Here are 5 policy decisions that reshaped Africa’s crypto map in 2025

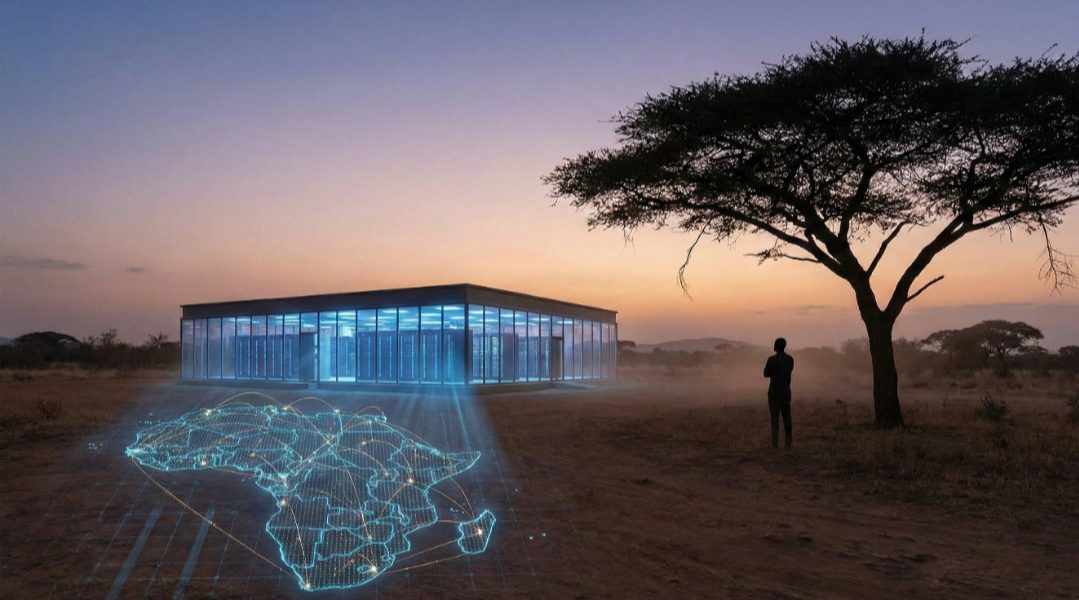

As we wrap up 2025 across Africa’s technology and startup ecosystem, one trend stands out clearly. Policy, not price action, did the heavy lifting. Crypto has moved from the fringes into formal policy conversations. Across boardrooms, parliaments and central banks, governments made decisions that reshaped how digital assets are treated on the continent.

For our methodology, we spoke with legal and policy experts working directly at the intersection of regulation and Web3 adoption. They were asked to identify the five policy decisions that, in their view, most significantly reshaped Africa’s crypto map in 2025, and to explain why.

Drawing from those expert insights, this article highlights five policy moves that marked a decisive break from Africa’s earlier era of uncertainty. It focuses on decisions that altered direction, unlocked activity, or forced long-delayed clarity.

Together, they show a continent moving steadily from caution to structure.

Senator Ihenyen, Lead Partner at Infusion Lawyers and Executive Chair of the Virtual Asset Service Providers Association

Senator Ihenyen, Lead Partner at Infusion Lawyers and Executive Chair of the Virtual Asset Service Providers Association

According to Senator Ihenyen, Lead Partner at Infusion Lawyers and Executive Chair of the Virtual Asset Service Providers Association, 2025 was a turning point. “In my advocacy work across Africa, I observed that the crypto map changed from fragmentation to formalisation,” he said. “The big economies have aligned on one truth. Crypto is too big to ban. It must be regulated.”

Here are the top five crypto policies in Africa in 2025:

1. Nigeria’s Investments and Securities Act (ISA) 2025

Africa’s largest crypto market finally ended years of ambiguity with the signing of the Investments and Securities Act (ISA) 2025 into law by President Bola Ahmed Tinubu on 28th March 2025. The law formally recognises virtual assets as securities and places them under the regulatory authority of the Securities and Exchange Commission.

Ihenyen describes the move as pivotal. “By moving from a grey market to a fully codified securities framework, this decision has the potential of unlocking institutional capital,” he said. He added that it also improves confidence for banks and financial institutions to support crypto businesses without fear of regulatory backlash.

