Bitcoin Price Plummets: The Alarming Flight to Safety as US Economy Stumbles

BitcoinWorld

Bitcoin Price Plummets: The Alarming Flight to Safety as US Economy Stumbles

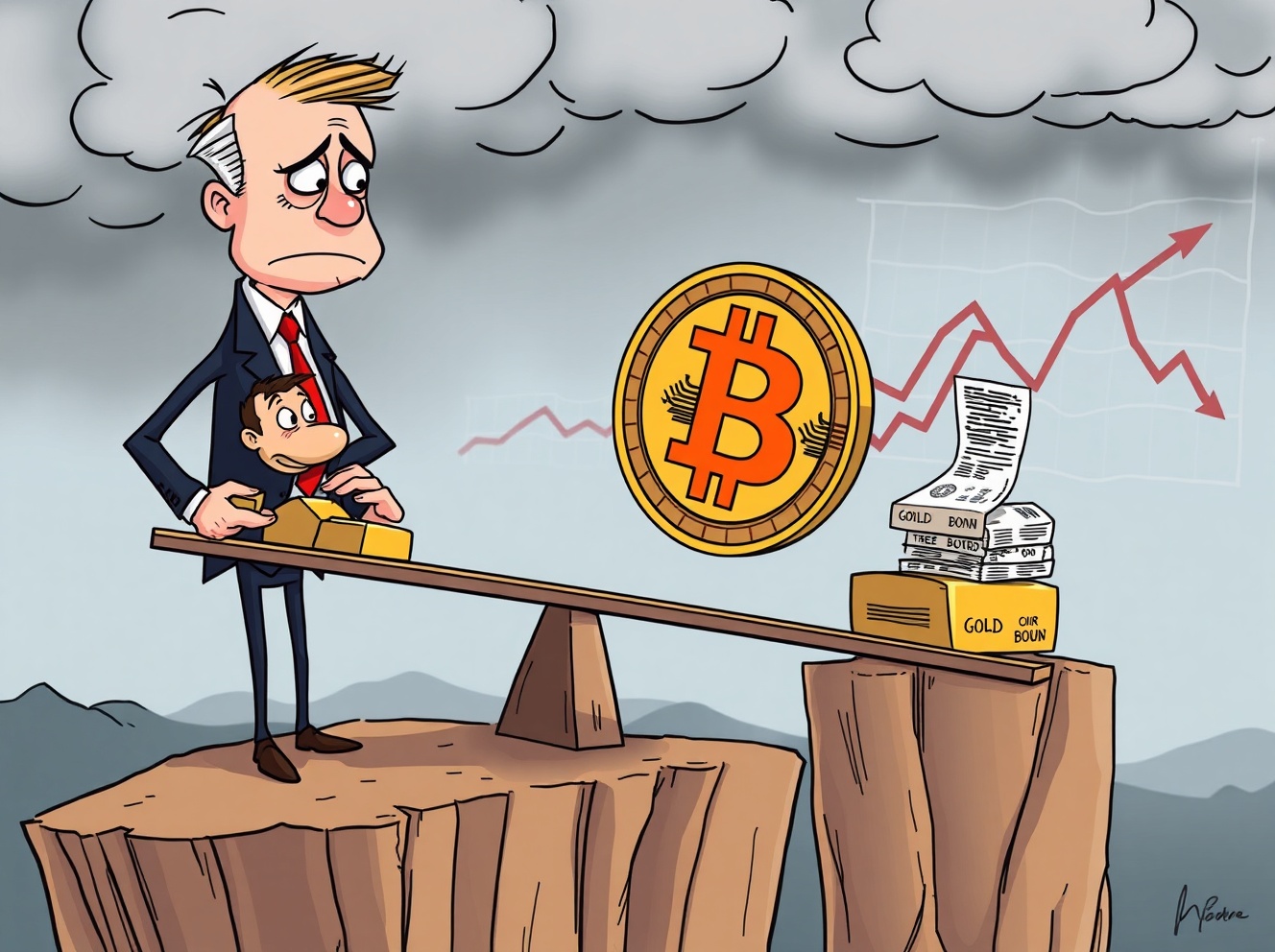

Is your Bitcoin portfolio feeling the pressure? You’re not alone. The Bitcoin price is facing significant headwinds as a wave of concerning economic data from the United States sends shockwaves through global markets. Investors, spooked by the numbers, are executing a classic maneuver: the flight to safety. This shift in sentiment is creating a challenging environment for cryptocurrencies, pulling capital away from volatile assets like Bitcoin and into perceived stable harbors.

Why is the Bitcoin Price Under Pressure?

The recent slump in the Bitcoin price isn’t happening in a vacuum. It’s a direct reaction to fundamental economic signals. According to a Cointelegraph analysis, two key factors are driving the sell-off. First, recent U.S. employment figures came in weaker than expected, hinting at a slowing economy. Second, broader economic growth metrics are also flashing warning signs. When traditional markets get nervous, the ripple effects are felt acutely in the crypto space.

