Boeing (BA) Stock: Rises 2.79% Ahead of FAA Certs and 777F Waiver

TLDRs;

- Boeing stock climbs 2.79% as FAA certification updates and 777F waiver drive investor optimism.

- Holiday trading week may amplify Boeing’s price moves due to thinner market liquidity.

- Production ramp-up on 737 MAX and 787 Dreamliner supports positive 2026 cash-flow outlook.

- Defense contracts and Spirit AeroSystems integration remain key factors for BA stock performance.

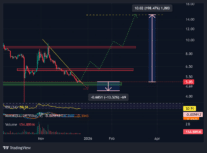

Boeing stock (NYSE: BA) advanced 2.79% to close at $214.08 as traders focus on FAA certification developments and regulatory updates impacting its widebody and narrowbody programs. With the U.S. markets entering a holiday-shortened week, liquidity is lighter than usual, amplifying price swings for headline-sensitive stocks like Boeing.

The market will operate on a condensed schedule, with trading on Monday and Tuesday, an early close on Wednesday, closure for Christmas on Thursday, and regular sessions resuming Friday. Analysts note that such conditions often make premarket headlines more impactful, as even modest updates on certification, production, or defense awards can shift investor sentiment rapidly.

FAA Certification Remains Central Catalyst

Investors are closely monitoring the progress of Boeing’s 737 MAX 10 and MAX 7 certifications. The FAA is reviewing modifications to the cockpit alerting system on the MAX 10, a crucial step in clearing the aircraft for commercial operations.

The Boeing Company, BA

Technical challenges, including engine de-icing concerns, have delayed certification, keeping airline customers cautious about delivery timelines.

For investors, the certification schedule is more than just a milestone, it directly affects cash flow, production planning, and overall confidence in Boeing’s operational execution. Southwest Airlines has publicly noted expectations for MAX 7 certification around mid-2026, signaling that airline planning remains contingent on regulatory progress.

Production Ramp Drives Optimism for 2026

Boeing’s path to financial recovery hinges on its ability to steadily increase production. The 737 MAX remains the centerpiece of this turnaround, with rate increases expected to support deliveries and revenue recognition.

Meanwhile, the 787 Dreamliner production expansion in North Charleston aims to raise output from seven to ten units per month in 2026, providing a tangible lever for positive cash flow.

Monthly delivery and order reports continue to influence sentiment, with notable activity in 777X orders attracting market attention. Investors are assessing whether Boeing can maintain consistent execution and convert production gains into reliable cash generation.

777F Waiver, Defense Contracts, and Supply-Chain Dynamics

Boeing’s 777X program still poses risks, with first deliveries pushed to 2027 and a recent $5 billion charge affecting expectations. Meanwhile, Boeing is seeking an FAA emissions waiver to sell 35 additional 777F freighters ahead of new 2028 rules.

This move aims to meet interim customer demand and bolster widebody cash flow, highlighting how regulatory approvals can directly influence revenue timing.

Defense and government contracts also provide headline support, with over $7 billion in Pentagon awards and additional Navy and Air Force deals underscoring backlog stability. At the same time, Boeing’s recent acquisition of Spirit AeroSystems is designed to tighten supply-chain control, though integration and labor negotiations could present near-term challenges.

Looking Ahead

Wall Street maintains a generally positive outlook, with average price targets in the high-$240s and JPMorgan recently naming Boeing a top pick for 2026. Analysts and investors will closely watch FAA updates, Spirit integration progress, freighter approvals, and any new defense awards as key indicators of whether Boeing can convert operational improvements into sustained free cash flow.

With these factors in play, Boeing remains a “show-me” stock, traders are eager for concrete proof that production, certification, and cash flow expectations align with market optimism heading into 2026.

The post Boeing (BA) Stock: Rises 2.79% Ahead of FAA Certs and 777F Waiver appeared first on CoinCentral.

You May Also Like

Sandbrook Capital Announces Acquisition of United Utility Services from Bernhard Capital Partners

TRUMP Struggles Below $5 as Unlock Adds Downside Pressure