Viewpoint: It is not advisable to "buy at the bottom" at the moment, wait for these three situations to occur

Author: The DeFi Investor

Compiled by: Felix, PANews

Almost every coin has been experiencing a multi-week decline.

If you have lost a lot of money recently, I would personally recommend taking a break from trading, making a new plan, and doing whatever you can to avoid revenge trading.

The goal now is to survive and preserve remaining capital.

As long as you don't lose everything and continue to stay at the "gambling table", there will be another chance.

Why does the market continue to fall?

In my opinion, there are two main reasons:

1. There is a lot of macro uncertainty: The stock market has also been crashing, and cryptocurrencies have always been closely correlated with the stock market.

As crazy as it may sound, these uncertainties are likely created intentionally by the US government.

Why?

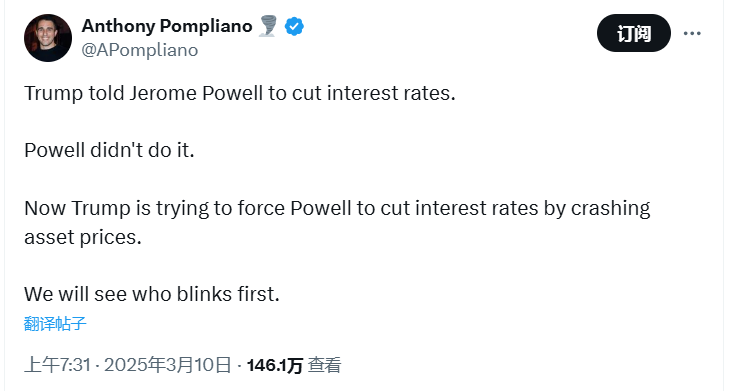

Because Trump wants to force the Fed Chairman to cut interest rates.

The Trump administration's constant threats to impose tariffs and then reversals at the last minute created a lot of panic in the market.

The Trump administration is destroying the market in this way and putting pressure on Federal Reserve Chairman Jerome Powell to cut interest rates because Powell is more likely to cut interest rates when market conditions are bad.

Unfortunately, unless the Trump administration stops fearmongering or Powell agrees to cut rates, financial markets will continue to suffer.

Cryptocurrencies, which are considered a high-risk asset class, were particularly affected by the news.

2. The White House’s first cryptocurrency summit and the national Bitcoin reserve did not achieve the expected “ hype ” effect.

(Don’t get me wrong, the US establishing a national Bitcoin reserve will still have a huge impact in the long run)

This good news has long been digested by the market. It was a long time ago that Trump first stated that the Bitcoin currently held by the United States will be stored in the national reserve.

However, many expect Trump to also announce a specific strategy for the U.S. government to increase its holdings of Bitcoin over time.

But such strategic moves were not announced, and the Trump administration only announced that it would not sell the confiscated Bitcoins. This is why the launch of the US Bitcoin Reserve ultimately became a selling event.

Nevertheless, current macro uncertainty remains the main reason for the recent market plunge.

When to buy the dip?

Before buying aggressively on dips, expect to see the following happen (not investment advice):

- The Fed cuts rates - historically, rate cuts are good news for financial markets, and the Trump administration may stop creating so much market uncertainty once the dust settles

- A new upcoming major crypto catalyst emerges - the biggest rally seen in this cycle was driven by two major events in the past: the launch of a spot Bitcoin ETF and Trump’s victory

- BTC and altcoins show strength even amid bearish news — a sign that sellers are running out of tokens

Before that, individuals would rather use idle funds for yield mining and airdrops. The market has been "bleeding" for several weeks, and it is wise to wait for signs of recovery in the market before buying.

I am very confident that the crypto market will make a comeback.

If the collapse of FTX, Three Arrows Capital, and Terra Luna wasn’t enough to destroy crypto, what else could?

Sometimes it makes sense to take high risks, but sometimes the best thing to do is to sit back and protect your hard-earned money.

Related reading: Trump 2.0: What new changes are coming to cryptocurrency regulation? A review of key policy adjustments in the eight weeks since he took office

You May Also Like

The Manchester City Donnarumma Doubters Have Missed Something Huge