Aptos Stablecoin Inflows Hit $386M, Leading Daily On-chain Liquidity Shift

This article was first published on The Bit Journal.

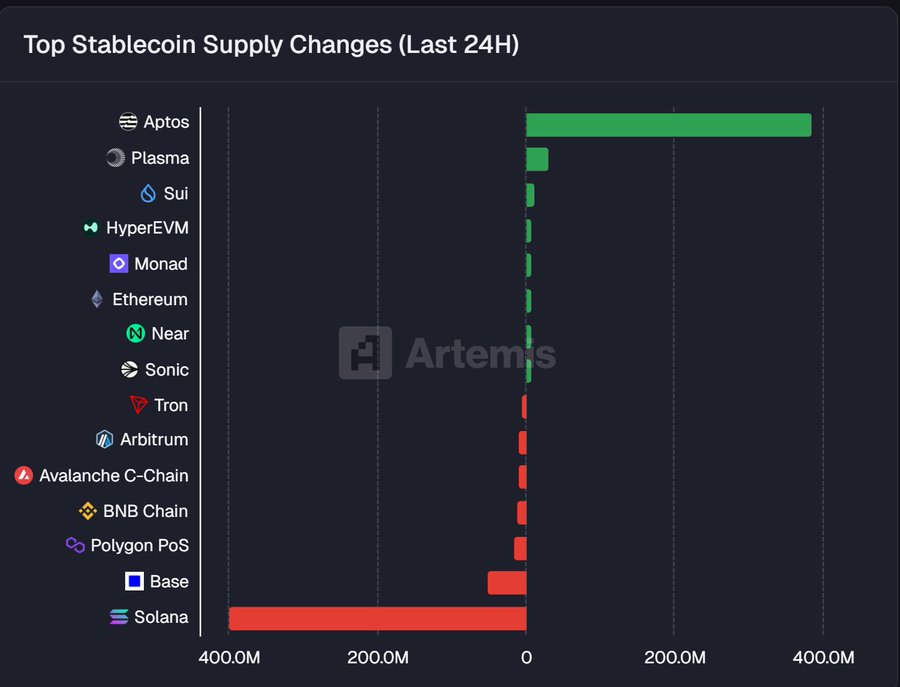

Aptos is drawing growing attention in the crypto market. New on-chain data places the network at the top of daily stablecoin supply changes. Aptos stablecoin inflows have surpassed those of all major blockchains within the last 24 hours.

The shift signals a meaningful change in how liquidity is distributed across chains. Market participants are increasingly viewing Aptos as a rising hub for stablecoin activity.

Aptos Stablecoin Inflows Signal Sustained Liquidity Expansion

Data shared by blockchain analytics platform Artemis shows Aptos recording the highest net increase in stablecoin supply. Roughly $386 million moved onto the network in a single day.

No other major blockchain posted comparable numbers. Analysts say Aptos stablecoin inflows reflect strong confidence from capital allocators seeking efficient on-chain settlement.

Sourcee: X

Sourcee: X

The daily surge aligns with a longer trend. Aptos entered 2025 with an estimated $600 million in stablecoin supply. That total has since grown to around $1.9 billion.

The steady climb suggests Aptos stablecoin inflows are not temporary. Instead, they point to sustained growth in network liquidity and usage.

Aptos Leads Daily Stablecoin Supply Changes

Among tracked blockchains, Aptos ranked first in daily stablecoin supply growth. Artemis compared networks including Ethereum, Solana, Arbitrum, Base, BNB Chain, Polygon PoS, and others.

Also Read: Aptos Price Prediction 2025–2027: Why Analysts See $APT Hitting Double Digits Soon

Aptos clearly stood out. The data highlights how Aptos stablecoin inflows exceeded activity across competing ecosystems during the period.

Mixed Performance Across Other Networks

While Aptos gained, other networks showed mixed results. Plasma and Sui posted limited positive changes. HyperEVM, Monad, Ethereum, Near, and Sonic also recorded small inflows. These increases reflected gradual usage growth.

