From Livermore to Crypto Whales: A century-long trading war, revealing the offensive and defensive game behind the $300 million order on Hyperliquid

Author: Frank, PANews

"Of all the days in my career as a stock trader, I remember this day most vividly. It was the day that my profits exceeded $1 million for the first time. It marked the first successful close of my trading strategy that I had planned. Everything I had foreseen was now a fact of the past. But beyond all this was this: my wild dream had become a reality.

For this day, I am the king of the market!"

——Reminiscences of a Stock Operator

More than a hundred years ago, the legendary stock trader Livermore used this sentence to describe his success. A hundred years later, the same scene seems to be happening again in the crypto market. Coincidentally, the king of the market this time also successfully traded on a large scale, and took the initiative to blow up his position when the market liquidity was insufficient, performing an extreme operation and causing the market to worship him. The difference is that the profits of the king of the market this time were paid by the exchange.

Reincarnation of the Century: The Ghost of Wall Street Reborn on the Chain

This whale, who once invested $6 million to buy ETH and BTC with 50x leverage and made $6.8 million just before Trump announced that five crypto assets including BTC, ETH, SOL, ADA, and XRP would be added to the strategic reserve of crypto assets, has repeatedly made profits in the market in the past month and once again fought a classic battle that will be recorded in the history of Hyperliquid.

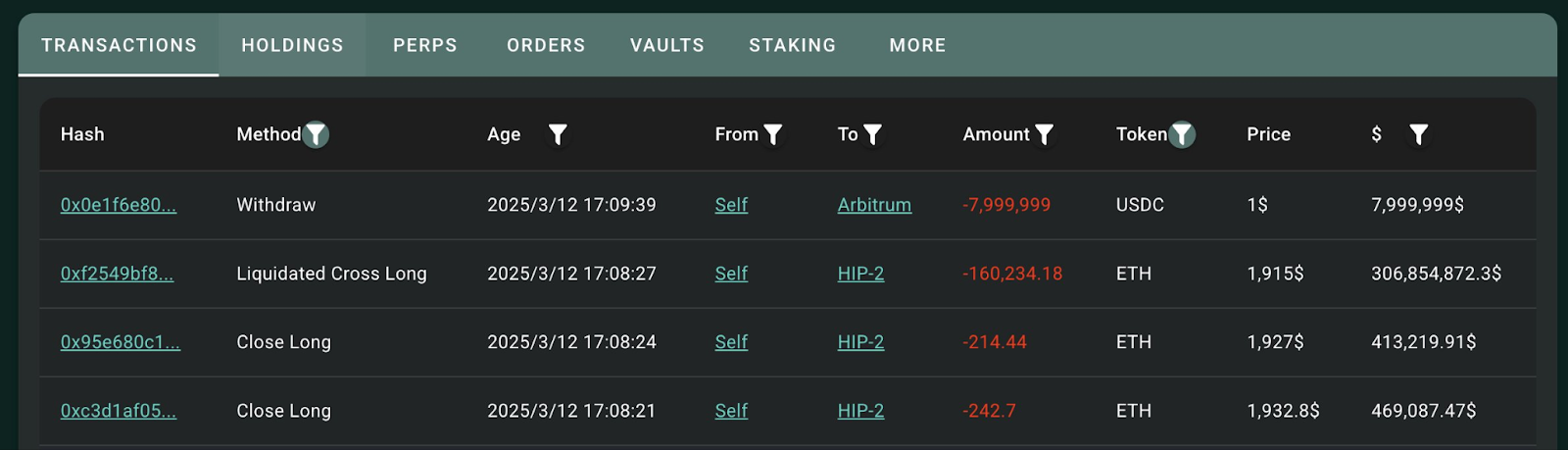

On March 12, the whale again opened a 50-fold long position of 160,000 ETH, withdrew $8 million in funds, and then liquidated its position, ultimately making a profit of approximately $1.8 million, while the Hyperliquid exchange lost $4 million.

This situation seems logically bizarre, but in essence it is an attempt to profit from the "loophole" in Hyperliquid's on-chain transactions.

