Visa Goes All-In on Stablecoins With New Advisory Practice

On December 15, Visa officially launched its Stablecoins Advisory Practice under Visa Consulting & Analytics, signaling a decisive shift from experimentation to execution.

The new unit offers hands-on guidance to banks, fintechs, and enterprises looking to issue, integrate, and scale stablecoin-based payment systems.

According to WatcherGuru, the advisory practice has already completed more than 20 global client engagements, helping organizations move beyond high-level strategy into live, production-grade implementations.

This is not a research desk.

It is an operational play.

From Concept to Live Stablecoin Payments

Visa’s Stablecoins Advisory Practice is designed to address a recurring problem across traditional finance.

Interest in stablecoins is high. Execution remains difficult.

Many institutions understand the potential of blockchain-based settlement but struggle with technical integration, compliance design, operational workflows, and go-to-market execution. Visa’s new unit steps directly into that gap.

The advisory practice covers the full lifecycle of stablecoin deployment, including:

- Stablecoin education and market trends

- Use-case sizing and commercial strategy

- Technical integration and operational setup

- Deployment focused on cross-border payments and B2B settlement

The emphasis is practical. Clients are not being sold theory. They are being guided through implementation decisions that affect cost, speed, compliance, and scalability.

Visa’s role is to shorten the distance between intention and production.

A Focus on Cross-Border and B2B Payments

One area receives particular attention: cross-border and business-to-business payments.

These segments remain among the most inefficient in global finance. Settlement delays, high fees, fragmented correspondent banking networks, and liquidity traps continue to burden enterprises and financial institutions.

Stablecoins offer a direct alternative.

By enabling near-instant settlement on blockchain rails, stablecoins can reduce both transaction costs and settlement times dramatically. Visa’s advisory unit is built to help clients identify where these efficiencies are most impactful and how to deploy them safely.

For multinational companies and banks operating across jurisdictions, this is not about novelty. It is about working capital efficiency and operational resilience.

Building on Visa’s Existing Stablecoin Infrastructure

The launch of the advisory practice does not happen in isolation.

Visa has already spent years working with stablecoins in production environments. That includes:

- USDC-based settlement flows

- Stablecoin-linked card products

- Direct wallet payouts to users

These initiatives have allowed Visa to develop internal expertise across blockchain settlement, compliance integration, and network interoperability.

As of 2025, Visa’s own stablecoin settlement volume is running at an annualized pace of $3.5 billion, according to figures cited alongside the announcement. This is not pilot-scale activity. It reflects real transaction volume flowing through Visa-connected systems.

The advisory practice leverages these learnings, turning Visa’s internal experience into a service offering for the broader financial ecosystem.

Stablecoins Reach Critical Mass

Timing matters.

The advisory launch comes as stablecoins surpass $200 billion in total market capitalization in 2025. What was once a niche instrument for crypto trading has become a foundational layer of global digital payments.

Stablecoins now underpin remittances, on-chain settlement, merchant payments, and treasury operations. Their growth has attracted increasing attention from regulators, central banks, and multinational corporations.

For Visa, this represents a structural shift.

Stablecoins are no longer peripheral to payment networks. They are becoming part of the core settlement stack. By formalizing an advisory practice, Visa acknowledges that clients no longer need convincing. They need guidance.

Visa Moves From Operator to Advisor

Perhaps the most important signal in this announcement is strategic.

Visa is not merely deploying stablecoins for its own network. It is advising others on how to do the same. That distinction matters.

It suggests confidence. Not only in the technology, but in the regulatory trajectory and commercial viability of stablecoin-based payments.

Visa’s advisory role positions it as a neutral infrastructure expert, capable of helping banks and fintechs navigate decisions around issuance models, custody frameworks, integration architecture, and compliance design.

This is a notable evolution. Payment giants historically guarded their rails closely. In contrast, Visa is now helping clients build blockchain-based rails that may operate alongside, or partially outside, traditional card networks.

That shift reflects reality. Payments are no longer confined to a single channel. They are becoming programmable, interoperable, and increasingly on-chain.

The Bigger Picture: Finance Accelerates Toward Blockchain Rails

The broader implications extend beyond Visa.

With clearer regulatory frameworks taking shape in the United States and other major markets, traditional finance is accelerating toward blockchain-based settlement. The question is no longer whether stablecoins will be used, but how.

Visa’s move underscores this transition.

Rather than waiting for disruption, incumbents are shaping it. They are embedding blockchain capabilities into existing systems, aligning them with compliance requirements, and offering them as enterprise-grade solutions.

This is how financial infrastructure evolves.

Quietly. Incrementally. With advisory units, operational tooling, and institutional buy-in.

Visa’s Stablecoins Advisory Practice is not a marketing announcement. It is a signal that stablecoins are entering the operational core of global payments.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news!

You May Also Like

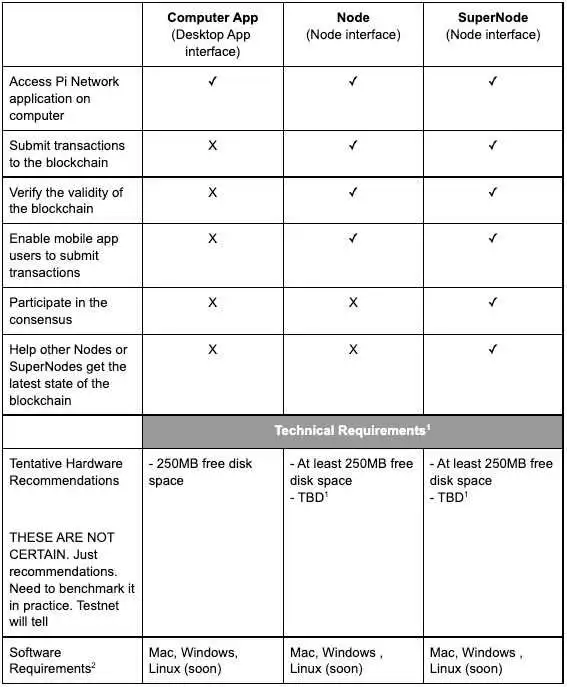

Pi Network Sets Feb 15 Deadline for Mainnet Node Upgrade

Pi Network Sets February 15 Deadline for Mandatory Mainnet Node Upgrade