While the blanket classification of all virtual assets as securities remains contentious, the clarity it introduced was widely welcomed.

Buki Ogunsakin, Web3 Policy and Legal Consultant at Interstellar Inc., agrees. “The ISA has really outlined the involvement of digital assets under the Securities and Exchange Commission. That is significant for the crypto landscape,” she said.

Nigeria doubled down with its updated Tax Act, which explicitly brings digital and virtual assets into the tax net. For the first time, crypto holders and businesses have statutory clarity on how transactions are treated. According to Ogunsakin, this matters because taxation signals permanence. Crypto is no longer a side conversation. It is part of the formal economy.

Buki Ogunsakin, Web3 Policy and Legal Consultant at Interstellar Inc

Buki Ogunsakin, Web3 Policy and Legal Consultant at Interstellar Inc

“It confirms that digital assets are taxable property or assets under federal law,” she noted.

2. Kenya’s Virtual Asset Service Providers Act 2025

Kenya followed a different but equally important path. In October 2025, the country signed the Virtual Asset Service Providers Act into law. The legislation introduced a comprehensive licensing and compliance regime for crypto operators.

What made Kenya’s approach stand out was institutional coordination. Oversight is shared between the Central Bank of Kenya and the Capital Markets Authority, rather than creating an entirely new regulator.

Ogunsakin described the law as a landmark moment. “Kenya has gone from talking to working,” she said. “They drafted it, passed it and implemented it. That sets a precedent for the digital economy across Africa.” She also pointed to the joint oversight model as one, other countries are already studying closely.

Ihenyen also highlighted the symbolic shift embedded in the law. By introducing crypto taxation alongside licensing, Kenya moved from caution to monetisation. In his words, the country shifted from “warning” to “revenue generation”, sending a strong signal to both local founders and global investors.

3. South Africa’s Crypto Asset Service Providers’ mandatory licence

South Africa’s defining moment came through enforcement rather than new legislation. In June 2025, the Financial Sector Conduct Authority enforced its deadline for all Crypto Asset Service Providers to be licensed or exit the market.

This was the end of South Africa’s transitional phase. “With this move, South Africa moved into a fully regulated enforcement regime,” Ihenyen said. The message was clear. The market was no longer open to opportunistic or poorly governed operators.

The decision also played a role in South Africa’s successful efforts to exit the FATF grey list, reinforcing its credibility as a compliance-driven jurisdiction.

4. Ghana’s Virtual Asset Service Providers Bill, 2025

In West Africa, Ghana chose a more incremental but strategic route. In September 2025, the Bank of Ghana commenced a mandatory registration exercise for crypto exchanges and stablecoin issuers. Rather than rushing into a full regulatory framework, authorities prioritised visibility.

Ghana’s approach stood out for its focus on stablecoins. Ihenyen believes this reflects a deeper shift. “It signals a move where African central banks view crypto as a partner in forex stabilisation rather than a rival,” he said. For a region grappling with currency volatility, this framing could shape future monetary policy debates.

Ghanaian President, John Mahama

Ghanaian President, John Mahama

Ogunsakin agreed, pointing to Ghana’s emphasis on stakeholder input and supervisory clarity. “They are creating their own virtual assets regulatory office,” she said. “That coordination is something other African countries can learn from.”

5. Seychelles overhauled its Virtual Asset Act

Seychelles delivered one of the most globally consequential decisions of the year, maybe only second to the Genius Act. The country overhauled its Virtual Asset Act to require real physical presence and substantive management for licensed entities.

Historically known as a paper offshore jurisdiction, Seychelles’ pivot forced major global exchanges to rethink their structures. “This changes the global map by forcing exchanges to either build real teams in Africa or lose their licences,” Ihenyen noted. The decision repositioned Africa not just as a user base, but as a serious compliance jurisdiction.

Overall, these five decisions tell a coherent story. Africa’s crypto ecosystem in 2025 moved decisively from fragmentation to formalisation. As Ihenyen observed, the continent’s biggest economies aligned around a simple truth. Crypto adoption is too large to ban. Regulation is the only viable path.

For founders, investors and policymakers, the implications are lasting. Regulatory clarity is becoming a competitive advantage. Jurisdictions that get it right will attract capital, talent and infrastructure.

Those who delay risk being left behind.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

MMDA, sleep health organization launch drowsy driving campaign ahead of holidays