Ethereum price loses $3,000 psychological support, raising capitulation risk

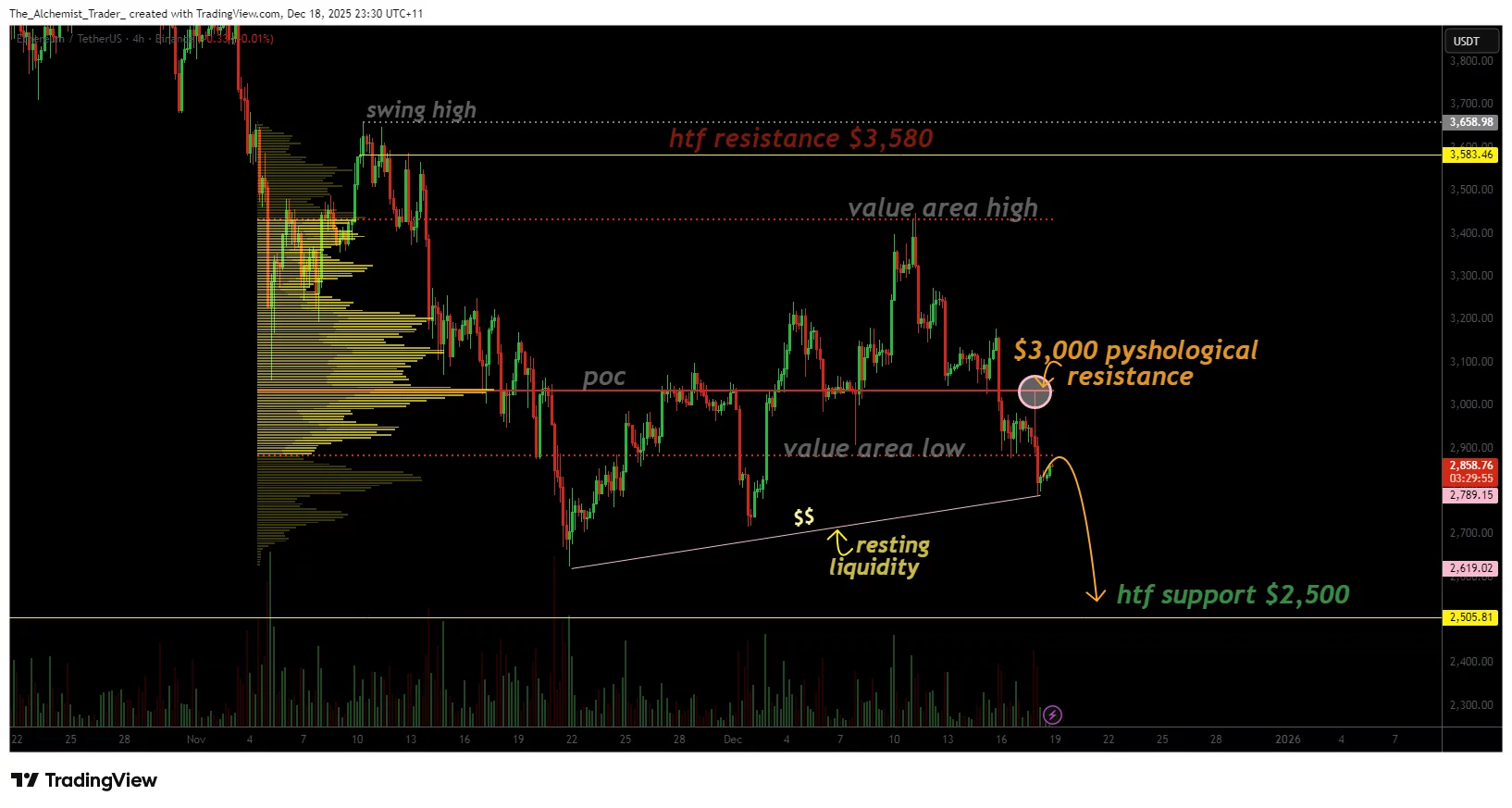

Ethereum price breaks below the $3,000 psychological level and the point of control, increasing the risk of capitulation as bearish structure and downside liquidity targets remain intact.

- Ethereum price loses $3,000 psychological support and POC.

- Bearish structure remains intact with lower highs and lower lows.

- Capitulation risk increases toward the $2,500 support zone.

Ethereum (ETH) price is facing renewed downside pressure after losing the critical $3,000 psychological support level, a zone that also aligned with the market’s Point of Control (POC). This breakdown marks a shift in market structure, as $3,000 now transitions from support into resistance.

With price failing to reclaim this region on a closing basis, bearish momentum remains firmly in control, increasing the probability of a deeper corrective move.

Ethereum price key technical points

- Ethereum loses the $3,000 psychological level and POC, confirming structural weakness.

- Market structure remains bearish, with consecutive lower highs and lower lows.

- Downside liquidity sits near $2,500, raising the risk of a capitulation-style move.

The loss of $3,000 represents more than just a psychological setback for Ethereum. This level previously acted as a major area of balance, where significant trading volume accumulated. Its failure on a closing basis signals a clear shift away from equilibrium and toward renewed downside exploration.

Since breaking below the Point of Control, Ethereum has attempted minor relief rallies. However, these moves have been rejected almost “to the dollar,” reinforcing $3,000 as a firm resistance zone. From a technical standpoint, this behavior suggests that buyers lack the capacity to regain control.

At the same time, sellers continue to defend lower prices aggressively, a dynamic that increases downside risk for BMNR stock as Ethereum’s technical pattern becomes more concerning.

The broader market structure remains decisively bearish. Ethereum continues to print lower highs and lower lows, a classic definition of a sustained downtrend. Within this context, the current low-time-frame rally is best viewed as another lower high, rather than the start of a meaningful reversal. Such corrective bounces are common during downtrends and often precede further downside rather than sustained recoveries.

One of the most important factors increasing capitulation risk is the presence of resting liquidity below current price levels. Since Ethereum established a local low near the $2,600 region, liquidity has steadily built beneath that area. Markets tend to seek out these liquidity pools, especially when bearish momentum remains intact and structural support levels fail.

The next major downside target sits near $2,500, a high-time-frame support region that aligns with previous consolidation and structural demand. A move into this area would likely clear out remaining downside liquidity, a process often associated with capitulation-style price action. Capitulation typically involves accelerated selling, forced liquidations, and emotional exits, marking the final phase of a corrective move.

From a price-action perspective, Ethereum’s behavior below $3,000 reflects acceptance rather than rejection. Price is consolidating below the resistance level instead of reclaiming it, which statistically favors a continuation of the decline. Prolonged consolidation below a broken key level often increases, rather than reduces, the probability of a decisive downside move.

Volume dynamics further support this view. Recent downside moves have exhibited greater participation than upside attempts, indicating that sell-side pressure remains dominant. Until Ethereum can reclaim $3,000 with substantial volume and hold above it, bullish scenarios remain secondary.

That said, capitulation zones often create conditions for longer-term stabilization once liquidity is fully cleared. While the immediate outlook remains bearish, traders should closely monitor how the price behaves if and when Ethereum approaches the $2,500 region, as strong reactions there could signal exhaustion of selling pressure.

What to Expect in the Coming Price Action

As long as Ethereum remains below the $3,000 psychological level and the Point of Control, downside risk remains elevated. Continued consolidation beneath this region increases the likelihood of a capitulation move toward $2,500, where the next major support and liquidity zone is located.

You May Also Like

Whales keep selling XRP despite ETF success — Data signals deeper weakness

Foreigner’s Lou Gramm Revisits The Band’s Classic ‘4’ Album, Now Reissued