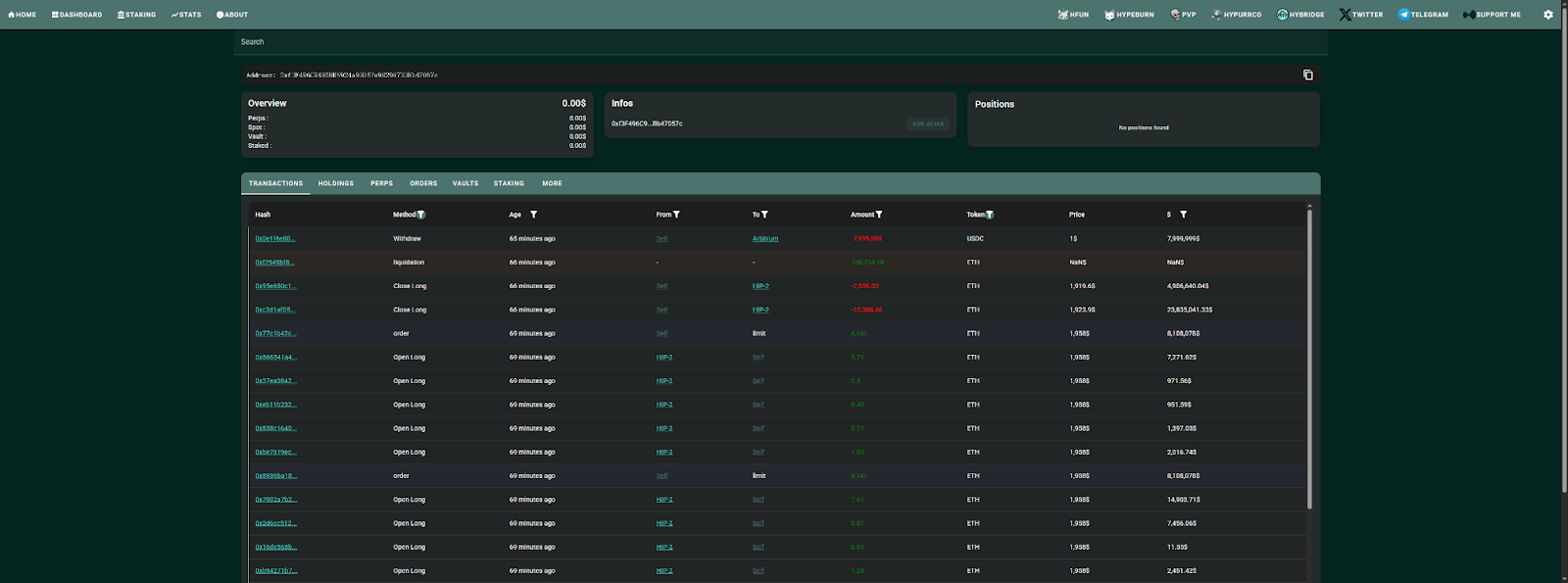

Let's review the operation process of this giant whale:

