Bitcoin, Ethereum options expiry puts max pain levels to the test Dec. 20

Bitcoin and Ethereum options worth billions expire Dec. 20, with max pain clusters and BTC put skew setting the stage for short‑term volatility.

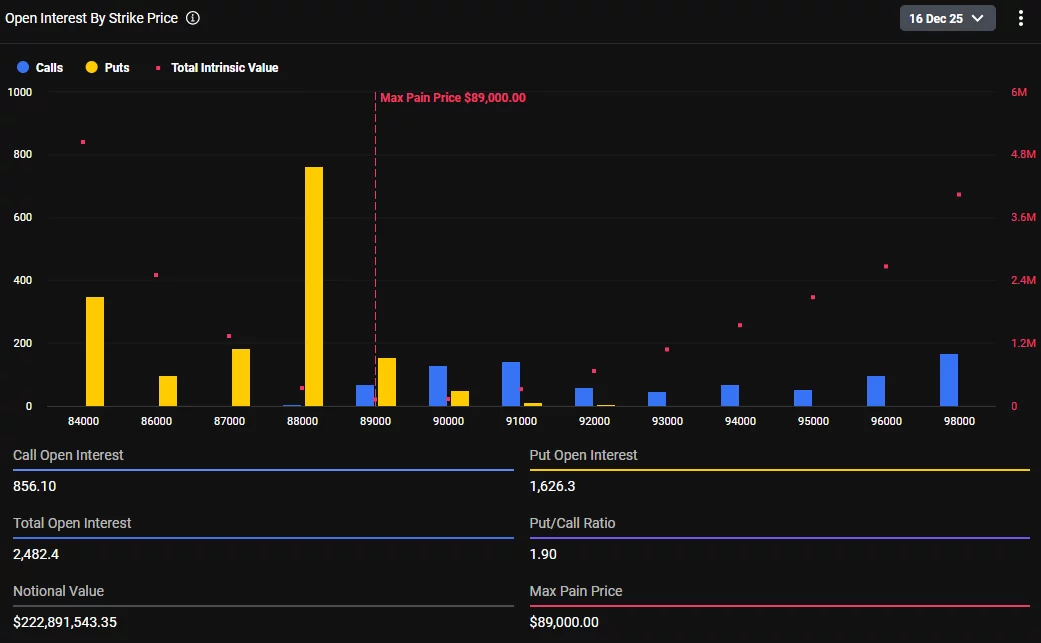

- Options data shows Friday’s expiry concentrates BTC and ETH open interest around clear max pain levels that often act as near‑term magnets.

- Bitcoin’s structure leans heavier to puts, signaling stronger demand for downside protection versus calls ahead of settlement.

- Ethereum’s put/call ratio looks more balanced, implying less aggressive hedging and softer downside bias than in Bitcoin.

A significant volume of Bitcoin (BTC) and Ethereum (ETH) options contracts is scheduled to expire Friday, with substantial notional value at stake, according to options market data.

Bitcoin, Ethereum options expiring

Bitcoin options represent the majority of expiring contracts set to settle, the data shows. Market analysis identifies a max pain price level, defined as the price point at which the greatest number of options contracts would expire worthless.

Current options data reveals put open interest and a put/call ratio indicating heavier weighting toward put contracts in Bitcoin’s options structure ahead of expiration, according to the market data.

Ethereum options comprise a smaller portion of the total expiry volume, with fewer contracts scheduled to mature. The data identifies a max pain price for Ethereum as well.

Ethereum’s options positioning shows put open interest and a put/call ratio that reflects more balanced structure compared to Bitcoin, the data indicates. The figures suggest reduced emphasis on downside protection in Ethereum relative to Bitcoin.

Market data highlights specific price levels for both Bitcoin and Ethereum as central zones tied to Friday’s options expiry. These levels correspond to areas where options positioning is most heavily concentrated heading into settlement, according to the analysis.

Options expiries can influence short-term price action as market participants adjust positions ahead of contract settlement.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

Uniswap Gains Momentum While Pi Network Waits: Is BlockDAG At $0.001 The Best Crypto To Buy Now?