows resumed on Wednesday after a two-day pause. Its inflows rose by $2.5 million, bringing the total inflows to over $54 million. The Grayscale LINK ETF now has $77 million in assets, a figure that will likely continue growing.

Chainlink price wavered as the network growth continued. The network’s Cross-Chain Interoperability Protocol (CCIP) is the exclusive bridging solution for all Coinbase-wrapped assets, including cbBTC, cbDOGE, cbLTC, and cbXRP. In a statement, Josh Leavitt, a senior director at Coinbase, said:

Chainlink price technical analysis

The four-hour chart shows that the LINK price has rebounded in the past few weeks, moving from a low of $11.58 in November to the current $13.6.

A closer look shows the token is forming a bullish flag pattern, consisting of a flagpole and a horizontal channel. It is now hovering near the lower side of the flag.

The token has also settled at a strong pivot-reverse point on the Murrey Math Lines tool.

Therefore, the most likely Chainlink price forecast is bullish, with the initial target at the upper channel boundary at $14.95. This target also coincides with the extreme overshoot level. A move above that level will signal further gains toward the psychological level at $20.

You May Also Like

WTI nears multi-month high as Hormuz closure fuels supply concerns

Vitalik Buterin Reveals Ethereum’s Long-Term Focus on Quantum Resistance