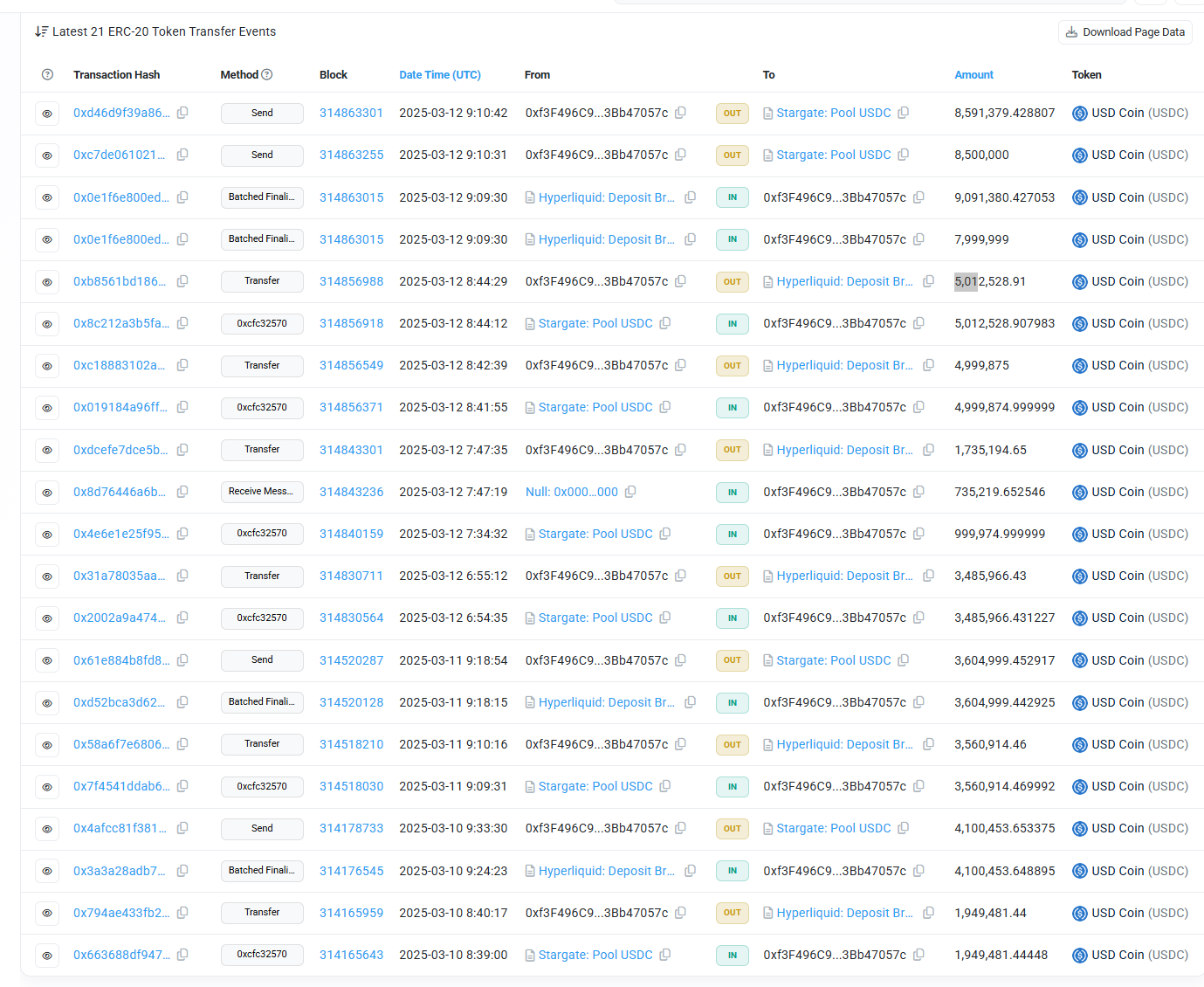

At 6:54 on March 12, the address deposited $3.48 million to Hyperliquid through the cross-chain bridge and opened a position of 17,000 ETH (worth $31.2 million).

The address then increased its position to 21,790 ETH (worth $40.85 million) by replenishing margin and continuing to expand its position.

Subsequently, the address continued to increase its holdings, raising the total ETH position to 170,000 (valued at $343 million), with a paper profit of $8.59 million.

During this process, the address used a total of US$15.21 million in deposit.

Ultimately, by closing positions and withdrawing margin, he recovered $17.08 million and made a profit of $1.87 million.

In the last operation, the user withdrew $8 million in funds and retained approximately $6.13 million as margin, waiting for forced liquidation.

Hunting time: the precise calculation behind the 170,000 ETH position

Why do whales do this instead of waiting for profits to close their positions?

In this process, the whale has two options: one is to close the position directly, with a paper profit of $8.59 million. This operation maximizes the benefits. However, the opponent on the chain may not be able to take such a large order at one time, and can only wait for the price to continue to fall and reduce profits before the transaction can be completed. Once the $343 million order is actively closed, it may greatly affect the market trend and cause a significant reduction in profits.

Therefore, the whale chose the second option, withdrawing the margin and part of the profit (i.e. closing part of the position and then withdrawing the remaining margin), keeping the margin at the minimum standard of 50x leverage. In this way, if the market continues to rise, he will be able to make greater profits and can choose to continue to close the position in batches. If the market falls sharply, his position will be liquidated in a 2% drop. But because he has withdrawn $17.08 million in funds, the overall profit has already reached $1.87 million. Therefore, even if the position is liquidated, it will not lead to actual losses.

This seemed like a crazy gambler's operation, but in the end he chose a conservative profit strategy.

Afterwards, according to the data released by Hyperliquid, Hyperliquid lost $4 million that day (including some profits from copying orders), while the whale realized a profit of more than $1.8 million.

In fact, from the profit and loss ratio, the whale invested about $15.21 million and realized a profit of $1.87 million, with a profit margin of about 12.2%. In terms of percentage and amount, it is not as much as the address when Trump announced that ADA and SOL were selected for strategic reserves.

