Solana News: JPMorgan Completes On-Chain Debt Deal for Galaxy Digital

The bank arranged a commercial paper issuance for Galaxy Digital, settling the deal entirely in USDC through major partners including Coinbase and Franklin Templeton.

- JPMorgan executed a commercial paper deal for Galaxy Digital using Solana and USDC.

- The bank is now testing public blockchains as potential rails for institutional market infrastructure.

- Solana gains credibility as a viable platform for real-world asset tokenization.

- The move expands JPMorgan’s broader push into digital assets following new U.S. regulatory clarity.

The development signals a noticeable shift in how the banking giant is approaching digital markets. Instead of relying solely on private ledgers or controlled in-house systems, JPMorgan is now experimenting with open, high-throughput blockchains — a move that would have seemed improbable only a few years ago.

A New Experiment in On-Chain Market Structure

Rather than frame the deal as a crypto novelty, JPMorgan positioned it as a practical test of public networks for regulated financial transactions. Executives at the bank described the issuance as an early look at how future debt markets, settlements, and funding operations may function once tokenization becomes standard.

The project reflects a growing confidence within the bank’s digital-assets division. JPMorgan has been rapidly scaling its blockchain presence, especially following clearer U.S. crypto guidelines implemented under President Donald Trump. Just weeks earlier, the firm rolled out JPMD, an updated version of JPM Coin deployed on Base, the Coinbase-backed Layer 2 network.

The Solana transaction broadens that exploration, showing that the bank is willing to test multiple ecosystems rather than commit exclusively to Ethereum-based infrastructure.

Solana Gains a Strategic Entry Into Institutional Capital

For Solana, the deal represents one of the strongest endorsements it has received from a major financial institution. The network, often associated with consumer-facing crypto activity, has struggled to break into conventional finance despite its speed and scalability.

Seeing JPMorgan use Solana for a core financial instrument — commercial paper — sends a message that public chains can meet institutional expectations when designed properly. Members of the Solana Foundation said the issuance demonstrates that blockchain settlement can meet the precision and reliability that high-value markets demand.

READ MORE:

U.S. Court Announces 15-Year Prison Sentence for Do Kwon

This shift could open the door for more issuers exploring real-world asset (RWA) tokenization on Solana, an area still in early development despite booming global interest.

A Push Toward Public Blockchain Integration

The broader implication is clear: large banks are no longer limiting blockchain experiments to private, permissioned networks. They are beginning to view public chains as viable rails for tokenized money, securities, and debt instruments. With regulated stablecoins like USDC now acting as settlement currency, institutions have the infrastructure they need to transact at scale.

JPMorgan’s decision comes at a moment when crypto markets are strengthening and tokenization is becoming a central narrative in the institutional adoption cycle. If more firms follow, Solana could see a surge of enterprise usage that accelerates its midterm growth trajectory.

What was once a theoretical conversation — major banks settling real financial instruments on public blockchains — has now become a concrete pilot project. And for JPMorgan, this may only be the beginning.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Solana News: JPMorgan Completes On-Chain Debt Deal for Galaxy Digital appeared first on Coindoo.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

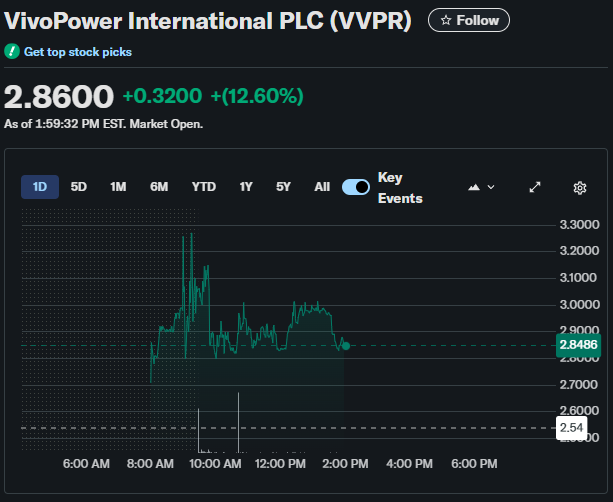

VivoPower’s $300M Investment in Ripple Triggers 13% Stock Rally