Artificial Intelligence to add $1 trillion to Africa’s GDP by 2035- AfDB report

Africa’s Gross Domestic Product (GDP) is projected to grow by an additional $1 trillion by 2035, driven by the integration of artificial intelligence models. This is according to a report by the African Development Bank (AfDB) in partnership with Bazara Tech, a consulting firm.

The report explained that increased productivity fueled by Africa’s digital potentials and AI enablement will be spread across various sectors on the continent. With this, the additional $1 trillion projection is equivalent to nearly one-third of Africa’s current GDP.

At the core of the engine is Africa’s growing digital capacity, favourable demographics, and ongoing sectoral reforms, making Africa one of the most promising regions for AI-driven growth globally.

Aside from the $1 trillion uplift, the AI drive is projected to create 35 to 40 million digital jobs and see 300 million youth integrated into the workforce. In addition, African data and languages are expected to be incorporated into global models, paving the way for more equitable model generalisation.

Image Credit: DW

Image Credit: DW

According to the report, AI and digital integration are expected to capture five sectors. With the use of a data-driven scoring model based on GDP share, digital readiness, and SDG leverage, the report identified five ‘high-impact’ sectors. These sectors are projected to capture 58% of the overall $1 trillion, or approximately $580 billion in total by 2035.

- Agriculture (20%) – $200 billion.

- Wholesale and Retail (14%) – $140 billion

- Manufacturing and Industry (9%) – $90 billion

- Finance and Inclusion (8%) – $80 billion

- Health and Life Sciences (7%) – $70 billion.

- Other 10 sectors (42%) – $420 billion

All five sectors were envisioned to enhance food security, reduce health service gaps, expand financial inclusion, and raise productivity with AI models across the continent’s informal economies. The report noted that the sectors represent both economic scale and inclusive development value.

Nicholas Williams, Manager of the ICT Operations Division at AfDB, explained that strategic actions are in place to drive implementations towards meeting these potentials.

“The Bank is ready to release investment to support these actions. We expect the private sector and the government to utilise this investment to ensure we achieve the identified productivity gains and create quality jobs,” he added.

Also Read: FairMoney to support Nigeria’s $1 trillion GDP goal with new product offerings.

$1 trillion GDP upliftment: The Roadmap

To achieve the $1 trillion GDP goal, the report highlighted Africa’s roadmap to AI-readiness, consisting of three phases between now and 2035.

The first is Ignition (2025–2027), which will focus on charter policy frameworks, launch pilots, and initiate computer deployment. Then, Consolidation (2028–2031), involving building regional corridors, deploying sandbox regulation, scaling skills and capital. Scale and Diffusion (2032–2035) with full activation of the AI readiness flywheel across all regions and sectors.

“To anchor this transition, five flagship programs were proposed, each corresponding to one of the readiness levers. Together, they provide a structured platform for coordinated investment and reform,” the report said.

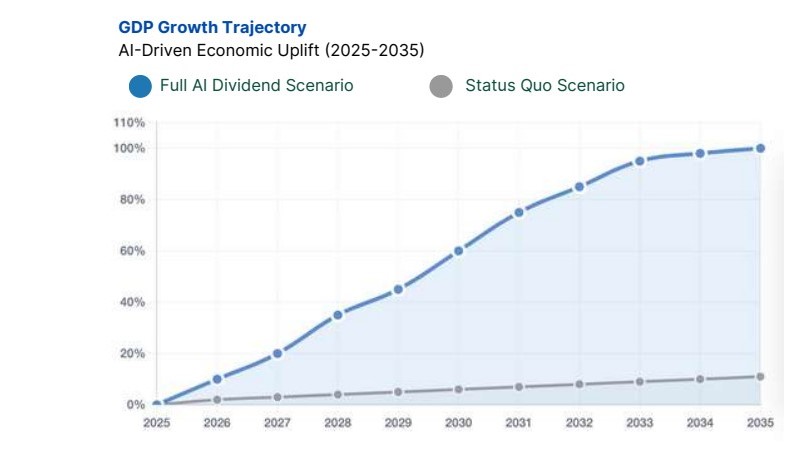

GDP Growth Trajectory

GDP Growth Trajectory

To further realise the potential of AI, the report highlighted five interlinked enablers, such as data, compute, skills, trust, and capital. In further breakdown, it explained that reliable data forms the foundation for AI insights, while scalable compute infrastructure ensures solutions can be deployed across Africa.

Also, a skilled workforce is necessary to develop, implement, and maintain AI systems, and trust grows via governance, and regulatory frameworks enable adoption. Lastly, adequate capital investment in innovation and accelerated deployment helps safeguard the AI-driven growth.

You May Also Like

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise

The aftermath of the energy war: As Microsoft, BlackRock monopolize infrastructure, Eden Miner becomes retail’s last backdoor to the “hashrate yield network”