This creates a perfect storm for Bitcoin. The asset, often touted as ‘digital gold,’ is currently being treated as a risk-on investment by the majority of the market. Therefore, when fear grips investors, they retreat to assets with a long history as stores of value during turmoil.

The Safe Haven Shift: Where is the Money Going?

So, if money is flowing out of Bitcoin, where is it going? The answer lies in traditional finance. Investors are pivoting hard towards assets known for their stability during economic uncertainty.

- U.S. Treasury Bonds: Demand for government debt has surged. Bonds are seen as one of the safest bets, especially when economic growth falters.

- Gold: The classic safe-haven asset is seeing renewed interest as a tangible store of value outside the financial system.

- The U.S. Dollar: The dollar often strengthens during global uncertainty as investors seek liquidity and stability.

This mass migration is compounded by shifting expectations from the Federal Reserve. With sticky inflation and a still-strong labor market, the likelihood of an imminent interest rate cut has diminished. Higher rates for longer make yield-bearing, safe assets like bonds more attractive compared to non-yielding cryptocurrencies, further pressuring the Bitcoin price.

Is This Just a U.S. Problem?

While the U.S. data is the primary catalyst, global economic worries are adding fuel to the fire. For instance, Japan recently slipped into an unexpected recession. This global economic fragility reinforces the risk-off mood. Investors are not just reacting to one country’s data; they are reassessing global growth prospects. In such an environment, high-volatility assets like Bitcoin are often the first to be sold, regardless of their long-term potential.

The key takeaway is that cryptocurrency markets remain deeply interconnected with traditional finance. Macroeconomic indicators, central bank policies, and global risk sentiment are powerful forces that can override crypto-specific narratives in the short term.

What Can Investors Do During This Bitcoin Price Weakness?

Market downturns, while stressful, are a normal part of the investment cycle. Here are some actionable insights:

- Assess Your Risk Tolerance: Ensure your portfolio allocation to crypto aligns with your long-term goals and ability to handle volatility.

- Consider Dollar-Cost Averaging (DCA): For long-term believers, a lower Bitcoin price can be an opportunity to accumulate assets gradually at a discount.

- Diversify: Don’t put all your capital into one asset class. A diversified portfolio can better weather different economic storms.

- Stay Informed: Follow credible sources to understand the macro trends driving market sentiment beyond daily price movements.

Conclusion: Navigating the Storm

The current Bitcoin price action is a stark reminder that cryptocurrencies are not yet decoupled from traditional market forces. The flight to safety, triggered by poor U.S. economic data and global recession fears, is a powerful short-term headwind. However, for patient investors, these periods of fear and selling often create the foundations for future growth. The fundamental narrative around Bitcoin and digital assets continues to evolve, but its journey will inevitably be marked by volatility as it interacts with the wider economic world.

Frequently Asked Questions (FAQs)

Q: How long will this Bitcoin price downturn last?

A: It’s impossible to predict exact timelines. The duration will depend on upcoming economic data, Federal Reserve policy signals, and broader global market sentiment. Historically, crypto markets recover, but the timing is always uncertain.

Q: Should I sell my Bitcoin now?

A: This is a personal decision based on your investment strategy. Selling during a dip locks in losses. Many long-term investors view these periods as buying opportunities, but you should never invest money you cannot afford to lose.

Q: What economic data should I watch?

A: Key indicators include the U.S. Consumer Price Index (CPI) for inflation, monthly Non-Farm Payrolls for employment, and Gross Domestic Product (GDP) for growth. Federal Reserve meeting minutes and statements are also critical.

Q: Are all cryptocurrencies affected the same way?

A> Generally, yes. Bitcoin often sets the trend for the broader crypto market. During strong risk-off events, most altcoins tend to fall even more sharply due to their higher volatility and perceived risk.

Q: Is this a good time to buy Bitcoin?

A> For investors with a long-term horizon and a strategy like Dollar-Cost Averaging, lower prices can be attractive. However, trying to ‘time the bottom’ is extremely difficult and risky.

Q: Does this mean Bitcoin failed as a safe haven?

A> In the short term, the market is not treating it as one. Bitcoin’s narrative as a hedge against inflation and systemic risk is a long-term thesis that is still being tested over multiple economic cycles.

Found this analysis of the Bitcoin price and market dynamics helpful? Share this article with fellow investors on your social media channels to help them navigate these turbulent market conditions. Knowledge is power, especially in volatile markets!

To learn more about the latest Bitcoin price trends, explore our article on key developments shaping Bitcoin and its long-term institutional adoption.

This post Bitcoin Price Plummets: The Alarming Flight to Safety as US Economy Stumbles first appeared on BitcoinWorld.

You May Also Like

ADA Price Prediction: Here’s The Best Place To Make 50x Gains

China Merchants Bank: The yen carry trade may undergo a sustained reversal, exerting long-term downward pressure on global asset liquidity.