Aftershocks and revelations: Driving the evolution of on-chain exchanges

From a market perspective, this operation ultimately led to an exchange buying order, which is an extremely rare occurrence. However, this situation seems to be only possible on Hyperliquid.

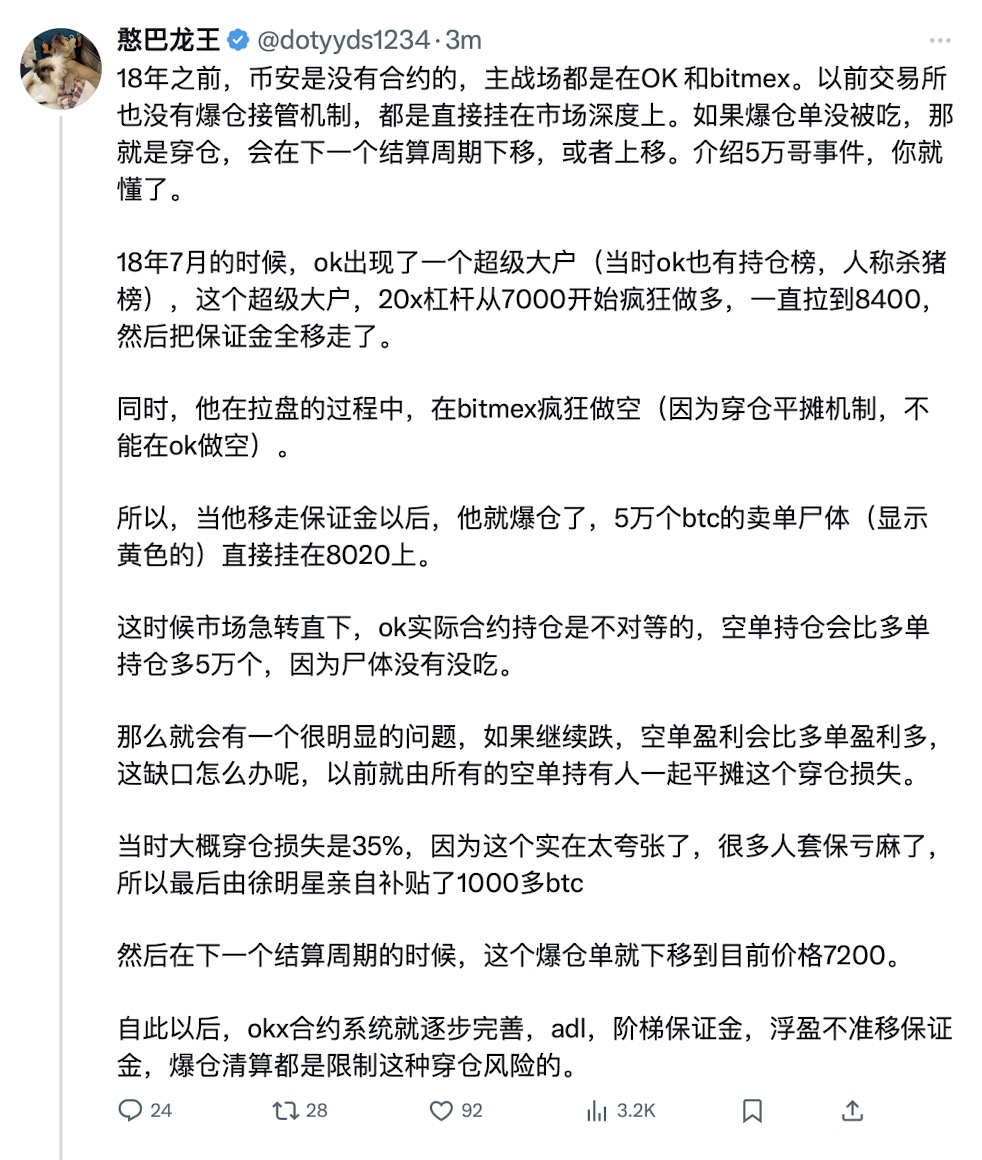

According to KOL Hanbalongwang’s tweet, a similar incident occurred in the OK Exchange in 2018. The same method was used, and the margin was withdrawn after making a profit, causing the market to reach the liquidation price and no counterparty could absorb it, resulting in the exchange buying the order.