Several well-known chains saw net outflows. Solana recorded the largest decline. Base, Avalanche C-Chain, Arbitrum, Tron, and Polygon PoS also trended lower. The contrast underlines how capital rotation favored Aptos stablecoin inflows.

Native Stablecoins Strengthen Liquidity

The expansion of native stablecoin deployments has supported recent growth. USDT and USDC have increased their presence in Aptos. This expansion improves liquidity depth across applications. It also reduces friction for users.

Developers gain easier access to reliable settlement assets. These factors directly support sustained Aptos stablecoin inflows.

Institutional Stablecoins Boost Confidence

Institutional-grade stablecoins have added credibility to the network. The launch of Paxos-issued USDG introduced a regulated option for larger investors.

Institutional products often attract more consistent capital flows. This dynamic helps explain the scale of recent Aptos stablecoin inflows. Institutions tend to deploy capital with longer holding periods.

Developer Activity Converts Liquidity Into Usage

Liquidity growth is matched by rising developer engagement. More applications are launching across the Aptos ecosystem. Many integrate stablecoins as core components.

This ensures Aptos stablecoin inflows translate into real on-chain activity. Payments, DeFi platforms, and settlement tools all benefit. Network effects strengthen as adoption expands.

Aptos Climbs Stablecoin Supply Rankings

Owing to continued inflows, Aptos is now in the list of top 10 blockchains by stablecoin supply. The rating also keeps getting better with the arrival of new capital.

Those watching the inflows into the Aptos stablecoin stock note that consistent growth is more significant than transitory spikes. It’s a sign of lasting adoption among users and builders.

Broader Market Implications

The numbers are a reflection of changing dynamics in the stablecoin world. Liquidity is also becoming more shared across networks.

Aptos is also becoming a legitimate option to established chains. With daily growth breaking records and total supply climbing, it’s clear that Aptos stablecoin inflows are reshaping on-chain capital flows.

Conclusion

Recent data shows that the rise in stablecoin flows to Aptos is a continued trend. Real demand is also indicated by the fact that about $386 million flows in every day and supply of almost $1.9 billion.

Increase in developer activity corroborates long term usage. Aptos is no more a backwater. It’s emerging as a hub for stablecoin liquidity.

Also Read: Will WLFI’s USD1 Stablecoin on Aptos Gain Traction With Trump Jr.?

Appendix: Glossary of Key Terms

Aptos: A Layer One blockchain designed for fast, scalable transactions with minimal latency.

Stablecoin: A digital asset whose value is pegged to that of a stable asset, usually the United States dollar.

Stablecoin Supply: The total value of stablecoins in circulation on a blockchain network.

Onchain Liquidity: Available capital actively known for use via blockchain applications.

Net Inflows: Total amount of capital that has flowed into a blockchain minus any outflows.

Base Layer 1 Blockchain: A primary blockchain that deals with and secures transactions directly.

Institutional Stablecoin: A regulated stable coin for financial applications at scale.

Developer Activity: How much of application development and deployment is taking place on a blockchain platform.

Frequently Asked Questions About Aptos Stablecoin Inflows

1- What are Aptos stablecoin inflows?

They represent the net increase of stablecoins moving onto the Aptos blockchain over a given period.

2- Why did Aptos lead daily stablecoin growth?

Expanded native stablecoins, institutional products, and active developers attracted new capital.

3- What is the size of Aptos’ stablecoin supply today?

It is approximately $1.9 billion and growing.

4- Which blockchains saw outflows at the same time?

Solana led declines, followed by Base, Polygon PoS, Arbitrum, and others.

References

Coinomedia

BlockchainReporter

Read More: Aptos Stablecoin Inflows Hit $386M, Leading Daily On-chain Liquidity Shift">Aptos Stablecoin Inflows Hit $386M, Leading Daily On-chain Liquidity Shift

You May Also Like

USD/CAD rises above 1.3750 after rebounding from three-month lows

Bitwise Forecasts Bullish 2026 for Crypto: Bitcoin to Hit New All-Time Highs, ETF Demand to Surge, Institutional Adoption to Deepen