After the OK incident, various centralized exchanges added a tiered margin system to keep users’ margins within a reasonable range. This incident seems to have taught a lesson to the emerging on-chain exchange Hyperliquid. Since the DEX trading method was adopted throughout the process, there was no risk control for the margin requirements.

As a result, when the whale's position was blown up, the market lacked sufficient liquidity to take over the forced liquidation order, so Hyperliquid had to pay out of its own pocket to be the counterparty. HLP data shows that the loss of $4 million is almost equal to Hyperliquid's profit for the entire month. As of March 10, Hyperliquid's HLP revenue has accumulated to $63.5 million, so even if this order lost money, there is still a profit of nearly $60 million left.

However, given that this incident has sparked heated discussions on social media, there may be users who will follow the whale’s lead in future operations. Hyperliquid also immediately announced that in order to avoid similar problems, it would adjust the leverage ratio of BTC to 40 times and ETH to 25 times.

As for whether this method will fundamentally shake Hyperliquid, we can understand this possibility through calculation: Hyperliquid's HLP pool currently still holds nearly $60 million in funds. Based on the maximum leverage of BTC at 40 times, the maximum risk of a position loss can be $2.4 billion. From this perspective, it seems that few users have the strength to match it. When facing general market orders, the market counterparty is all that is needed to smooth it out.

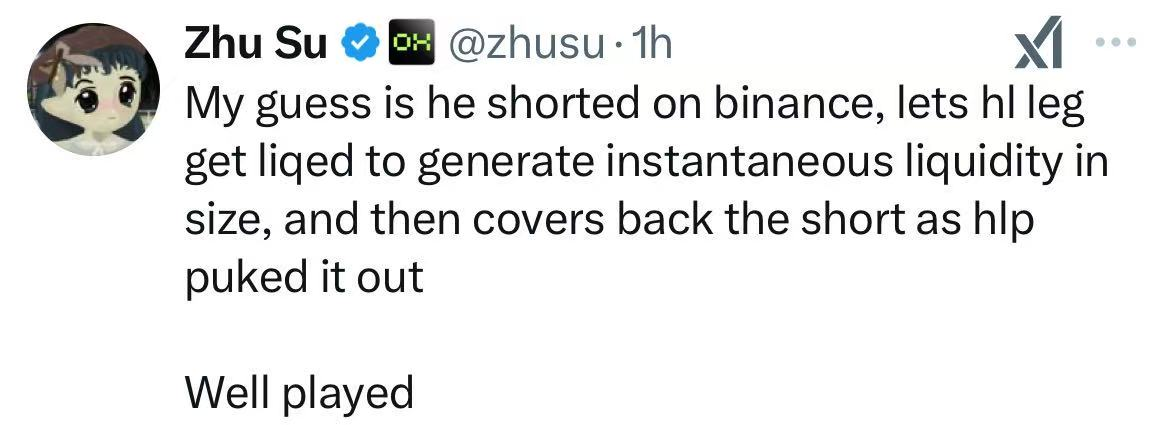

Looking back at the whole incident, we can see that this whale may have conducted multiple tests before completing this operation. Zhu Su, co-founder of Three Arrows Capital, speculated that the reason why this address was able to take such a big risk was because he shorted on Binance Exchange during the same period of time. It is equivalent to the order status of long and short hedging, and it was because he found that Hyperliquid's mechanism of liquidation was different from that of centralized exchanges that he chose to start from there.

In fact, this operation method is not a magical innovation. As mentioned at the beginning, Livermore had accidentally achieved a similar effect a hundred years ago. It was just that Livermore chose to actively go long and close his positions for the survival of the market. In today's market, there are exchanges to cover this phenomenon, which has enabled the phenomenon of users cutting back on exchanges. However, the space for this operation method is probably closed again from now on, and it will be difficult for similar platforms to achieve similar effects in the future.

For exchanges, this is another case of learning a lesson at a cost. For retail investors, such operations are short-lived, an individual phenomenon of finding loopholes and making profits, and have no significance for reproducing operations. They are just a topic of conversation that people enjoy talking about in a boring trend.

You May Also Like

USD/INR Exchange Rate Shows Remarkable Resilience Despite Alarming Decline in Foreign Institutional Investment

TeraWulf Revenue Jumps 20% but Massive $661M Loss Raises Eyebrows